Are you weighing the pros and cons of car sharing versus car renting? Both options offer flexibility and convenience, but when it comes to your finances, the right choice can significantly impact your wallet. This article dives into the financial benefits of each option, helping you decide whether car sharing or renting aligns better with your budget and transportation needs. We’ll explore factors like monthly costs, insurance premiums, and hidden fees, revealing which option truly offers the best value for your money. Let’s break down the numbers and find the solution that fits your lifestyle!

Understanding the Cost Differences Between Car Sharing and Renting

When it comes to transportation, there are numerous options available, each with its own set of advantages and disadvantages. Two popular alternatives to owning a car are car sharing and car rental. While both offer flexibility and convenience, they differ significantly in terms of cost.

Car sharing services, such as Zipcar or Car2Go, typically involve paying a membership fee and an hourly or daily rate for vehicle use. Membership fees can range from a few dollars to several hundred dollars annually, depending on the provider and plan. The hourly or daily rate is generally lower than traditional car rentals.

Car rentals, on the other hand, involve paying a daily or weekly rate, which can vary depending on the vehicle type, rental duration, and location. Additional fees may apply for things like insurance, mileage, and late returns.

Factors Affecting Costs

Here are some key factors that influence the cost of car sharing and car rental:

- Vehicle Type: The type of car you choose will significantly impact the cost. Larger vehicles, such as SUVs or vans, tend to be more expensive than compact cars or hatchbacks.

- Rental Duration: The longer you rent a car, the higher the cost will be. However, some car sharing services offer discounts for longer-term rentals.

- Location: Rental rates can fluctuate depending on the city or region. Prices tend to be higher in major metropolitan areas.

- Time of Year: Rental rates are often higher during peak travel seasons, such as summer and holidays.

- Insurance and Fees: Both car sharing and car rental companies charge fees for insurance, mileage, and other services. These fees can add up quickly.

Cost Comparison

In general, car sharing tends to be more cost-effective for shorter trips or occasional use. If you need a car for a few hours or a day, car sharing can be a more affordable option than renting. However, for longer trips or frequent use, car rental may be a better choice.

Here’s a breakdown of the potential cost differences:

| Service | Cost |

|---|---|

| Car Sharing (Hourly Rate) | $9-$15 per hour |

| Car Sharing (Daily Rate) | $50-$100 per day |

| Car Rental (Daily Rate) | $30-$150 per day |

| Car Rental (Weekly Rate) | $150-$700 per week |

It’s important to note that these are just general estimates, and actual costs may vary depending on the specific provider, vehicle type, and other factors.

The decision of whether to choose car sharing or car rental depends on your individual needs and usage patterns. If you need a car infrequently for short periods, car sharing can be a more cost-effective option. However, for longer trips or frequent use, car rental may be a better choice. It’s essential to compare prices and consider all the associated fees before making a decision.

Pros and Cons of Car Sharing for Budget-Minded Individuals

In today’s economy, finding ways to save money is more important than ever. For budget-minded individuals, car sharing services can be a great alternative to traditional car ownership. But before you jump in, it’s important to weigh the pros and cons of car sharing to make sure it’s the right choice for you.

Pros

Here are some of the advantages of car sharing:

- Lower costs: Car sharing services can save you money on car payments, insurance, maintenance, parking, and fuel. You only pay for the time you use the car, and you don’t have to worry about the hassle of owning a car.

- Convenience: Car sharing services are available 24/7, so you can access a car whenever you need it. You can also choose from a variety of car models to fit your needs.

- Flexibility: Car sharing allows you to use a car for short trips, errands, or even weekend getaways without the commitment of owning a car.

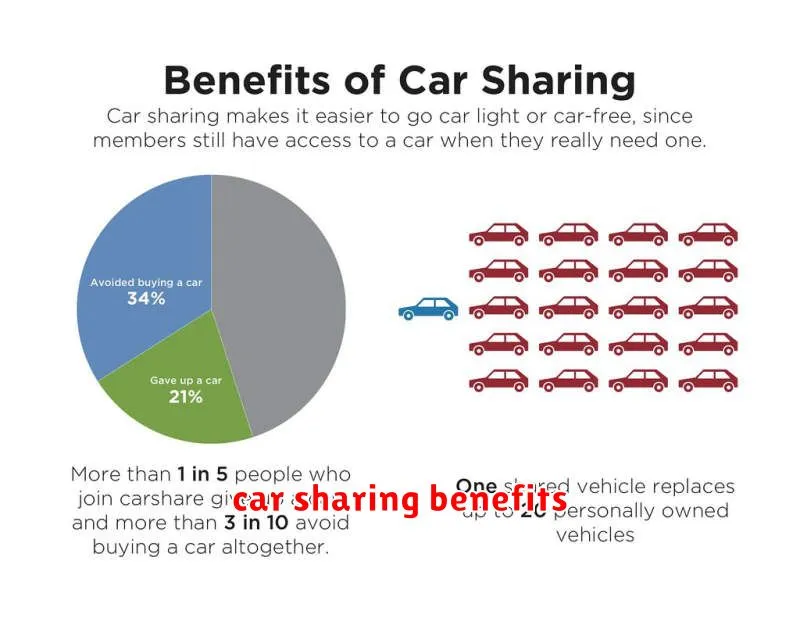

- Environmentally friendly: Car sharing services can reduce the number of cars on the road, which can help to reduce traffic congestion and pollution.

Cons

While car sharing has many benefits, there are also some drawbacks to consider:

- Availability: Car sharing services may not always have a car available when you need one, especially during peak hours or in popular areas.

- Cost per mile: Car sharing can be expensive if you drive frequently or long distances. The cost per mile can sometimes be higher than driving your own car.

- Limited personalization: You can’t customize a shared car to your preferences like you can your own vehicle. You’ll need to make do with the features that are available.

- Additional fees: Car sharing services often charge extra for things like parking, tolls, and late fees. These additional costs can add up quickly.

Whether or not car sharing is right for you depends on your individual needs and lifestyle. If you’re looking for a cost-effective and convenient way to get around, car sharing can be a great option. However, if you drive frequently or need a car for long distances, it may be more affordable to own your own car.

When Renting a Car Makes Financial Sense

Renting a car can be a convenient and cost-effective option for various situations. However, it’s essential to weigh the pros and cons before making a decision. Here are some scenarios where renting a car makes financial sense:

Short-Term Trips

If you’re planning a short vacation or business trip, renting a car can be more economical than driving your own. You won’t have to worry about the wear and tear on your vehicle, parking fees, and the hassle of driving long distances. For short-term trips, renting a car often works out to be less expensive than driving your own car.

Special Events

For special occasions like weddings, conferences, or family reunions, renting a car can provide a comfortable and luxurious ride for you and your guests. You can choose a car that suits the event, and you won’t have to worry about parking or transportation logistics.

Moving

When moving, renting a moving truck or van can be significantly cheaper than hiring professional movers. You can save money by packing and loading your belongings yourself, and you have the flexibility to move at your own pace.

Car Maintenance or Repairs

If your car is in need of major repairs or maintenance that will take several days, renting a car can provide you with transportation while your vehicle is being fixed. This can be a convenient and affordable option, especially if you rely on your car for work or daily errands.

Testing a New Vehicle

Before committing to buying a new car, you might want to test drive it for an extended period. Renting a car similar to the one you’re considering can give you a better feel for its features, performance, and overall driving experience.

While renting a car can be a practical choice for many situations, it’s important to consider the costs involved, including rental fees, insurance, and gas. By comparing the expenses with your existing transportation options, you can determine if renting is the most cost-effective solution for your needs.

Evaluating Your Usage Needs for Cost-Effectiveness

In the dynamic world of technology, choosing the right tools and services is crucial for maximizing cost-effectiveness. Evaluating your usage needs is a fundamental step in this process. By understanding your requirements and aligning them with available options, you can make informed decisions that optimize your spending and ensure a smooth workflow.

1. Define Your Usage Scenarios

Start by clearly defining your specific usage scenarios. What tasks will you be performing? What software or platforms will you be using? Who will be using these tools? This step helps you identify the key features and functionalities you need.

2. Assess Frequency and Intensity

Consider the frequency and intensity of your usage. How often will you be using these tools? What volume of data will you be processing? This information helps you determine the appropriate level of resources and capacity you require.

3. Evaluate Your Current Infrastructure

Take stock of your existing infrastructure and technology resources. Do you have adequate hardware, software, and network capabilities to support your anticipated usage? Identify any potential limitations or bottlenecks that might impact your workflow and cost-effectiveness.

4. Explore Available Options

Research and compare different options available in the market. Explore various software licenses, cloud computing services, and hardware configurations. Consider factors like pricing, features, performance, and scalability.

5. Analyze Cost-Benefit Ratios

Calculate the cost-benefit ratios of different options. Consider the initial investment, ongoing operational costs, and potential returns on investment. Compare the cost of acquiring, maintaining, and using each option against its value in terms of efficiency, productivity, and overall benefits.

6. Factor in Future Growth

Don’t just focus on your current needs; consider your future growth and scalability. Choose solutions that can adapt to your evolving requirements and avoid the need for frequent upgrades or replacements.

7. Implement Monitoring and Optimization

Once you’ve implemented your chosen solutions, establish robust monitoring and optimization processes. Regularly track your usage patterns, resource consumption, and performance metrics to identify areas for improvement and cost savings.

By carefully evaluating your usage needs and following these steps, you can ensure that your technology investments align with your goals and drive cost-effectiveness. Remember, a proactive approach to resource management can make a significant difference in your bottom line.

How to Choose Between Sharing and Renting

When you need something for a short period of time, you might consider sharing or renting it. But how do you know which is right for you? Both options offer unique benefits, so it’s important to weigh your needs and priorities before making a decision.

Sharing

Sharing involves borrowing something from someone you know, usually for free or for a small fee. This can be a great option if you need something for a short period and have a friend or family member who owns it. Sharing also helps build relationships and foster a sense of community.

Renting

Renting involves paying a fee to use something that you don’t own. This is a good option if you need something for a longer period, or if you don’t know anyone who owns it. Renting can also offer flexibility, as you can often choose the length of your rental period and have access to a variety of items.

Factors to Consider

Here are some factors to consider when deciding between sharing and renting:

- Duration: How long do you need the item? Sharing is better for short-term needs, while renting is suitable for longer durations.

- Availability: Does someone you know own the item? Sharing depends on the availability of someone willing to lend. Renting offers more flexibility.

- Cost: Renting can be more expensive than sharing, especially if you need the item for a short period.

- Flexibility: Renting offers more flexibility, as you can choose the duration and type of item.

- Convenience: Sharing might be more convenient if you can borrow it from someone you know. Renting requires finding a rental provider and picking up the item.

Ultimately, the best choice between sharing and renting depends on your individual needs and preferences. Consider the factors above, and choose the option that best fits your situation.

Budgeting for Short-Term vs. Long-Term Car Needs

When it comes to car needs, there are two main categories: short-term and long-term. Short-term needs usually arise from unexpected situations, such as a flat tire or a broken down car. Long-term needs, on the other hand, are more planned out and can include buying a new car, paying for car repairs, or saving for future car-related expenses.

Budgeting for both short-term and long-term car needs is crucial for financial stability. A well-planned budget can help you avoid unexpected costs and ensure you have the resources available when you need them. Here are some tips for budgeting for each type of car need:

Short-Term Car Needs

For short-term car needs, it’s important to have an emergency fund. This fund should cover unexpected costs such as:

- Car repairs: Including tire changes, oil changes, and minor repairs

- Towing: If your car breaks down and needs to be towed to a repair shop

- Rental car: If you need to rent a car while yours is being repaired

Aim to have at least $1,000 in your emergency fund. This amount may seem like a lot, but it can be a lifesaver in a crisis. You can build your emergency fund by setting aside a small amount of money each month.

Long-Term Car Needs

Budgeting for long-term car needs requires more planning and foresight. Here are some key areas to consider:

- Car payments: If you’re financing a new or used car, factor in your monthly car payments.

- Car insurance: Ensure you have adequate car insurance coverage and factor in the monthly premiums.

- Gas and maintenance: Create a budget for your estimated monthly gas costs and routine maintenance expenses.

- Car repairs and replacements: As your car ages, you’ll likely need to budget for more frequent repairs or eventually a car replacement.

- Savings for future car needs: It’s wise to set aside money for future car-related expenses, such as a new car purchase or major repairs.

By carefully planning and budgeting for both short-term and long-term car needs, you can stay on top of your car expenses and avoid financial stress. Remember, a well-managed car budget can help ensure you have the resources available when you need them and keep your car running smoothly for years to come.

How Car Sharing Can Reduce Monthly Expenses

In today’s economy, it’s more important than ever to find ways to save money. One area where many people spend a significant amount of money is on their cars. Between car payments, insurance, gas, and maintenance, owning a car can be a major drain on your budget. Fortunately, there’s a great alternative that can help you save: car sharing.

Car sharing is a service that allows you to rent a car by the hour or day. It’s a much more affordable option than owning a car, and it can save you a lot of money in the long run. Here are some of the ways car sharing can reduce your monthly expenses:

Lower Monthly Costs

When you own a car, you have to make monthly payments on the loan, as well as pay for insurance, registration, and maintenance. Car sharing services allow you to avoid these expenses. You only pay for the car when you use it.

Save on Gas and Parking

If you live in a city, you know how expensive gas and parking can be. Car sharing can help you save money on both of these expenses. You only pay for the gas you use, and you can often find free or discounted parking at car sharing locations.

Reduce Maintenance Costs

Car maintenance can be a huge expense. With car sharing, you don’t have to worry about oil changes, tire rotations, or other routine maintenance. The car sharing company takes care of all of that for you.

Flexibility and Convenience

Car sharing gives you the flexibility to use a car only when you need it. You don’t have to worry about finding a parking spot or making a long commute to work. You can simply book a car on your phone and have it delivered to your location.

Environmentally Friendly

Car sharing is also an environmentally friendly option. By reducing the number of cars on the road, car sharing helps to reduce traffic congestion and air pollution.

If you’re looking for a way to reduce your monthly expenses, car sharing is a great option. It’s affordable, convenient, and good for the environment. Give it a try and see how much money you can save!

Understanding Insurance Options in Car Sharing

Car sharing, also known as peer-to-peer (P2P) car rental, has become increasingly popular in recent years, offering an alternative to traditional car ownership. However, navigating the world of car sharing can be a bit complex, especially when it comes to insurance. Understanding the different insurance options available is crucial to ensure you’re adequately protected while using a shared vehicle.

Typically, there are two primary insurance components involved in car sharing: the car owner’s insurance and the car sharing platform’s insurance.

Car Owner’s Insurance

The car owner’s insurance policy generally provides primary coverage for the vehicle. This means that the owner’s insurance will usually be the first to respond in case of an accident or damage. However, it’s essential to note that some car owner’s insurance policies may have limitations or exclusions when the vehicle is being used for car sharing purposes. It’s crucial to check with your insurance provider to understand any specific restrictions or requirements.

Car Sharing Platform’s Insurance

Car sharing platforms often provide their own insurance policies to cover the renter and the shared vehicle. These policies typically include liability coverage, which protects the renter in case of an accident causing damage to another vehicle or property. They may also offer collision and comprehensive coverage to protect the shared vehicle itself. However, the specific coverage provided by each platform can vary, so it’s important to review the platform’s terms and conditions carefully.

Additional Insurance Options

Beyond the primary coverage provided by the car owner and the car sharing platform, you may have the option to purchase additional insurance options. These may include:

- Rental car insurance: This can provide additional coverage, often for situations not covered by the primary insurance policies.

- Personal accident insurance: This coverage can help protect you in case of an accident causing personal injury.

Important Considerations

When deciding on insurance for car sharing, it’s crucial to consider the following:

- Coverage limits: Make sure the coverage limits are sufficient for your needs, especially if you’re planning to drive longer distances or transport valuable items.

- Deductibles: Understand the deductible amount you’ll have to pay in case of an accident.

- Exclusions: Be aware of any activities or situations that are not covered by the insurance policy.

By carefully examining the insurance options available and understanding the coverage provided, you can make an informed decision to ensure you’re adequately protected while enjoying the benefits of car sharing.

Tips for Finding the Best Car Sharing Deals

Car sharing services have become increasingly popular in recent years, offering a convenient and affordable alternative to car ownership. But with so many different companies and plans available, it can be tough to find the best deals. Here are some tips to help you save money on car sharing:

1. Compare Prices and Plans

Don’t just settle for the first car sharing service you find. Compare prices and plans from different providers to find the best value for your needs. Consider factors such as:

- Hourly rates: How much do you pay per hour?

- Daily rates: How much do you pay for a full day of use?

- Membership fees: Do you have to pay a monthly or annual membership fee?

- Fuel costs: Who is responsible for paying for fuel?

- Insurance: What kind of insurance coverage is included?

2. Look for Discounts and Promotions

Many car sharing companies offer discounts and promotions to new and existing members. Look for deals on their websites, social media pages, and email newsletters. You may also be able to get discounts through your employer or other organizations.

3. Choose the Right Car for Your Needs

Not all car sharing services offer the same types of vehicles. If you only need a small car for short trips, you can save money by choosing a compact car instead of a larger SUV. However, if you need to haul a lot of cargo or passengers, you may need to rent a larger vehicle.

4. Use the App to Your Advantage

Most car sharing companies have apps that allow you to reserve a car, track your usage, and manage your account. Take advantage of the app’s features to save money. For example, some apps allow you to extend your rental time without having to pay a penalty fee.

5. Be Mindful of Your Usage

The more you use a car sharing service, the more you’ll likely spend. Be mindful of your usage and only use the service when you really need it. Consider alternative forms of transportation, such as public transit or biking, for shorter trips.

By following these tips, you can find the best car sharing deals and save money on your transportation costs. Just remember to do your research and compare your options before you commit to any one service.

Planning for Flexibility with Car Sharing

In today’s fast-paced world, flexibility is key. Whether it’s your work schedule, travel plans, or even your transportation needs, having options is essential. Car sharing services have become increasingly popular in recent years, offering a convenient and flexible alternative to traditional car ownership.

One of the biggest advantages of car sharing is its flexibility. You only pay for the time you use the car, so you’re not tied down by monthly payments or insurance costs. This makes it an ideal solution for people who don’t drive often, or who only need a car for occasional errands or trips.

Car sharing services also offer a wide range of vehicles to choose from, catering to different needs and preferences. Whether you need a compact car for city driving or a larger SUV for a family road trip, you’ll find a suitable option. You can even choose from electric or hybrid vehicles for eco-conscious commuting.

Another key benefit is the convenience. Car sharing services typically have locations throughout the city, making it easy to find a car close to you. You can book a car online or through a mobile app, and access it with your phone. There’s no need to worry about parking or maintenance, as the service provider takes care of all that.

Car sharing is also a cost-effective alternative to car ownership. You’re not responsible for maintenance costs, insurance premiums, or depreciation. Plus, you can avoid the hassle of paying for parking, which can be a significant expense in urban areas.

Overall, car sharing offers a range of benefits for individuals and families looking for a more flexible and cost-effective transportation solution. With its convenience, affordability, and wide selection of vehicles, it’s no surprise that car sharing is becoming increasingly popular in cities around the world.