Moving to a new city is exciting, but it’s also a significant financial decision. Whether you’re a recent graduate, a young professional, or simply looking for a change of scenery, finding the right apartment in a new city can be overwhelming. In this guide, we’ll walk you through the financial considerations you need to make when renting an apartment in a bustling urban environment. From understanding rental costs and budgeting for utilities to navigating the hidden costs of city living, this comprehensive guide will equip you with the knowledge and tools to make smart financial decisions and find the perfect apartment that fits your budget.

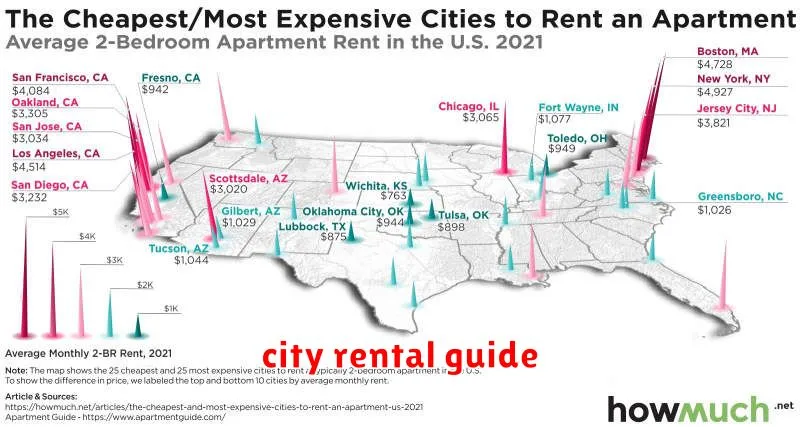

Best Cities for Affordable Apartment Rentals

Finding an affordable apartment in a major city can feel like an impossible task. But don’t despair! There are still places where you can find decent housing without breaking the bank. We’ve compiled a list of the best cities for affordable apartment rentals, based on average rent prices, cost of living, and overall quality of life.

1. Fort Wayne, Indiana

Fort Wayne consistently ranks among the most affordable cities in the United States. With a median rent of around $700 for a one-bedroom apartment, you’ll have plenty of money left over for other expenses. The city also boasts a vibrant arts and culture scene, making it a great place to live for young professionals and families alike.

2. Wichita, Kansas

Wichita is another Midwest city that offers surprisingly affordable housing. The median rent for a one-bedroom apartment is around $750, and the cost of living is significantly lower than in many other major cities. Wichita is also home to a growing tech scene, making it a good option for those looking for job opportunities.

3. Columbus, Ohio

Columbus has become a popular destination for young professionals thanks to its affordable housing and growing economy. The median rent for a one-bedroom apartment is around $800, and the city offers a wide range of amenities, including parks, museums, and restaurants. With a vibrant food scene and a booming tech industry, Columbus is an excellent place to put down roots.

4. Tulsa, Oklahoma

Tulsa is a hidden gem in the Midwest, offering a low cost of living and a thriving arts and culture scene. The median rent for a one-bedroom apartment is around $850, making it an attractive option for budget-conscious renters. Tulsa also boasts a strong economy, with a growing energy sector and a variety of industries.

5. Memphis, Tennessee

Memphis is a vibrant city with a rich musical heritage. The median rent for a one-bedroom apartment is around $900, which is lower than many other major cities in the South. Memphis offers a diverse range of neighborhoods, from historic districts to trendy urban areas.

Tips for Finding Affordable Apartments

Here are some tips to help you find affordable apartments in any city:

- Be flexible with your location: Consider living in less popular neighborhoods or a bit farther from the city center. You might be surprised by the affordable options available.

- Look for roommates: Sharing an apartment with roommates can significantly reduce your monthly expenses.

- Negotiate: Don’t be afraid to negotiate with landlords, especially if you’re willing to sign a longer lease.

- Use online resources: Websites like Zillow, Trulia, and Apartments.com can help you find a wide range of listings.

Finding an affordable apartment can be challenging, but with a little research and some creative thinking, it’s definitely achievable. These cities offer a great balance of affordability, quality of life, and job opportunities. So, if you’re looking to save money on rent and live in a thriving city, consider these top contenders.

Understanding Urban Rental Markets

Urban rental markets are dynamic and complex ecosystems influenced by a myriad of factors, including demographics, economics, and local policies. Understanding these markets is crucial for both landlords and tenants, as it helps navigate the complexities of finding and securing desirable rental properties.

Key Factors Influencing Urban Rental Markets:

Several key factors play a significant role in shaping urban rental markets:

- Population Growth and Demographics: As cities grow, demand for housing increases, putting upward pressure on rental rates. Demographic shifts, such as the rise of millennials and aging populations, also influence housing preferences and affordability.

- Economic Conditions: Economic performance impacts both tenant demand and landlord investment. Strong employment growth can lead to increased rental demand, while economic downturns can result in reduced demand and lower rents.

- Local Policies: Zoning regulations, rent control measures, and housing subsidies all influence the availability and affordability of rental housing. Understanding local policies is essential for both landlords and tenants.

- Availability of Housing: The supply of available rental units plays a critical role in determining rental rates. Limited housing supply in high-demand areas can drive prices up significantly.

- Interest Rates: Interest rates influence mortgage costs, which, in turn, can impact rental rates. When interest rates are low, homeownership becomes more attractive, potentially reducing rental demand.

Navigating the Market:

For landlords, understanding these factors helps in setting competitive rental rates, attracting reliable tenants, and maximizing property returns. For tenants, this knowledge enables them to make informed decisions about location, budget, and property features.

Research and analysis are crucial for both sides. Landlords should stay updated on market trends and demographics, while tenants should thoroughly research potential neighborhoods and properties to find the best fit for their needs and budget.

Communication is also key. Landlords should be transparent about rental terms and property conditions, while tenants should openly discuss their needs and expectations. This fosters trust and ensures a positive rental experience for both parties.

Top Financial Tips for Apartment Renting in Major Cities

Renting an apartment in a major city can be an exciting experience, but it also comes with significant financial considerations. The cost of living in these urban centers is often high, making it essential to manage your finances wisely to ensure a comfortable and sustainable living arrangement. Here are some top financial tips to help you navigate the complexities of renting in a major city:

1. Budgeting and Saving

Before you even start looking for an apartment, create a detailed budget that accounts for all your potential expenses. This should include:

- Rent and utilities

- Groceries and dining

- Transportation

- Entertainment and leisure

- Savings for unexpected expenses and emergencies

It’s also important to build up a savings account to cover the following:

- Security deposit: This is typically one to two months’ rent.

- First month’s rent: You’ll need to pay this upfront.

- Last month’s rent: Some landlords require this as well, but it’s not always the case.

- Moving expenses: This includes the cost of moving trucks, movers, and packing materials.

2. Location, Location, Location

Your choice of location plays a crucial role in your overall budget. Consider the following factors:

- Proximity to work: Living closer to your workplace can save you money on transportation and commuting time.

- Public transportation: If you rely on public transportation, ensure that your chosen neighborhood has convenient access to buses, trains, or subways.

- Neighborhood amenities: Factor in the cost of living in different neighborhoods, considering things like groceries, restaurants, and entertainment.

3. Negotiate and Shop Around

Don’t be afraid to negotiate with landlords. You may be able to secure a lower rent, especially if you’re willing to sign a longer lease or pay your rent in full on time. Also, shop around and compare different apartments before making a decision. Don’t settle for the first place you see. Consider:

- Utilities: Are they included in the rent or are they separate? This can significantly impact your monthly expenses.

- Amenities: Do they offer laundry facilities, parking, or other amenities that you’re willing to pay extra for?

- Lease terms: Pay attention to the length of the lease, the renewal process, and any penalties for breaking the lease.

4. Maximize Your Savings

Take advantage of every opportunity to save money on your apartment expenses. Some strategies include:

- Cook at home: Eating out regularly can significantly drain your budget. Prepare your own meals whenever possible.

- Cut down on entertainment: Explore free or affordable activities in your city. There are many museums, parks, and events that are free or offer discounted rates.

- Utilize public transportation: Instead of relying on taxis or ride-sharing services, consider using public transportation to save money.

- Use energy-efficient appliances: This can help reduce your utility bills in the long run.

5. Financial Planning and Emergency Funds

Beyond budgeting and saving, it’s essential to plan for the future. This includes:

- Build a strong credit score: This can help you qualify for better rental rates and lower security deposits.

- Set up an emergency fund: This will help you cover unexpected expenses like job loss or medical bills.

- Consider a roommate: Sharing an apartment with a roommate can significantly reduce your rent and living expenses.

How to Budget for City Living

City living can be an exciting and fulfilling experience, but it can also be expensive. If you’re planning to move to a city, it’s important to create a budget that will help you manage your finances and avoid financial stress. Here are some tips for budgeting for city living:

1. Research the Cost of Living

Before you move, research the cost of living in the city you’re considering. Websites like Numbeo and Expatistan can help you compare the cost of housing, transportation, food, and other expenses in different cities. This will give you a good idea of what to expect and help you create a realistic budget.

2. Consider Your Housing Costs

Housing is typically the biggest expense for city dwellers. When deciding on a place to live, consider the trade-offs between location, size, and affordability. You may need to consider sharing an apartment or living in a smaller space to keep your housing costs down.

3. Factor in Transportation Costs

City living often means relying on public transportation, taxis, or ride-sharing services. Factor in the cost of these options, especially if you have a daily commute to work or school. Consider whether it’s more cost-effective to own a car or rely on alternative transportation options.

4. Plan for Food and Entertainment

Eating out and entertainment are common expenses in cities. Set a budget for these activities and try to find affordable alternatives, such as cooking at home or attending free events. Explore discounts and deals available in your city.

5. Track Your Expenses

Once you’ve created a budget, it’s important to track your expenses to ensure you’re staying on track. There are many budgeting apps and websites available that can help you track your spending and identify areas where you can save money.

6. Find Ways to Save Money

There are many ways to save money in the city. Look for free or discounted events, take advantage of public transportation, and find affordable ways to entertain yourself. You can also look for ways to save on everyday expenses like groceries and utilities.

7. Adjust Your Budget Regularly

Your budget should be a living document that you review and adjust regularly. As your income or expenses change, you may need to make adjustments to your budget to ensure you’re still on track. Regularly review your spending habits and make adjustments as needed.

Budgeting for city living can be challenging, but it’s essential for managing your finances and avoiding financial stress. By following these tips, you can create a budget that works for you and enjoy the benefits of city living without breaking the bank.

Balancing Rent with Cost of Living Expenses

Living in a city can be an exciting and rewarding experience, but it also comes with its fair share of financial challenges. One of the biggest concerns is balancing rent with other essential cost of living expenses. Finding a comfortable and affordable place to live while still having enough money to cover your daily needs can be tricky. But with careful planning and budgeting, it’s definitely possible.

The first step is to assess your financial situation. Figure out your monthly income and then determine how much you can realistically afford to spend on rent. A general rule of thumb is to keep your rent at or below 30% of your gross income. This leaves you with enough money for other important expenses like groceries, transportation, utilities, and healthcare.

Once you know your budget, start exploring different neighborhoods and housing options. Consider factors such as location, proximity to work, and amenities. You might find that a slightly smaller apartment in a less trendy neighborhood could save you money and still meet your needs. If you’re willing to share an apartment with roommates, that can also reduce your rent significantly.

Beyond rent, it’s crucial to prioritize your essential expenses. Create a budget that outlines your spending for groceries, utilities, transportation, and healthcare. Look for ways to cut costs in these areas, such as cooking at home instead of eating out, using public transportation or biking, and exploring free or low-cost activities in your city.

Remember that balancing rent with other expenses is an ongoing process. Regularly review your budget and look for opportunities to make adjustments. Don’t be afraid to ask for help if you’re struggling to make ends meet. There are many resources available, such as financial counseling services or community organizations that can provide support and guidance.

Living in a city doesn’t have to be a financial burden. By being mindful of your spending and making smart decisions, you can find a balance between your rent and other essential costs, allowing you to enjoy all the benefits of city living without breaking the bank.

Evaluating Commute Costs for City Renters

Moving to a city often means a trade-off: proximity to work versus affordability. While living close to the office sounds ideal, rent prices in central locations can be significantly higher. This begs the question: is it worth paying a premium for a short commute, or can you save money by living further out and factoring in transportation costs?

To make an informed decision, consider the following:

1. Transportation Costs

Calculate the average cost of your commute, including:

- Public Transportation: Factor in the cost of fares, monthly passes, and potential transfers.

- Driving: Consider gas, tolls, parking fees, and car maintenance.

- Ride-sharing: Calculate the average cost per trip for services like Uber or Lyft.

2. Time Costs

Beyond monetary costs, consider the value of your time. A longer commute can mean less time for:

- Sleep

- Exercise

- Hobbies

- Spending time with loved ones

3. Potential Savings

Compare the difference in rent prices between central and less central locations. Factor in the potential transportation costs and the value of your time to determine if the savings outweigh the inconvenience of a longer commute.

4. Long-Term Perspective

Think about your long-term goals. If you anticipate moving to a different job or a different city in the future, a longer commute might be more beneficial. But if you plan to stay in the same city for a long time, it might make sense to invest in a shorter commute now.

5. Personal Preferences

Ultimately, the decision is subjective and depends on your individual priorities. Some people value a shorter commute above all else, while others are more comfortable with longer commutes in exchange for lower rent costs.

By carefully evaluating all aspects of your commute, you can make a decision that fits your lifestyle and budget. Don’t underestimate the impact of transportation costs and time on your overall financial well-being and quality of life.

Exploring Urban Apartment Rental Laws

Navigating the world of urban apartment rentals can be a complex and often confusing process, especially when it comes to understanding your rights and responsibilities as a tenant. It’s essential to familiarize yourself with the legal framework governing rental agreements in your city, as it can significantly impact your living experience.

This article will delve into the essential aspects of urban apartment rental laws, providing insights into key areas such as:

- Lease Agreements: Understanding the terms and conditions of your lease, including rent, security deposits, and termination clauses.

- Tenant Rights: Exploring your legal protections as a tenant, including rights to privacy, quiet enjoyment, and reasonable repairs.

- Landlord Responsibilities: Understanding the obligations of landlords in maintaining safe and habitable living conditions.

- Dispute Resolution: Knowing how to address disputes and resolve conflicts with your landlord through legal channels.

By gaining a solid understanding of these laws, you can protect your rights and ensure a smoother and more positive rental experience.

Choosing Neighborhoods Based on Rental Prices

When you’re looking for a new place to live, rental prices are one of the most important factors to consider. It can be overwhelming to compare different neighborhoods, especially if you’re unfamiliar with the area. Here are a few tips to help you choose neighborhoods based on rental prices:

1. Determine Your Budget

Before you start looking at apartments, it’s important to know how much you can afford to spend on rent. This will help you narrow down your search and avoid looking at places that are out of your price range. Consider your income, expenses, and any other financial obligations you may have.

2. Research Average Rental Prices

Once you know your budget, you can start researching average rental prices in different neighborhoods. There are many online resources that can help you with this, such as Zillow, Trulia, and Apartments.com. You can also check out local real estate websites or newspapers for listings.

3. Consider Factors Beyond Price

While price is an important factor, it’s not the only thing to consider. You should also think about the following:

- Proximity to work or school

- Access to public transportation

- Safety and crime rates

- Amenities and attractions

- Overall quality of life

4. Be Flexible

It’s important to be flexible when you’re looking for a place to live. You may not be able to find the perfect neighborhood that meets all of your criteria. Be willing to compromise on some things, such as size or location. You may also want to consider renting a room or sharing an apartment with roommates to help reduce your overall rent costs.

5. Don’t Forget to Negotiate

Once you’ve found a few apartments that you like, don’t be afraid to negotiate the rent price. Landlords are often willing to work with tenants, especially in a competitive market. Be prepared to provide a strong case for why you deserve a lower rent, such as your credit score, rental history, or willingness to sign a longer lease.

By following these tips, you can choose a neighborhood that fits your budget and your lifestyle. Remember, finding the right place to live is an important decision, so take your time and do your research.

The Role of Location in Rental Prices

Location is a crucial factor in determining rental prices. Neighborhoods with high demand, desirable amenities, and proximity to desirable features such as schools, parks, and public transportation tend to command higher rental rates.

Proximity to employment centers is another significant factor. Areas close to major employers often experience higher demand and therefore higher rental prices. Commuting costs and time are also crucial considerations, as renters often prioritize convenient access to work.

Amenities and lifestyle are also essential. Neighborhoods with excellent schools, parks, restaurants, and cultural attractions typically command higher rental prices. This is because renters value access to these amenities and are willing to pay a premium for them.

Safety and security are paramount to renters. Neighborhoods with low crime rates and strong community policing tend to attract higher rental prices. This is because renters prioritize safety and security and are willing to pay for it.

Property type and size also play a role. Larger units with desirable features such as balconies, in-unit laundry, and parking often command higher rental prices. The type of property, such as a single-family home, townhouse, or apartment building, also influences rental rates.

In conclusion, location is a key factor in determining rental prices. Demand, amenities, proximity to employment centers, safety, and property type all contribute to rental rates. Understanding these factors can help renters find the most suitable and affordable rental options that meet their needs and preferences.

Tips for Reducing Costs When Renting in Expensive Cities

Living in a major city can be exciting, but it often comes with a hefty price tag. Rent is frequently the biggest expense for city dwellers. If you’re looking to cut down on your rental costs, here are some tips to consider.

1. Choose a Smaller Apartment

Downsizing to a smaller apartment can make a significant difference in your monthly rent. Consider a studio or one-bedroom instead of a two-bedroom, or explore options like micro-apartments or shared living spaces. While less square footage might mean less space, it can save you a considerable amount of money each month.

2. Seek Out Rent-Controlled or Stabilized Units

In some cities, rent-controlled or rent-stabilized units offer protections against excessive rent increases. These units are often older and may not be as modern as newer buildings, but the rent caps can make them significantly more affordable. Research whether these options are available in your city.

3. Consider Off-Peak Seasons

Rent prices often fluctuate with the seasons. If you’re flexible with your move-in date, look at renting during the off-peak seasons when demand is lower. This can potentially lead to better deals and lower rents.

4. Negotiate with the Landlord

Don’t be afraid to negotiate with your landlord. If you have good credit, a stable income, and a strong rental history, you might be able to negotiate a lower rent. You can also ask about potential concessions, such as free rent for the first month, or a discount if you pay rent upfront.

5. Look Beyond the City Center

Living further away from the city center can significantly reduce your rental costs. Consider commuting from the suburbs or surrounding neighborhoods to save on rent. You might find that the extra commute time is worth the savings.

6. Find Roommates

Sharing an apartment with roommates can help you split rent and other expenses. This is a great way to save money, especially if you’re moving to a city alone. Look for roommate matching services or online communities to find potential roommates who share your living style.

7. Explore Affordable Neighborhoods

Every city has its own hidden gems. Research neighborhoods that might be slightly less popular but offer lower rent prices. You might find a charming and affordable area just outside the city center.

Renting in a high-cost city doesn’t have to break the bank. By considering these tips, you can reduce your rental expenses and still enjoy the vibrant lifestyle that cities offer.