Are you trying to decide whether renting a car or an apartment is more financially viable? Finding the right rental option can be a challenge, especially when you’re trying to balance your budget. This guide will walk you through the crucial factors to consider when comparing car rental costs and apartment rental costs. We’ll provide practical tips and insights to help you make informed decisions and become a savvy renter.

Understanding the Cost Factors in Car and Apartment Rentals

Rental costs for cars and apartments can vary significantly depending on several factors. Understanding these factors can help you make informed decisions and potentially save money. Let’s explore some key influences on both car and apartment rentals:

Car Rentals

Location is a major factor in car rental costs. Popular tourist destinations or areas with high demand often have higher prices. Seasonality also plays a role, with rentals typically costing more during peak travel seasons. The type of car you choose is crucial. Luxury vehicles, SUVs, or larger cars generally cost more than compact or economy models. Rental duration impacts pricing, with longer rentals usually resulting in lower daily rates. Additional features like insurance, GPS, or child seats can add to the overall cost. Booking in advance can sometimes secure better rates and avoid last-minute price increases.

Apartment Rentals

Location is a primary determinant of apartment rental costs. Urban areas, desirable neighborhoods, or properties with convenient amenities often come with higher prices. Size and type of apartment also influence cost. Larger units with more bedrooms or amenities like balconies or in-unit laundry typically cost more. Building amenities such as swimming pools, fitness centers, or parking garages can increase rent. Lease terms can impact the overall cost, with longer leases sometimes offering lower monthly rates. Market conditions, including supply and demand, can affect rental prices in a particular area. Property management fees may also be added to the monthly rent.

Tips for Saving Money

To minimize rental costs, consider the following tips:

- Rent a car during off-peak seasons or weekdays.

- Compare prices from multiple car rental companies.

- Look for deals and promotions.

- Choose a smaller or less popular car model.

- Explore neighborhoods slightly further from the city center for apartments.

- Consider renting a studio or one-bedroom unit.

- Negotiate with landlords or property managers for lower rent.

By understanding the key factors influencing rental costs and employing smart strategies, you can find more affordable options for your car and apartment rental needs.

Top Tips for Budgeting Monthly Rental Costs

Rent is a significant expense for most people, and it can be difficult to budget for it effectively. However, with a little planning and organization, you can make sure that you’re always able to pay your rent on time and stay within your budget. Here are some top tips for budgeting monthly rental costs:

1. Track your spending. The first step to budgeting for rent is to track your spending. This will help you to identify areas where you can save money. You can use a budgeting app, a spreadsheet, or even just a notebook to track your spending. Try to track spending for a full month to get a good picture of your income and expenditures.

2. Create a budget. Once you know how much money you’re spending, you can create a budget. This will help you to allocate your money in a way that allows you to pay your rent on time and still have enough money left over for other expenses. You can use a budgeting app, a spreadsheet, or a budget planner to create a budget. There are many free and paid options available. Remember to include your monthly rental cost in your budget.

3. Negotiate your rent. If you’re struggling to afford your rent, you may be able to negotiate a lower price with your landlord. Many landlords are willing to work with tenants who are struggling financially. If you’re facing financial hardship, be transparent and polite about your situation and they may work with you to find a solution. This may take the form of a reduced rent or a payment plan. You may be able to get a discount if you are willing to sign a longer lease or prepay rent.

4. Find roommates. If you’re struggling to afford rent on your own, you may want to consider finding roommates. This will help to reduce your monthly costs. Roommates can help you to share the cost of rent, utilities, and other expenses. This is a great way to reduce your expenses and can work well for those who are outgoing and have a good track record of living with others.

5. Look for cheaper housing options. If you’re still struggling to afford rent, you may want to look for cheaper housing options. This could involve moving to a less expensive neighborhood or finding a smaller apartment. Don’t be afraid to shop around for the best rental deals. There are many websites and apps that list available rentals. You can also check with local real estate agents for assistance.

6. Automate your payments. Setting up automatic payments for rent can help to ensure that you always pay on time. This can help you to avoid late fees and build a good credit history. You can typically set up automatic payments through your landlord or through your bank. This is a great way to avoid late fees and free up mental energy for other things.

7. Set aside an emergency fund. Unexpected expenses can happen, so it’s important to have an emergency fund. This will help you to cover unexpected costs, such as a car repair or a medical bill. Having an emergency fund will help you to avoid having to dip into your rent money when you face an unexpected expense. This will give you peace of mind that you’re covered.

8. Use a budgeting app. Budgeting apps can help you to track your spending, create a budget, and set financial goals. There are many free and paid budgeting apps available, so you can find one that fits your needs and budget. Apps can be a great way to track your spending and stay on top of your budget, especially if you’re new to budgeting.

By following these tips, you can create a budget that allows you to pay your rent on time and stay within your budget. Remember to be flexible and adjust your budget as needed. Your rent will change over time as your lifestyle and income evolve.

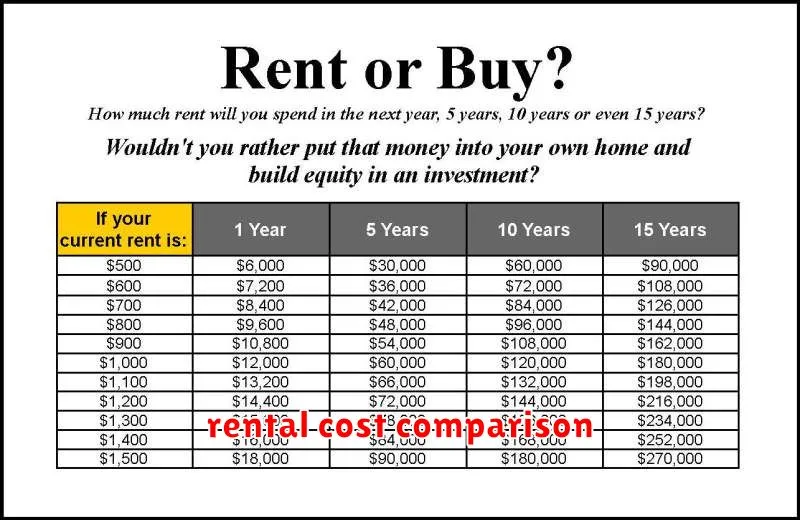

How to Choose Between Different Apartment Rental Prices

Finding the perfect apartment can be a challenging process, especially when faced with a range of rental prices. It’s essential to navigate this decision-making process wisely to ensure you find an apartment that fits your budget and meets your needs.

1. Determine Your Budget

Before you start looking at apartments, establish a clear budget. Consider your monthly income, essential expenses like groceries and transportation, and any other financial obligations. Aim to allocate no more than 30% of your income towards rent.

2. Consider Location and Amenities

Location plays a significant role in determining rental prices. Apartments in desirable neighborhoods or near popular amenities tend to be more expensive. Evaluate your priorities: Do you need to be close to work or public transportation? Is a gym or swimming pool essential? Balancing your needs with your budget is crucial.

3. Compare Apartment Features

Beyond the rental price, consider the apartment features. Compare the size and layout of apartments, the condition of appliances, the presence of laundry facilities, and parking options. Evaluate the overall quality and potential for future upgrades.

4. Factor in Additional Costs

Remember to factor in additional costs beyond the base rent. These can include:

- Utilities (electricity, gas, water)

- Internet and cable

- Parking fees

- Pet deposits or monthly pet rent

- Security deposits

These costs can significantly impact your overall expenses.

5. Negotiate with the Landlord

Don’t be afraid to negotiate with the landlord. If you’re a good tenant with a strong credit history and a steady income, you might be able to secure a lower rental price or request concessions like waived fees.

6. Trust Your Gut

Ultimately, choose an apartment that feels right for you. Consider your lifestyle, priorities, and long-term goals. Don’t settle for an apartment simply because it’s the cheapest option. Find a place that meets your needs and brings you joy.

Finding the Best Car Rental Deals on a Budget

Planning a trip and need a rental car? It’s easy to get overwhelmed by the seemingly endless options and fluctuating prices. But don’t despair! Finding affordable car rental deals is possible with a little research and planning. Here’s a guide to help you navigate the rental car jungle and secure the best deals:

1. Shop Around and Compare Prices

Don’t settle for the first quote you see. Use comparison websites like Kayak, Expedia, or Priceline to compare prices from multiple rental companies. Be sure to consider hidden fees like insurance and fuel charges. Remember, prices can vary significantly, so it’s essential to shop around before making a decision.

2. Be Flexible with Dates and Locations

If you have some flexibility with your travel dates, consider adjusting them slightly. Prices can fluctuate depending on the day of the week and the time of year. You may find better deals by renting on weekdays or during the off-season. Similarly, choosing a rental location slightly outside the busiest tourist areas can sometimes lead to lower prices.

3. Consider Off-Airport Locations

Rental companies often charge higher fees for airport pick-ups and drop-offs. If you’re not in a rush and can arrange your own transportation, renting from an off-airport location can save you money. You may also find better deals on insurance and other add-ons at off-airport locations.

4. Look for Discounts and Promotions

Many rental companies offer discounts for AAA members, military personnel, and senior citizens. Don’t forget to check for promotions and special offers. Some rental companies offer discounts for booking online, paying with a specific credit card, or joining their rewards program.

5. Choose the Right Car

Avoid the temptation to upgrade to a bigger or more luxurious car than you need. Stick to a smaller, more fuel-efficient vehicle, especially if you plan on driving long distances. Make sure the car meets your specific needs, such as luggage space or passenger capacity, but choose the most affordable option that will comfortably accommodate you and your belongings.

6. Don’t Overpay for Insurance

Rental companies often try to upsell you on additional insurance, but your existing auto insurance may already cover you. Review your coverage and consider declining optional insurance if it’s redundant. You can also purchase supplemental insurance from a third-party provider if you’re uncomfortable with the coverage provided by the rental company.

7. Book in Advance

Prices tend to increase as you get closer to your travel dates, so it’s often advantageous to book your rental car in advance. Booking ahead also allows you to secure your preferred car type and avoid last-minute disappointment.

8. Avoid Extra Fees

Pay attention to additional fees like early return fees, late return fees, and mileage fees. These can add up quickly. If possible, try to return the car at the scheduled time and stay within the designated mileage limit to avoid these extra costs.

9. Read the Fine Print

Always take a moment to carefully review the terms and conditions of your rental agreement. This includes checking for any limitations on driving areas, insurance coverage, and the process for reporting accidents or damage.

10. Don’t Be Afraid to Negotiate

If you’re feeling adventurous, don’t hesitate to negotiate with the rental company. They may be willing to offer a better price, especially if you’re willing to commit to a longer rental period or if you’re booking during the off-season.

By following these tips, you can save money and avoid common rental car pitfalls. Enjoy your trip and happy driving!

Evaluating Rental Companies for Cost Efficiency

Renting a car, truck, or other equipment can be a convenient and cost-effective option for short-term needs. However, with so many rental companies available, it’s crucial to compare prices and features to find the most cost-efficient option. Here’s a step-by-step guide to evaluating rental companies for cost efficiency:

1. Determine Your Needs

Before you start shopping around, it’s essential to clarify your specific requirements. Consider the following factors:

- Vehicle type: What kind of vehicle do you need (car, truck, van, etc.)?

- Rental duration: How long will you need the vehicle?

- Mileage: How many miles do you expect to drive?

- Location: Where will you pick up and return the vehicle?

- Additional features: Do you need GPS, insurance, or other add-ons?

2. Compare Prices and Packages

Once you know your needs, start comparing prices from various rental companies. Consider using online comparison websites like Kayak, Priceline, or Expedia to get a broad overview. Pay attention to the following:

- Base rental rate: This is the daily or weekly charge for the vehicle.

- Fees: Check for additional fees like airport surcharges, insurance, and fuel charges.

- Discounts: Look for discounts for AAA members, military personnel, or corporate accounts.

- Package deals: Some rental companies offer package deals that bundle insurance and other extras.

3. Evaluate Insurance Options

Rental companies typically offer various insurance options, but it’s essential to understand your existing coverage before making a decision. Consider:

- Collision Damage Waiver (CDW): This covers damage to the rental vehicle, but it might have a deductible.

- Liability Insurance: This protects you from financial liability in case of an accident.

- Personal Accident Insurance (PAI): This covers medical expenses in case of an accident.

- Your Personal Insurance: Check your personal car insurance policy to see if it provides coverage for rental vehicles.

4. Read the Fine Print

Always review the rental agreement thoroughly before signing. Pay attention to the following:

- Fuel policy: How are you expected to return the vehicle? Full tank, empty tank, or pre-paid fuel?

- Mileage restrictions: Are there any mileage limits? What are the charges for exceeding the limit?

- Cancellation policy: Understand the cancellation fees and deadlines.

- Additional fees: Be aware of any additional charges for late returns, cleaning, or damages.

5. Consider Customer Service and Reputation

In addition to price, it’s also important to consider the rental company’s reputation and customer service. Read online reviews from previous customers to get an idea of their experiences. Look for companies with a track record of reliability and prompt assistance.

6. Don’t Forget About Rewards Programs

Many rental companies have loyalty programs that can offer benefits like discounts, free upgrades, or bonus points. Consider joining a rewards program if you plan to rent frequently.

Evaluating rental companies for cost efficiency requires a thorough process that takes into account your specific needs, pricing structures, insurance options, and customer service. By following these steps, you can make an informed decision and secure the most cost-effective rental for your next trip or project.

Seasonal Trends in Car and Apartment Rental Prices

Rental prices, be it for cars or apartments, often fluctuate throughout the year, driven by a variety of seasonal factors. These fluctuations can significantly impact your travel budget and housing costs, making it crucial to understand the trends to make informed decisions.

Car Rental Prices

Car rental prices are typically higher during peak travel seasons like summer, holidays, and spring break. This is because demand for rental cars is high, and rental companies can charge premium prices. Conversely, rental prices tend to be lower during the off-season, when demand is lower.

Here are some key factors that influence car rental prices:

- Holidays: Rental prices surge during major holidays like Thanksgiving, Christmas, and New Year’s Eve, due to increased travel demand.

- School Breaks: Spring break and summer vacations witness a spike in rental prices as families and students travel.

- Weather: Destinations with favorable weather conditions, like beach resorts or ski towns, often have higher rental rates during peak seasons.

- Events: Large events, such as concerts, festivals, or conferences, can cause a temporary increase in rental prices in the area.

Apartment Rental Prices

Apartment rental prices also exhibit seasonal variations, though they are often less pronounced than car rental prices. In some areas, prices may be higher during peak seasons, typically driven by factors such as:

- Summer: In cities with a high influx of tourists during the summer, apartment prices may rise due to increased demand for short-term rentals.

- College Semester Start: Rental prices can increase near university towns as students move in for the new semester.

- Weather: In areas with harsh winters, apartment prices may be higher during the warmer months due to greater demand for comfortable living spaces.

Tips for Saving Money

To minimize your expenses, consider these tips:

- Book in Advance: Booking your car or apartment rental well ahead of time, especially during peak seasons, can secure better prices and avoid last-minute price hikes.

- Travel During Off-Season: If your travel dates are flexible, consider traveling during the off-season to enjoy lower prices and avoid crowds.

- Compare Prices: Utilize comparison websites and apps to compare prices from different rental companies and find the best deals.

- Look for Discounts and Promotions: Many rental companies offer discounts for AAA members, military personnel, or students. Additionally, check for special promotions and deals.

By understanding seasonal trends and employing these tips, you can navigate the fluctuations in rental prices and make informed choices to save money on your travels and housing expenses.

Pros and Cons of Short-Term vs. Long-Term Rentals

When searching for a new place to live, you have a choice between short-term rentals and long-term rentals. Both options have advantages and disadvantages, and the best choice for you will depend on your individual circumstances and priorities.

Short-Term Rentals

Short-term rentals typically last for a few months or less, and they are often found in furnished apartments or houses. They can be a good option for people who are looking for a temporary place to stay, such as:

- People who are relocating to a new city

- People who are traveling for work or leisure

- People who are between homes

Pros of Short-Term Rentals

- Flexibility: Short-term rentals allow you to stay in a place for a shorter period of time, giving you more flexibility to move or change your plans.

- Furnished accommodations: Many short-term rentals are fully furnished, which can be a huge convenience, especially if you are moving or traveling.

- Variety of options: Short-term rentals come in a wide range of styles and locations, making it easier to find a place that meets your needs.

- Potential for lower costs: In some cases, short-term rentals may be more affordable than long-term rentals, particularly if you only need a place to stay for a short time.

Cons of Short-Term Rentals

- Higher costs per month: While the total cost may be lower for a short period, short-term rentals often have higher monthly costs than long-term rentals.

- Limited amenities: Some short-term rentals may have limited amenities compared to long-term rentals.

- Less privacy: Short-term rentals are often located in buildings with multiple units, which can mean less privacy.

- Lack of stability: Short-term rentals can be less stable than long-term rentals, as you may have to move out on short notice.

Long-Term Rentals

Long-term rentals typically last for a year or more, and they are often found in unfurnished apartments or houses. They are a good option for people who are looking for a stable and affordable place to live.

Pros of Long-Term Rentals

- Lower monthly costs: Long-term rentals typically have lower monthly costs than short-term rentals.

- More stability: Long-term rentals offer more stability, as you will not have to move out on short notice.

- Greater privacy: Long-term rentals often offer greater privacy, as you are typically living in a single-family home or a larger apartment with fewer units.

- Potential for lower overall costs: While the monthly cost may be less, in the long run, long-term rentals can end up being more affordable than short-term rentals.

Cons of Long-Term Rentals

- Less flexibility: Long-term rentals offer less flexibility, as you are typically locked into a lease for a year or more.

- Less variety of options: The variety of available long-term rentals can be more limited than short-term rentals.

- Unfurnished accommodations: Many long-term rentals are unfurnished, which can add extra costs and hassle.

- Longer commitment: Long-term rentals require a greater commitment than short-term rentals.

The best type of rental for you will depend on your individual circumstances and priorities. Consider your budget, your need for flexibility, and your desired living situation before making a decision.

How to Use Credit Card Rewards for Rental Savings

Credit card rewards can be a great way to save money on your rent. Many credit cards offer cash back, travel miles, or points that can be redeemed for statement credits or gift cards. These rewards can be used to offset the cost of your rent, making it more affordable.

Choose a Card with Rewards That Align with Your Needs

The first step is to choose a credit card that offers rewards that align with your needs. If you’re looking to save money on your rent, a card with cash back rewards is a good option. You can also consider a card that offers points or miles that can be redeemed for travel, which can help you save on your next vacation. It’s important to read the terms and conditions of the card carefully to understand how the rewards program works and what the redemption options are.

Maximize Your Rewards

Once you have a rewards credit card, you need to maximize your rewards. This means using your card for everyday purchases and taking advantage of any bonus categories that the card offers. For example, some cards offer bonus rewards for groceries, gas, or dining. By using your card for these purchases, you can earn more rewards that can be used to pay for your rent.

Redeem Your Rewards for Statement Credits

Many credit card companies allow you to redeem your rewards for statement credits. This means that the rewards will be applied directly to your credit card balance, effectively reducing your rent payment. This is one of the most efficient ways to use your rewards to save money on your rent.

Use Rewards for Rent-Related Expenses

You can also use your credit card rewards for rent-related expenses, such as furniture, appliances, or utilities. This can help you save money on these expenses, which can free up more money to cover your rent. You can also redeem your rewards for gift cards to stores where you frequently shop for rent-related items.

Using credit card rewards to save on rent can be a great way to stretch your budget. By choosing a rewards credit card that aligns with your needs, maximizing your rewards, and redeeming them for statement credits or rent-related expenses, you can use your credit card to reduce your rent burden and save money.

Comparing Insurance Costs for Apartments and Cars

Insurance is a crucial aspect of financial planning, protecting us from unexpected events that could result in significant financial losses. Two common types of insurance that many individuals consider are apartment insurance and car insurance. Both offer valuable protection, but they differ in their coverage, cost factors, and overall benefits.

Apartment Insurance

Apartment insurance, also known as renter’s insurance, provides coverage for your personal belongings and liability in case of unforeseen incidents. It typically includes coverage for:

- Personal Property: Protects your belongings from damage or theft, including furniture, electronics, clothing, and valuables.

- Liability: Covers you if someone is injured in your apartment or if you accidentally damage someone else’s property.

- Additional Living Expenses: Helps cover temporary housing and other expenses if you’re forced to leave your apartment due to a covered event.

The cost of apartment insurance varies depending on factors such as:

- Location: Higher crime rates or natural disaster risks can increase premiums.

- Coverage Amount: The amount of coverage you choose for your personal property and liability will influence the cost.

- Deductible: A higher deductible will typically result in lower premiums.

- Credit Score: A good credit score can lead to lower insurance rates.

Car Insurance

Car insurance is a legal requirement in most states, and it protects you financially in case of accidents, theft, or other incidents involving your vehicle. It generally includes coverage for:

- Liability: Covers damages to other vehicles or property and injuries to others in case of an accident caused by you.

- Collision: Pays for repairs to your car if you’re involved in an accident, regardless of who’s at fault.

- Comprehensive: Covers damage to your car from incidents other than accidents, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist: Provides coverage if you’re hit by a driver without insurance or insufficient insurance.

The cost of car insurance is influenced by factors such as:

- Vehicle Type: The make, model, and value of your car can affect premiums.

- Driving History: A clean driving record with no accidents or violations can lead to lower rates.

- Age and Gender: Young drivers and males often pay higher premiums.

- Location: Higher crime rates and traffic congestion can impact insurance costs.

Comparing Costs

It’s difficult to provide a definitive answer to which insurance is more expensive because factors specific to each individual and their situation can significantly impact the cost. Generally, car insurance tends to be more expensive than apartment insurance, but this can vary greatly. For example, if you live in a high-risk area or have a high-value car, your car insurance premiums could be considerably higher.

Both apartment and car insurance offer valuable protection, but they serve different purposes and are influenced by different cost factors. It’s essential to compare quotes from different insurance providers to find the most affordable and suitable coverage for your individual needs. By understanding the factors that influence insurance costs and seeking out the right coverage, you can ensure that you’re adequately protected while keeping your insurance premiums manageable.

Negotiating Rent: Tips to Reduce Monthly Costs

Rent is a significant expense for many people, and finding ways to reduce it can make a big difference in your budget. While landlords may not always be willing to negotiate, there are strategies you can use to increase your chances of success.

1. Research the Market

Before you even start talking to landlords, do your research. Check online listings and contact local real estate agents to get an idea of the going rate for similar properties in your area. This information will give you a solid foundation for your negotiation.

2. Choose the Right Time to Negotiate

Timing is everything. Landlords are more likely to negotiate when they have a vacancy to fill or when the market is slow. Consider approaching them during the off-season or when they have several units available.

3. Offer a Longer Lease

Offering to sign a longer lease term can be a valuable bargaining chip. Landlords appreciate the stability and long-term income, and they might be willing to lower the monthly rent in exchange.

4. Highlight Your Strengths

Emphasize your positive attributes as a tenant. If you have a strong credit score, a stable job history, and a good track record with previous landlords, these factors will work in your favor.

5. Be Prepared to Walk Away

Don’t be afraid to walk away if the landlord isn’t willing to meet your needs. There are other properties available, and you don’t want to settle for a rental agreement that isn’t beneficial to you.

6. Be Polite and Professional

Maintain a respectful and professional demeanor throughout the negotiation process. This will create a positive impression and increase your chances of success.

7. Consider Other Options

If negotiating a lower rent doesn’t work, explore other options to reduce your monthly costs. For instance, look for apartments with included utilities or ask about the possibility of sharing rent with a roommate.

Negotiating rent can be a challenging process, but it’s worth the effort. By following these tips, you can increase your chances of finding a rental property that fits your budget and meets your needs.