Moving to a new city is an exciting adventure, but it can also be financially daunting. From finding a new place to live to budgeting for unexpected expenses, managing your finances during a relocation can be stressful. However, with a little planning and smart financial moves, you can make the transition smoother and keep your budget in check. This guide will provide you with valuable renting tips to help you find the perfect place without breaking the bank.

How to Budget for Relocating to a New City

Moving to a new city can be an exciting and daunting experience. It’s important to have a solid budget in place to ensure a smooth transition and prevent financial stress. Here’s a comprehensive guide to budgeting for your relocation:

1. Research the Cost of Living

Before you start packing, research the cost of living in your new city. Websites like Numbeo and Expatistan provide detailed comparisons of expenses like rent, groceries, transportation, and utilities. This information will give you a realistic picture of your potential expenses and help you adjust your budget accordingly.

2. Estimate Moving Expenses

Moving costs can vary significantly depending on the distance, the size of your belongings, and the type of moving service you choose. Get quotes from multiple moving companies and consider DIY options like renting a truck or hiring movers to help with loading and unloading. Don’t forget to factor in packing supplies, fuel, tolls, and any potential storage fees.

3. Secure Housing

Housing is often the largest expense when relocating. Explore different neighborhoods and consider your desired proximity to work, schools, and amenities. Research average rent prices or purchase costs and factor in security deposits, utility bills, and potential insurance costs. It’s crucial to secure housing before your move date to avoid last-minute scrambling.

4. Plan for Unexpected Costs

Life is full of surprises, and relocating can be no exception. Set aside an emergency fund for unexpected expenses, such as car repairs, medical bills, or unexpected home repairs. It’s better to be prepared than to face financial setbacks during a stressful time.

5. Create a Detailed Budget

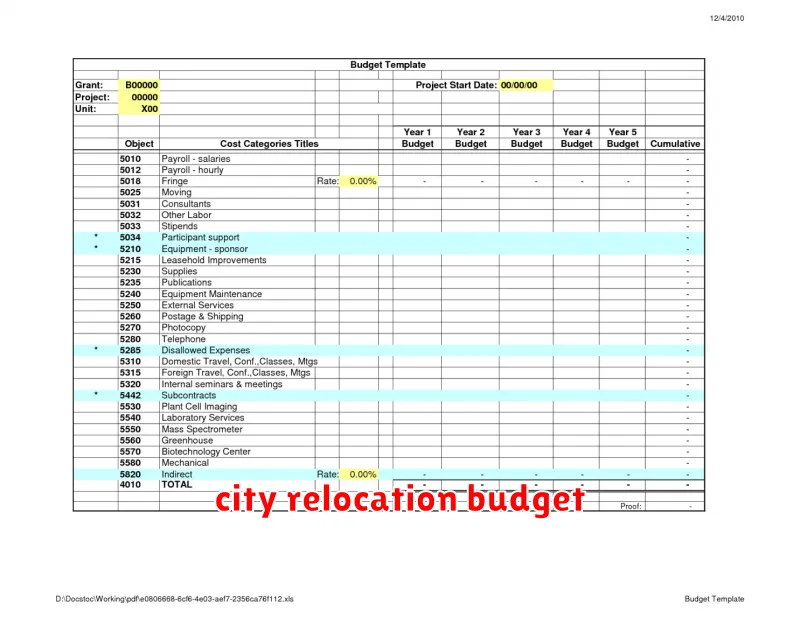

Once you have a good understanding of your anticipated expenses, create a detailed budget. This will help you track your spending, prioritize essential needs, and identify areas where you can save money. Use budgeting apps or spreadsheets to monitor your income and expenses and make adjustments as needed.

6. Seek Financial Assistance if Needed

If you’re struggling to cover relocation costs, explore available financial assistance options. Some employers offer relocation packages, and there may be government programs or grants available to help with housing or other expenses. Don’t hesitate to reach out to financial advisors or community resources for guidance.

7. Consider Downsizing

Relocating is a great opportunity to declutter and simplify your life. Downsizing your belongings can save you money on moving costs and storage fees. Sell unwanted items, donate to charity, or consider renting a storage unit for items you may need in the future.

8. Track Your Spending

Once you’ve settled into your new city, it’s important to track your spending habits. Regularly review your budget and make adjustments as needed. This will help you stay on top of your finances and ensure you’re not overspending in any particular area.

Moving to a new city is a significant life event that requires careful planning and budgeting. By following these tips, you can ensure a smooth and financially responsible transition to your new home.

Finding Affordable Rentals in Unfamiliar Cities

Moving to a new city can be an exciting time, but it can also be a daunting task, especially when it comes to finding affordable housing. With rising rent prices and a competitive market, securing a decent rental within your budget can feel like a monumental feat.

However, don’t despair! With a little research, planning, and a few smart strategies, you can find affordable rentals in unfamiliar cities. Here are some tips to help you on your quest:

1. Define Your Budget and Needs

Before you start your search, it’s crucial to determine your budget and prioritize your needs. Consider your monthly income and how much you’re comfortable spending on rent. Also, think about the type of living space you desire – a studio, one-bedroom, or larger apartment. Do you need specific amenities like laundry facilities, parking, or a pet-friendly environment?

2. Utilize Online Rental Platforms

Online rental platforms like Zillow, Apartments.com, Trulia, and Craigslist are excellent starting points for your search. They allow you to filter results based on location, budget, and desired amenities. Many platforms also offer virtual tours and 3D models to give you a better feel for the properties.

3. Explore Local Neighborhoods

Don’t limit yourself to popular or trendy neighborhoods. Consider exploring less well-known areas that might offer more affordable options. Check out websites like NeighborhoodScout and AreaVibes to learn about crime rates, schools, and other factors that might be important to you.

4. Consider Roommates or Shared Housing

If you’re on a tight budget, sharing a rental with roommates can significantly reduce your monthly expenses. Explore roommate-finding platforms like SpareRoom and Roomster or check out Facebook groups and local forums for potential roommates.

5. Network and Ask for Recommendations

Reach out to friends, family, or colleagues who have lived in the city you’re moving to. They might have valuable insights into affordable neighborhoods or recommend reliable real estate agents or property managers.

6. Be Prepared to Compromise

Finding the perfect apartment within your budget and with all your desired features might not be realistic. Be prepared to make some compromises. Consider sacrificing size, amenities, or location to stay within your budget.

7. Negotiate and Be Persistent

Don’t be afraid to negotiate rent prices, especially if you’re willing to sign a longer lease or pay a larger security deposit. Be persistent in your search and don’t give up easily. It might take some time, but with the right approach, you can find the perfect rental for you.

Finding affordable rentals in an unfamiliar city can be a challenging but rewarding experience. By utilizing these tips and staying organized and persistent, you’ll be well on your way to securing a comfortable and affordable place to call home.

Evaluating Cost of Living Differences

When considering a move or travel, it’s crucial to understand the cost of living differences between locations. Factors like housing, transportation, food, healthcare, and entertainment can significantly impact your budget. To accurately assess these differences, here’s a guide to evaluate the cost of living:

1. Housing

Housing is often the largest expense. Research average rent or property prices in different areas. Consider factors like apartment size, amenities, location, and proximity to work or schools. Websites like Zillow, Trulia, and Redfin provide valuable data.

2. Transportation

Evaluate transportation costs, including public transit fares, gas prices, and car maintenance. Cities with robust public transport systems may offer cheaper options. Consider the distance to work or frequently visited locations.

3. Food

Compare grocery prices, restaurant costs, and dining out habits. Check online resources for average food expenses or consult local grocery store websites. Account for differences in food culture and availability of fresh produce.

4. Healthcare

Healthcare costs vary widely. Research average healthcare premiums, doctor’s visit fees, and prescription drug prices. Explore options like healthcare plans, government programs, and private insurance.

5. Entertainment

Factor in entertainment expenses, including movies, concerts, dining out, and hobbies. Local event calendars and online listings can help gauge average costs. Remember, entertainment preferences vary greatly, so adjust accordingly.

6. Utilities

Consider utility costs, such as electricity, gas, water, and internet. Local energy providers and internet companies can provide information on average bills.

7. Taxes

State and local taxes can significantly impact your income. Research tax rates in different areas and compare overall tax burdens. Factor in sales taxes, property taxes, and income taxes.

8. Online Cost of Living Calculators

Use online cost of living calculators like Numbeo, Expatistan, or Cost of Living Comparison. These tools provide estimated costs based on your lifestyle and spending habits. They offer a quick overview of the relative affordability of different locations.

9. Consider Your Lifestyle

Your individual lifestyle and spending habits will impact your cost of living. Determine your priorities, essential needs, and discretionary spending. Adjust your evaluation based on your unique situation.

10. Research and Compare

Don’t solely rely on online calculators. Conduct thorough research using multiple sources. Contact local residents, consult websites, and compare cost of living data to get a comprehensive understanding.

By carefully evaluating these factors, you can gain a clearer picture of the cost of living differences between locations. This information empowers you to make informed decisions regarding your move or travel plans.

Setting a Budget for Moving and Setup Costs

Moving to a new place can be an exciting time, but it’s also a financially demanding one. With all the packing, transportation, and unpacking that needs to be done, it’s important to set a realistic budget for your moving and setup costs. This will help you avoid any surprise expenses and ensure a smooth transition to your new home.

1. Moving Costs

Moving costs are typically the biggest expense associated with moving. Here are some factors to consider:

- Distance: The farther you’re moving, the more expensive it will be.

- Size of your belongings: The more belongings you have, the more space you’ll need on the moving truck, which will cost more.

- Type of moving company: Hiring professional movers will cost more than doing it yourself.

- Time of year: Moving during peak season (summer months) is usually more expensive.

2. Setup Costs

Once you’ve moved into your new place, there are additional costs to factor in for setting up your home:

- Utilities: This includes electricity, gas, water, and internet service.

- Furniture: If you need to buy new furniture, this can be a significant expense.

- Decor: You’ll need to buy items like curtains, rugs, and artwork to make your new home feel like yours.

- Cleaning supplies: You’ll need to stock up on cleaning supplies to get your new place sparkling clean.

3. Other Expenses

In addition to moving and setup costs, there are also other expenses to consider:

- Security deposit: This is typically a month’s rent, and is refundable when you move out.

- First month’s rent: You’ll need to pay the first month’s rent in advance.

- Moving insurance: This will protect your belongings in case they get damaged during the move.

- Packing materials: If you’re doing the packing yourself, you’ll need to buy boxes, tape, and other packing materials.

4. Creating a Budget

Once you’ve considered all the potential expenses, it’s time to create a budget. Here are some tips:

- Get quotes: Get quotes from several moving companies and compare their prices.

- Research: Research the average cost of utilities in your new location.

- Set aside savings: Set aside some money in savings for unexpected expenses.

- Track your spending: Keep track of all your moving-related expenses so you can stay within budget.

By setting a budget and planning ahead, you can minimize the financial stress of moving and focus on enjoying the excitement of starting a new chapter in your life.

Tips for Finding Short-Term Rentals While Relocating

Relocating can be a stressful process, especially when you’re trying to find a new place to live. Short-term rentals can be a great option for those who are transitioning between homes, especially when relocating to a new city. However, finding the right short-term rental can be a challenge. Here are a few tips for finding short-term rentals while relocating:

Start Your Search Early

One of the most important things you can do is start your search early. The sooner you start looking, the more options you’ll have. If you’re planning to relocate in a few months, start looking for rentals now. This will give you plenty of time to compare options and find the perfect fit for your needs.

Define Your Needs

Before you start your search, take some time to define your needs. Consider the following:

- Budget: How much are you willing to spend on rent?

- Location: Where do you want to live?

- Amenities: What amenities are important to you?

- Length of stay: How long do you need the rental for?

Use Online Rental Platforms

There are a number of online rental platforms that can help you find short-term rentals. Some of the most popular platforms include:

- Airbnb: Airbnb offers a wide range of short-term rentals, from apartments to houses to rooms.

- VRBO: VRBO is another popular platform for finding short-term rentals. It offers a wide variety of options, including vacation homes and condos.

- Sonder: Sonder offers stylish and modern apartments in major cities around the world.

Check Local Listings

In addition to online platforms, you can also check local listings. Many newspapers and websites post listings for short-term rentals. You can also ask friends and family if they know of any available rentals.

Read Reviews

Before you book a short-term rental, it’s important to read reviews from other guests. This will give you an idea of what to expect from the rental and the landlord. Reviews can also help you identify any potential red flags.

Ask Questions

Don’t be afraid to ask questions before you book a rental. Ask the landlord about the following:

- The rental agreement: What are the terms of the rental agreement?

- Amenities: What amenities are included in the rental?

- Security deposit: Is a security deposit required?

- Cleaning fees: Are there any cleaning fees?

- Cancellation policy: What is the cancellation policy?

Get Everything in Writing

Once you’ve found a short-term rental that you’re interested in, make sure to get everything in writing. This includes the rental agreement, the cancellation policy, and any other important details. Having everything in writing will help protect you if any problems arise.

Enjoy Your Stay

Once you’ve found a short-term rental, relax and enjoy your stay. Short-term rentals can be a great way to experience a new city and get settled in before you find a permanent place to live. Remember to be a respectful guest and follow the rules of the rental.

Avoiding Financial Traps in New Rental Markets

Moving to a new city can be exciting, but it also comes with its fair share of financial challenges. Navigating a new rental market, especially in a booming area, can be tricky. Landlords and property managers may be less transparent, and you may find yourself in a tricky situation if you aren’t careful. Here are some key tips to avoid financial traps and ensure a smooth transition:

1. Do Your Research

Before you even start looking at properties, spend time researching the area. Check online resources like Zillow or Realtor.com to get an idea of average rental prices in different neighborhoods. Read reviews of property management companies and landlords. This initial research will help you set realistic expectations and avoid potential scams.

2. Ask the Right Questions

When touring properties, don’t be afraid to ask plenty of questions. Inquire about the following:

- Lease terms: Length of lease, renewal process, and any early termination fees.

- Utilities: What utilities are included in rent, and what are your responsibilities for setting up and paying for them?

- Pets: If you have pets, confirm their allowed and any associated fees.

- Parking: Is parking included, or are there additional fees for parking permits or designated spots?

- Maintenance: Who is responsible for repairs and maintenance? What is the process for reporting issues?

- Security deposit: How much is the security deposit, and how will it be returned to you?

- Application fees: Are there application fees, and what is the breakdown of those costs?

3. Get Everything in Writing

Don’t rely on verbal promises or agreements. Make sure all important details, including rent, utilities, parking, pet policies, and security deposits, are clearly outlined in your lease agreement. This document is your protection, so read it carefully before signing.

4. Be Wary of “Deals”

If a rental seems too good to be true, it probably is. Be cautious of properties advertised with significantly lower rent than the market average. These deals may have hidden costs or other stipulations that can lead to financial hardship later. Trust your gut and don’t rush into any decisions.

5. Avoid Paying Large Upfront Fees

Legitimate landlords will typically require a security deposit and the first month’s rent, but they should not ask for excessive upfront fees. Be wary of landlords who request multiple months’ rent in advance or who demand large deposits that are unrelated to the property’s value. This could be a red flag that they may not be legitimate.

6. Get the Lease Reviewed

Before signing your lease, consider having a lawyer or legal professional review it. They can identify any potentially problematic clauses or hidden fees that could harm your financial situation later. This is especially important if you’re unfamiliar with local rental laws.

7. Protect Your Credit

Landlords will often conduct a credit check during the application process. Make sure to maintain good credit scores to increase your chances of being approved for a rental and to ensure you’re getting the best possible rates. Avoid applying for new credit lines or making large purchases before applying for a rental, as this can impact your credit score.

8. Set Up a Budget

Before you move, create a detailed budget that includes your rent, utilities, transportation, food, entertainment, and other expenses. This will help you track your spending and avoid overextending yourself financially. Consider setting aside a “rainy day” fund to cover unexpected expenses, like repairs or emergencies.

9. Keep Good Records

Maintain detailed records of all your rental payments, communication with the landlord, and any maintenance requests. This will protect you if any disputes arise later. You can also use this documentation as leverage when it comes to getting your security deposit back.

10. Check Local Laws

Familiarize yourself with your new city’s rental laws and regulations. These laws can vary from state to state and city to city, and they offer crucial protections for renters. Knowing your rights can help you avoid unfair treatment from landlords and prevent financial pitfalls.

Balancing Proximity to Work with Rental Costs

Finding a place to live can be a challenging task, especially in major cities where the cost of living is high. One of the biggest dilemmas renters face is balancing the desire to be close to their workplace with the affordability of rent.

Living close to work offers many advantages, including:

- Reduced commute times: This translates into less time spent traveling and more time for other activities.

- Less stress: Shorter commutes can contribute to lower stress levels, as you avoid the frustrations of traffic and crowded public transportation.

- Increased productivity: Arriving at work feeling refreshed and less stressed can lead to improved focus and productivity.

- More flexibility: Being close to work allows you to run errands or take care of personal matters during your lunch break or after work, without having to spend significant time traveling.

However, living close to the city center or popular employment hubs often comes with a steep price tag. Rent prices in these areas tend to be significantly higher, which can put a strain on your budget. You might have to compromise on factors like living space, amenities, or neighborhood quality to stay within your means.

So how do you strike a balance between these two factors? Here are some tips:

- Set a realistic budget: Determine how much you can comfortably afford to spend on rent, factoring in your other expenses and income.

- Consider alternative transportation options: If you are willing to commute a bit further, explore public transportation, cycling, or ride-sharing services. These options can save you a substantial amount on rent.

- Be flexible with your location: Expand your search to include neighborhoods just outside the city center or major employment zones. These areas might offer more affordable rent while still being within a reasonable commute distance.

- Think long-term: If you plan to stay in the same city for an extended period, consider the potential for rent increases and factor that into your decision.

- Negotiate: Don’t be afraid to negotiate with landlords, especially if you are a reliable tenant with a good credit history.

- Look for roommate opportunities: Sharing an apartment with others can significantly reduce your overall rent burden.

Finding the perfect balance between proximity to work and rental costs requires careful planning and consideration. By weighing the pros and cons of each option and employing these strategies, you can increase your chances of securing a comfortable and affordable living space that meets your needs.

Researching Financial Aid Programs for Relocation

Relocating to a new city can be a daunting task, especially when you’re trying to balance the costs of moving with the expenses of starting a new life in a new place. While it can feel overwhelming to factor in all the expenses, there are resources available to help you with the transition. One such resource is financial aid, which can be a lifesaver for those struggling to make ends meet during a move.

In this article, we will discuss the different types of financial aid programs available for relocation and how you can research and apply for these programs. We’ll also delve into strategies for budgeting and managing your finances during a relocation.

Types of Financial Aid Programs

There are a variety of financial aid programs available for relocation, each with specific eligibility requirements and application processes. Here are some of the most common types of programs to look into:

- Government Grants and Subsidies: These programs are funded by the government and offer financial assistance to individuals or families who meet certain criteria. For example, some programs offer subsidies for housing, transportation, or job training.

- Non-Profit Organizations: Many non-profit organizations offer financial aid programs for relocation, particularly for vulnerable populations such as low-income families, veterans, or refugees. These organizations often focus on specific needs, such as housing assistance, job training, or mental health services.

- Employer-Sponsored Relocation Assistance: Some employers offer relocation assistance programs to their employees, covering expenses such as moving costs, housing, and transportation. This is a good option to explore if you are relocating for a new job.

- State and Local Programs: Many states and local municipalities offer financial aid programs for relocation, often focused on promoting economic development or attracting new residents. These programs may provide grants, subsidies, or tax breaks for relocating individuals or businesses.

How to Research Financial Aid Programs

The first step to finding financial aid programs for relocation is to identify your specific needs and circumstances. Once you know what you are looking for, you can start researching programs that match your requirements. Here are some helpful tips:

- Contact your local government: Reach out to your city, county, or state government to inquire about any relocation assistance programs they offer.

- Search online: Use keywords like “relocation assistance,” “moving grants,” or “housing subsidies” to find relevant programs online.

- Reach out to non-profit organizations: Contact non-profit organizations in your new city or state, particularly those focused on helping vulnerable populations or promoting economic development.

- Consult with a financial advisor: If you need help navigating the complexities of financial aid programs, a financial advisor can offer valuable guidance and support.

Applying for Financial Aid

The application process for financial aid programs can vary, so it is important to read the instructions carefully and gather all the necessary documents. Here are some general tips for applying for financial aid:

- Be organized: Keep track of deadlines, required documents, and application materials.

- Be thorough: Complete all sections of the application accurately and provide all the requested information.

- Follow up: After submitting your application, follow up with the program administrator to inquire about the status of your request.

Managing Finances During Relocation

Even if you secure financial aid, relocation can still be a costly endeavor. It is important to manage your finances wisely during this transition. Here are some tips:

- Create a budget: Develop a detailed budget that includes all relocation expenses, such as moving costs, housing, transportation, and living expenses.

- Save money: Start saving as early as possible to cover relocation expenses and establish a financial cushion in your new city.

- Seek out affordable housing: Consider renting a smaller apartment or sharing a house with roommates to reduce housing costs.

- Explore transportation options: Consider public transportation, biking, or walking to reduce transportation costs.

Relocating to a new city can be a significant life change, but it is also an opportunity for growth and new beginnings. By researching and applying for financial aid programs and managing your finances wisely, you can make the transition smoother and less stressful. With careful planning and preparation, you can turn your relocation into a positive and rewarding experience.

How to Plan for Initial Living Expenses

Moving to a new city can be exciting, but it also requires careful planning, especially when it comes to budgeting for your initial living expenses. This article will guide you through the essential steps to ensure a smooth transition and avoid any financial surprises.

1. Estimate Your Monthly Expenses

Before moving, it’s crucial to estimate your monthly expenses. Start by researching the average cost of living in your new city. Consider factors like:

- Rent or mortgage: Research average rental prices or mortgage costs in your preferred neighborhood.

- Utilities: Factor in electricity, gas, water, internet, and cable bills.

- Groceries: Account for your daily food needs.

- Transportation: Calculate costs for public transport, gas, or car payments.

- Healthcare: Estimate health insurance premiums and potential medical expenses.

- Other expenses: Include entertainment, dining out, personal care, and any other recurring costs.

2. Create a Budget

Once you have a good estimate of your monthly expenses, create a detailed budget. This will help you track your spending and ensure you stay within your financial limits. Some helpful budgeting tools include:

- Spreadsheet: Use a simple spreadsheet to track your income and expenses.

- Budgeting apps: Utilize apps like Mint, YNAB, or Personal Capital to automate tracking and provide insights.

3. Save for a Safety Net

It’s highly recommended to have a financial safety net before moving. Aim to save at least three to six months’ worth of living expenses. This safety net will provide a buffer in case of unexpected costs or job loss.

4. Factor in Moving Costs

Don’t forget to include the cost of moving in your budget. Moving expenses can vary depending on factors like distance, the size of your belongings, and whether you’re hiring movers or using a rental truck.

5. Consider a Temporary Housing Solution

To minimize financial stress, consider staying in temporary housing for a few weeks or months. This could be a short-term rental, Airbnb, or a stay with a friend or family member. This will give you time to find a permanent residence without feeling rushed.

6. Explore Local Resources

Many cities offer resources for new residents, including financial assistance or guidance. Research local organizations that can provide support and help you navigate the transition.

Planning for your initial living expenses is crucial for a smooth and successful move. By carefully estimating your costs, creating a budget, and setting aside a safety net, you can ensure a financially stable start in your new city.

Using Financial Tools for Relocation Budgeting

Relocating to a new city or country is an exciting but daunting process. It requires careful planning and budgeting to ensure a smooth transition. Financial tools can be invaluable in helping you manage your relocation expenses effectively.

1. Spreadsheet Software

Spreadsheets are a versatile tool for organizing and tracking your relocation budget. You can create separate columns for different categories like housing, transportation, utilities, and miscellaneous expenses. By inputting estimated costs for each category, you can get a comprehensive overview of your total budget.

2. Budgeting Apps

Numerous budgeting apps are available for smartphones and computers. These apps offer features like expense tracking, bill reminders, and financial goal setting. They can help you stay on top of your spending and identify areas where you can save money.

3. Online Calculators

Online calculators are a quick and easy way to estimate certain relocation expenses. For instance, you can find calculators for mortgage payments, rent estimates, and moving costs. These calculators can give you a general idea of what to expect and help you refine your budget.

4. Financial Advisors

If you have complex financial needs or are dealing with significant relocation costs, consulting a financial advisor can be beneficial. They can provide personalized advice on budgeting, investing, and managing your finances during the relocation process.

5. Moving Cost Estimators

Moving companies often offer online tools to estimate the cost of your move. These estimators take factors like distance, weight, and services required into account. They can help you get a realistic idea of how much your move will cost.

Tips for Using Financial Tools

- Be realistic with your estimates. Overestimate rather than underestimate your expenses.

- Track your actual spending and adjust your budget as needed.

- Consider using a combination of financial tools to maximize their benefits.

By utilizing these financial tools, you can create a comprehensive and effective relocation budget. This will help you navigate the financial aspects of your move with confidence and reduce the risk of unexpected expenses.