Renting a property can be a great way to save money and build equity, but it’s important to understand the financial implications of your rental agreement. A well-written rental agreement can protect you from unexpected costs and ensure that your finances are secure. This article will cover the key financial aspects of rental agreements and provide tips for protecting your money.

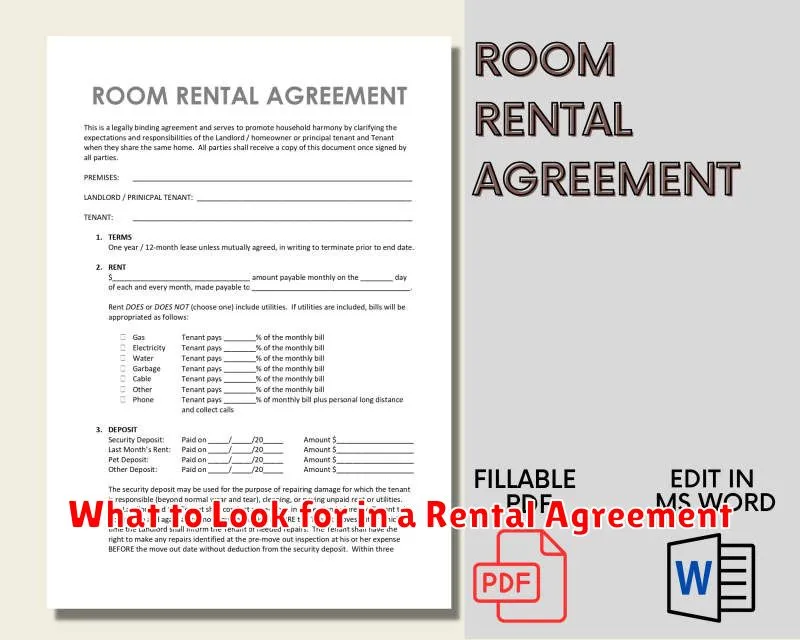

What to Look for in a Rental Agreement

A rental agreement is a legally binding document that outlines the terms and conditions of a rental property. It is essential to carefully review the agreement before signing it. Here are some crucial points to consider:

Rental Period and Renewal Options

The agreement should clearly state the duration of the lease, whether it’s a month-to-month agreement or a longer term. It should also outline the process for renewal, including any notice periods and renewal fees.

Rent Amount and Payment Schedule

The agreement should specify the monthly rent amount and the due date for payment. It should also include information about late fees, grace periods, and acceptable payment methods.

Security Deposit and Pet Deposit

Understand how much security deposit is required and what it will be used for. The agreement should explain the conditions for returning the security deposit at the end of the lease. If you have pets, ensure the pet deposit amount and any pet-related rules are clearly outlined.

Responsibilities of Landlord and Tenant

The agreement should clearly define the responsibilities of both the landlord and the tenant. This includes aspects like maintenance, repairs, utilities, and any specific restrictions on the property’s use.

Termination Clause

The agreement should outline the circumstances under which either party can terminate the lease. This could include things like breach of contract, non-payment of rent, or early termination fees.

Disclaimers and Warranties

Be aware of any disclaimers or warranties included in the agreement. These could relate to the condition of the property or the landlord’s liability for certain issues.

Legal Language and Clarity

The language used in the agreement should be clear and concise. If you have any doubts or questions, consult with a lawyer or a legal professional to ensure you understand the terms and conditions of the agreement.

Don’t Rush

Take your time to read the rental agreement thoroughly. Don’t feel pressured to sign it immediately. If you have any concerns or require clarification, discuss them with your landlord before signing.

A well-drafted and comprehensive rental agreement protects both the landlord and the tenant. By carefully reviewing and understanding all the terms and conditions, you can ensure a smooth and positive rental experience.

Common Financial Clauses in Rental Contracts

A rental contract, also known as a lease agreement, is a legally binding document that outlines the terms and conditions of renting a property. It covers various aspects of the rental relationship, including financial obligations. Understanding the common financial clauses in rental contracts is crucial for both landlords and tenants to ensure a smooth and transparent transaction.

Rent Payment

One of the most important clauses in a rental contract is the rent payment clause. This section specifies the amount of rent due, the payment schedule, and the acceptable payment methods. It also typically includes details regarding late fees and penalties for non-payment.

Security Deposit

A security deposit is a sum of money that the tenant pays upfront to protect the landlord against potential damages to the property. This clause outlines the amount of the security deposit, the conditions under which it can be used, and the process for its return at the end of the lease term.

Utilities

The utilities clause specifies which utilities are included in the rent and which are the tenant’s responsibility. This can include electricity, gas, water, trash removal, and internet. It’s essential to clarify who pays for each utility to avoid confusion and potential disputes.

Insurance

The insurance clause may require the tenant to maintain renter’s insurance, which protects their personal belongings and liability. It can also stipulate that the landlord carries property insurance to cover the building itself.

Pet Clause

If pets are allowed, the pet clause outlines any restrictions, such as breed or number of pets. It may also include a pet deposit or additional monthly fees.

Early Termination

The early termination clause specifies the conditions under which either party can terminate the lease before the end of the term. It may involve penalties or fees for breaking the lease.

Renewal Options

The renewal options clause outlines the terms for renewing the lease after the initial term expires. It may specify the duration of the renewal term, the rent amount, and any other relevant conditions.

Default and Remedies

The default and remedies clause describes the consequences of breaching the lease agreement. It outlines the steps that the landlord can take if the tenant fails to pay rent or violates other lease terms.

Understanding the financial clauses in a rental contract is essential for both landlords and tenants to ensure a successful and harmonious rental relationship. It’s important to carefully read and discuss these clauses with the other party before signing the agreement. Seeking legal advice can help ensure that all parties understand their rights and obligations.

How to Negotiate Rental Terms to Save Money

Renting an apartment can be a significant expense, but there are ways to negotiate rental terms to save money. By understanding the market, knowing your rights, and being prepared to walk away, you can potentially lower your monthly rent, secure a better lease agreement, and save thousands of dollars over the course of your lease.

Research the Market

Before you start negotiating, it’s crucial to know what other comparable apartments in your area are renting for. Websites like Zillow, Trulia, and Apartments.com can provide you with valuable insights into rental rates. You can also ask local real estate agents or property managers for their insights on the market.

Be Prepared to Negotiate

When you find an apartment you like, be prepared to negotiate. Having a list of potential concessions in mind can give you leverage. These can include:

- Lower monthly rent

- Reduced security deposit

- Free month of rent

- Free parking

- Pet fee waiver

- Improvements or repairs

Know Your Rights

It’s essential to understand your rights as a renter. Depending on your location, certain laws may protect you from unfair rental practices. Check your local laws and regulations for details on:

- Security deposit limitations

- Rent increase restrictions

- Tenant rights to repair

- Eviction procedures

Be Polite and Professional

Even when negotiating, it’s crucial to maintain a polite and professional demeanor. Be respectful of the landlord or property manager’s time and always approach the conversation with a collaborative attitude. Your goal is to find a solution that benefits both parties.

Be Prepared to Walk Away

If the landlord or property manager is unwilling to negotiate to your satisfaction, be prepared to walk away. There are likely other apartments available that might be a better fit for your needs and budget.

Negotiating rental terms can be a daunting task, but it can save you a significant amount of money over the course of your lease. By researching the market, knowing your rights, and being prepared to walk away, you can potentially secure a more favorable lease agreement. Remember to be polite and professional throughout the process, and always aim for a mutually beneficial outcome.

Understanding Security Deposits and Refunds

A security deposit is a sum of money a tenant pays to a landlord at the start of a lease agreement. The security deposit is intended to cover any damages the tenant may cause to the property during the lease period. Landlords are required to return the security deposit to the tenant within a specific timeframe after the lease ends, as long as the tenant has fulfilled the terms of the lease agreement and left the property in good condition.

Why are security deposits required?

Landlords require security deposits to protect themselves from financial losses caused by tenant damage. This could include:

- Damage to walls, floors, or appliances

- Unpaid rent

- Cleaning costs beyond normal wear and tear

How is a security deposit returned?

Once the lease has ended, the landlord is required to return the security deposit to the tenant within a certain timeframe, typically 30 days. However, the landlord can deduct a portion of the deposit to cover any damages to the property. The landlord must provide the tenant with an itemized list of deductions and supporting documentation, such as photos or receipts.

How can I get my security deposit back?

To ensure you receive your full security deposit back, it is important to:

- Read your lease agreement carefully and understand the terms and conditions.

- Take photos of the property before moving in to document its condition.

- Keep the property in good condition and make repairs promptly.

- Provide the landlord with your forwarding address so they can contact you about your deposit.

- Communicate with your landlord about any issues or repairs that need to be addressed during your tenancy.

What if my landlord fails to return my deposit?

If your landlord fails to return your security deposit within the specified timeframe or with proper deductions, you may be able to file a claim with your local housing authority or small claims court. It is important to keep all documentation, including your lease agreement, photos, and communication with your landlord.

Understanding the terms of your lease agreement and your rights regarding security deposits is crucial for ensuring a smooth and fair tenancy experience. By following the tips outlined above, you can minimize the chances of encountering issues with your deposit return.

Financial Implications of Lease Termination

Lease termination can have significant financial implications for both landlords and tenants. Understanding these implications is crucial before making a decision to terminate a lease agreement. Here’s a breakdown of the financial aspects involved:

For Landlords:

- Lost Rent: The most immediate financial impact is the loss of future rental income. Landlords lose out on the remaining lease term’s payments.

- Vacancy Costs: Finding a new tenant can take time, incurring marketing and advertising expenses. Additionally, there might be periods of vacancy, leading to further revenue loss.

- Repairs and Maintenance: The property might require repairs or upgrades before being rented out again, leading to additional costs for the landlord.

- Legal Fees: If the termination is contested or involves legal action, landlords might incur significant legal fees.

For Tenants:

- Breach of Contract: Early lease termination typically involves a breach of contract, which could result in financial penalties.

- Early Termination Fees: Lease agreements often include early termination clauses specifying a fee payable to the landlord.

- Unpaid Rent: Tenants might be responsible for unpaid rent for the remaining lease term, depending on the lease agreement and local laws.

- Security Deposit: The landlord might retain part or all of the security deposit to cover unpaid rent, repairs, or cleaning costs.

- Moving Expenses: Finding a new place and relocating can involve significant moving expenses.

Other Considerations:

- State and Local Laws: Lease termination laws vary by state and locality. It’s crucial to consult with a legal professional to understand the specific requirements and potential consequences.

- Negotiation and Compromise: In some cases, landlords and tenants may be able to negotiate a mutually acceptable solution, such as finding a new tenant or reducing the financial penalties.

- Documentation: All communication and agreements related to lease termination should be documented in writing to protect both parties’ interests.

Ultimately, lease termination can be a complex and costly process. Thoroughly understanding the financial implications and exploring all available options before making a decision is vital for both landlords and tenants.

Tips for Avoiding Hidden Fees in Rental Agreements

Renting an apartment or house can be a significant financial commitment, and it’s crucial to understand all the associated costs. While the monthly rent is often the most apparent expense, hidden fees can quickly add up and inflate your overall spending. These fees can be tricky to spot and can include various charges that are not always explicitly stated in the lease agreement. To avoid unpleasant surprises and ensure you’re budgeting accurately, here are some tips for navigating the world of rental agreements and avoiding those pesky hidden fees.

Read the Fine Print

This might seem obvious, but many renters skip over the fine print, only to discover hidden fees later. Take your time and carefully read every section of the lease agreement. Pay special attention to clauses related to:

- Application fees: Some landlords charge fees for processing applications, even if you’re not approved.

- Pet fees: If you have pets, make sure to understand the pet deposit, monthly pet rent, and any breed restrictions.

- Late rent fees: Know the penalty for late rent payments, including grace periods and calculation methods.

- Move-in/move-out fees: There might be charges for cleaning, repairs, or utility connections.

- Security deposits: Ensure the amount is reasonable and understand how it will be refunded.

Ask Questions

Don’t hesitate to ask the landlord or property manager questions about anything you don’t understand. Clarify any vague terms or unclear fees. If you’re unsure about something, it’s better to be safe than sorry. A little extra time spent asking questions could save you a lot of money in the long run.

Negotiate

Some fees are negotiable. If you find a fee that seems excessive, try negotiating a lower amount or waiving it altogether. You might be surprised at what you can achieve with a polite and assertive approach.

Get Everything in Writing

Once you’ve discussed fees and any negotiated changes, make sure everything is clearly outlined in writing. This can prevent disputes and ensure that both parties are on the same page.

Be Aware of Common Hidden Fees

Beyond the obvious fees, be aware of these common hidden charges:

- Amenities fees: Some buildings charge for access to common areas like fitness centers, swimming pools, or laundry facilities.

- Parking fees: Parking can be an additional cost, especially in urban areas.

- Trash removal fees: Some landlords may charge separate fees for trash removal services.

Consider a Third-Party Review

Before signing a lease, research the landlord or property management company online. Check websites like Yelp or ApartmentRatings to see what other tenants have to say about their experiences. Reviews can often highlight hidden fees or other issues that you might not have considered.

Know Your Rights

Every state has different landlord-tenant laws, so it’s essential to know your rights as a renter. Consult local resources or legal aid organizations to learn more about your legal protections.

By following these tips, you can increase your chances of avoiding hidden fees in rental agreements and ensure a more transparent and financially responsible rental experience.

Renters’ Rights and Financial Protections

As a renter, you have certain rights and financial protections that are important to understand. These rights ensure that you have a safe and habitable living space, and that you are treated fairly by your landlord. It’s important to familiarize yourself with your state’s specific laws and regulations, as they can vary.

Rights to a Safe and Habitable Living Space

Your landlord is legally obligated to provide you with a safe and habitable living space. This includes:

- Working plumbing, electricity, and heating: Your landlord is responsible for ensuring these essential services are operational.

- Safe and sanitary living conditions: This includes proper ventilation, pest control, and garbage disposal.

- Protection from dangerous conditions: Your landlord is responsible for addressing any hazardous conditions on the property, such as lead paint or mold.

If your landlord fails to meet these obligations, you have the right to take action. This might include demanding repairs, withholding rent, or even pursuing legal action.

Financial Protections for Renters

In many jurisdictions, renters have certain financial protections:

- Security deposit limits: Laws often limit the amount of security deposit a landlord can collect.

- Security deposit return: You are entitled to a full refund of your security deposit within a specific timeframe, minus any deductions for damages.

- Eviction protection: Your landlord must follow a legal process to evict you, which often includes giving you proper notice and providing an opportunity to resolve the issue.

- Rent control: Some cities and states have rent control laws that limit how much a landlord can increase rent.

It’s important to understand your rights and obligations as a renter. If you have concerns about your living situation, reach out to your local tenant’s rights organization or an attorney. Knowing your rights can help you navigate issues with your landlord and ensure a safe and comfortable living experience.

The Importance of Reading the Fine Print

In today’s fast-paced world, it’s easy to skim through documents and agreements, especially when we’re faced with lengthy and complex legal jargon. However, taking the time to carefully read the fine print is crucial, as it often contains vital information that can significantly impact your rights, obligations, and overall experience.

Here are some compelling reasons why reading the fine print is essential:

1. Understanding Your Rights and Obligations

The fine print outlines the specific terms and conditions of a contract, agreement, or product. It defines your rights as a consumer or user and the obligations you must adhere to. By reading it carefully, you’ll be aware of what you’re entitled to and what’s expected of you.

2. Avoiding Unexpected Costs and Fees

Many hidden costs, fees, or penalties can be buried within the fine print. This could include late payment fees, cancellation charges, or additional charges for services not explicitly mentioned in the main agreement. Understanding these provisions upfront can prevent unpleasant surprises and financial strain.

3. Protecting Your Privacy and Data

With the increasing concerns about data privacy, it’s imperative to pay attention to the fine print regarding data collection, usage, and sharing. Reading the privacy policy will help you understand how your personal information is being handled and whether it aligns with your comfort level.

4. Ensuring Product or Service Compliance

The fine print may contain information about warranties, guarantees, or limitations on the product or service you’re purchasing. This ensures you understand the extent of the seller’s liability and what recourse you have if any issues arise.

5. Avoiding Potential Disputes

By understanding the terms and conditions upfront, you can minimize the chances of misunderstandings or disagreements later on. Reading the fine print can help you proactively address any potential concerns and prevent future disputes.

In conclusion, while it may seem tedious and time-consuming, reading the fine print is a crucial habit to develop. It empowers you to make informed decisions, protect your interests, and avoid unexpected surprises. Remember, taking the time to understand the details can make a significant difference in your overall satisfaction and peace of mind.

What to Do if You Encounter Financial Disputes

Financial disputes can be stressful and overwhelming, but it’s important to remember that you’re not alone. Many people experience these issues, and there are steps you can take to resolve them. Here’s a guide to help you navigate financial disputes effectively:

1. Stay Calm and Organized

It’s crucial to remain calm and collected when dealing with financial disagreements. Avoid making rash decisions or engaging in heated arguments. Instead, take a step back, gather all relevant documentation, and assess the situation objectively.

2. Communication is Key

Open and honest communication is essential. Try to understand the other party’s perspective and explain your own clearly. Listen actively and be willing to compromise. If communication breaks down, consider involving a mediator or neutral third party.

3. Document Everything

Maintain a detailed record of all communications, transactions, and agreements related to the dispute. This documentation can be invaluable if the issue needs to be escalated to legal channels.

4. Explore Resolution Options

Several options can help you resolve financial disputes without resorting to litigation. Consider these methods:

- Mediation: A neutral third party facilitates communication and helps reach a mutually agreeable solution.

- Arbitration: A neutral party hears evidence and makes a binding decision. This process can be quicker and less expensive than litigation.

- Negotiation: Both parties work together to reach a compromise that satisfies their needs.

5. Seek Professional Advice

If you’re struggling to resolve a financial dispute on your own, don’t hesitate to seek professional assistance. Consult with a financial advisor, lawyer, or mediator to gain expert guidance and support.

6. Be Prepared for Litigation

While litigation should be a last resort, it’s important to be prepared if the dispute escalates. Gather all necessary documentation and consult with an experienced attorney to understand your legal options.

Remember, resolving financial disputes takes time and effort. By staying calm, communicating effectively, and exploring all available options, you can work toward a positive outcome.

Seeking Legal Help for Rental Agreement Issues

Rental agreements are essential contracts that outline the terms and conditions of a lease between a landlord and a tenant. These agreements cover crucial aspects such as rent payments, responsibilities, and lease duration. However, disagreements and disputes can arise, leading to challenges for both parties. If you’re facing difficulties with your rental agreement, seeking legal help can be a wise decision to protect your rights and interests.

When to Seek Legal Assistance

It’s advisable to consult an attorney if you encounter the following issues:

- Breach of Contract: When either the landlord or tenant fails to fulfill their obligations outlined in the rental agreement.

- Discrimination: If you believe you’ve been discriminated against based on your protected status, such as race, religion, or disability.

- Unlawful Eviction: When a landlord attempts to evict you without following proper legal procedures.

- Unsafe or Unlivable Conditions: If your rental property poses health or safety risks due to neglect or lack of repairs.

- Security Deposit Disputes: When there are disagreements regarding the return or deduction of your security deposit.

Benefits of Legal Counsel

Seeking legal help offers several advantages, including:

- Understanding Your Rights: A lawyer can explain your legal rights and obligations under the rental agreement and relevant state laws.

- Negotiation and Mediation: Legal counsel can assist in negotiating a resolution with the other party, potentially avoiding costly litigation.

- Legal Representation: If negotiations fail, a lawyer can represent you in court, advocating for your interests and protecting your rights.

- Peace of Mind: Having legal support can provide peace of mind, knowing you’re being represented and guided through the process.

Finding the Right Legal Help

When seeking legal assistance for rental agreement issues, consider these factors:

- Experience: Look for an attorney specializing in landlord-tenant law.

- Reputation: Research the attorney’s reputation and client reviews.

- Communication: Ensure you feel comfortable communicating with the attorney.

- Fees: Discuss fees and payment options upfront.

Rental agreements are crucial legal documents that govern your tenancy. If you encounter issues, seeking legal help from an experienced attorney can provide valuable guidance, protect your rights, and ensure a fair resolution.