Are you looking for ways to build financial stability? Renting out your apartment and car can be a great way to generate passive income and boost your financial security. With careful planning and execution, you can successfully create a steady stream of income that can help you achieve your financial goals. This article will provide a comprehensive guide on how to build financial stability with apartment and car rentals, covering everything from finding the right tenants to managing your properties.

Why Renting Can Be a Smart Financial Move

In today’s economic landscape, the age-old debate of buying versus renting a home continues to rage on. While homeownership is often lauded as the pinnacle of financial success, there are compelling reasons why renting can be a smart financial move, especially in certain circumstances.

Financial Flexibility: One of the most significant advantages of renting is the flexibility it provides. Renters have the freedom to move without the burden of selling a property. This mobility is invaluable for individuals whose careers or life circumstances are prone to change. Whether it’s a job relocation, a desire to explore a new city, or simply a change of scenery, renting allows for seamless transitions.

Reduced Financial Risk: Unlike homeowners who shoulder the responsibility of property maintenance and repairs, renters can avoid these financial burdens. Landlords are generally obligated to address major repairs and upkeep, shielding renters from unexpected and potentially costly expenses. This eliminates the risk of significant financial outlays for unforeseen repairs or market fluctuations that can affect home values.

Predictable Monthly Expenses: Rent payments are typically fixed, providing renters with predictable monthly expenses. This predictability simplifies budgeting and financial planning, making it easier to track spending and save for future goals. Homeownership, on the other hand, can come with fluctuating expenses, such as property taxes, insurance premiums, and maintenance costs, which can be difficult to predict.

Lower Initial Costs: Renting requires significantly lower upfront costs compared to purchasing a home. Renters avoid the hefty down payment, closing costs, and ongoing mortgage payments that come with homeownership. These savings can be used for other financial priorities, such as investing, paying down debt, or building an emergency fund.

Access to Amenities: Many rental properties come equipped with amenities that homeowners may not have access to, such as swimming pools, fitness centers, and laundry facilities. These amenities can enhance quality of life and save on individual expenses. Moreover, renters can often enjoy the benefits of a professionally managed property, such as security and landscaping services.

Investment Opportunities: While renting may not provide the equity build-up of homeownership, it allows individuals to invest their savings elsewhere. Instead of tying up funds in a fixed asset like a house, renters can invest in stocks, bonds, or other assets that have the potential for greater returns over time.

Conclusion: Renting can be a smart financial decision for those seeking flexibility, reduced risk, predictable expenses, and access to amenities. It allows individuals to allocate their resources towards other financial goals while enjoying a comfortable and convenient living arrangement. While homeownership may be a desirable long-term goal, renting can provide a solid foundation for financial stability and growth in the present.

Setting a Realistic Budget for Renting

Finding the perfect place to rent can be exciting, but it’s crucial to set a realistic budget before you start your search. Failing to do so can lead to financial stress and potential issues later on. This guide will walk you through the essential steps to establish a sound rental budget that aligns with your financial situation.

1. Assess Your Income and Expenses

Start by taking a close look at your income and your regular expenses. This includes:

- Your monthly take-home pay after taxes

- Recurring bills like utilities, internet, phone, and transportation

- Debt payments, including student loans, credit cards, and personal loans

- Other regular expenses, such as groceries, entertainment, and subscriptions

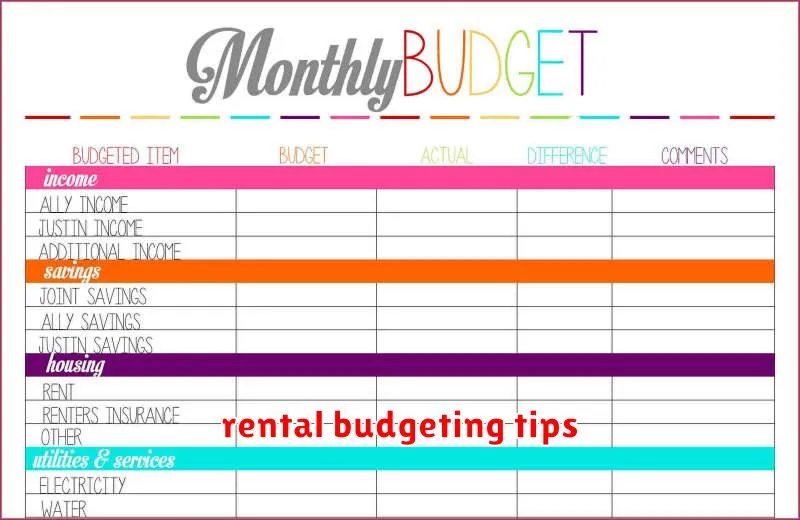

It’s helpful to create a detailed spreadsheet or use a budgeting app to track your income and expenses for a few months to gain a comprehensive understanding of your financial situation.

2. Determine Your Maximum Rent

A widely accepted rule of thumb is to allocate no more than 30% of your gross monthly income towards rent. This leaves enough room for your other expenses and creates a safety net for unexpected costs.

For example, if your gross monthly income is $4,000, your maximum rent should be around $1,200. However, consider adjusting this percentage based on your individual financial comfort level and other obligations.

3. Factor in Additional Costs

Remember that rent isn’t the only expense associated with renting. Factor in these additional costs:

- Security Deposit: Usually equal to one or two months’ rent

- First Month’s Rent: Due upfront

- Utilities: Gas, electric, water, and trash service may be included in rent, but often are not

- Internet and Cable: Costs vary depending on the provider and plan

- Parking: Some buildings offer parking for an additional fee

- Pet Fees: If you have a pet, expect fees or deposits

Don’t underestimate these additional costs, as they can significantly impact your overall monthly spending.

4. Explore Your Options and Negotiate

Once you have a clear understanding of your budget, you can start exploring rental options. Consider factors like location, amenities, and size when making your decision. Don’t hesitate to negotiate with landlords or property managers, especially if you’re a strong candidate with good credit and rental history. You might be able to negotiate rent, security deposit terms, or even some utilities.

5. Review and Adjust Regularly

It’s essential to periodically review your rental budget, especially if your financial circumstances change. As your income increases or expenses decrease, you may have more flexibility in your rental budget. Conversely, if your income drops or your expenses rise, you might need to adjust your rent accordingly.

By establishing a realistic budget, you can avoid financial stress and find a rental that comfortably fits your financial situation. This approach allows you to enjoy your new space without the weight of overwhelming costs.

Understanding Your Financial Goals for Rental Agreements

When you’re deciding on a rental agreement, it’s important to understand your financial goals. This will help you choose the best option for your situation and ensure that you’re making a financially sound decision.

Here are some key financial goals to consider:

1. Budgeting:

Your budget should be the foundation of your rental decision. Consider the following:

- Rent payments

- Utilities

- Maintenance costs

- Other expenses related to the property (e.g., insurance, property taxes, HOA fees)

Make sure you have a realistic understanding of how much you can afford to spend each month on rent and related costs.

2. Savings:

If you’re looking to build your savings, a rental agreement with a lower rent payment might be a good option. This will allow you to allocate more money to your savings goals each month.

3. Investment:

If you’re looking to invest in real estate, a rental agreement with a higher rent payment might be a good option. This will allow you to build equity in the property and potentially generate a positive return on your investment.

4. Flexibility:

If you need flexibility, a shorter-term rental agreement might be a good option. This will allow you to move more easily if your circumstances change.

5. Stability:

If you’re looking for stability, a longer-term rental agreement might be a good option. This will give you peace of mind knowing that you have a place to live for a set period of time.

By considering these financial goals, you can make a well-informed decision about your rental agreement and ensure that it aligns with your overall financial objectives.

How to Avoid Common Rental Debt Traps

Renting can be a great option for those who don’t want the responsibility of homeownership. However, there are some common rental debt traps that tenants need to be aware of. By understanding these traps and taking steps to avoid them, you can save yourself a lot of financial stress and heartache.

1. Late Fees

One of the most common ways tenants fall into debt is by paying rent late. Late fees can add up quickly, and if you’re consistently late, you could find yourself in a difficult financial situation. Make sure you know your rent due date and set a reminder so you don’t forget. If you’re struggling to make rent on time, talk to your landlord about a payment plan.

2. Security Deposit Issues

Your security deposit is meant to cover any damage you cause to the rental property. However, landlords can sometimes try to withhold this money for reasons that aren’t valid. Make sure you take photos and videos of the property’s condition before you move in so you have documentation to support your case if there’s a dispute. When you move out, do a thorough cleaning and repair any damage you’ve caused. This will help you get your full deposit back.

3. Hidden Fees

Some landlords may try to sneak in hidden fees that weren’t disclosed in the lease agreement. This could include things like pet fees, parking fees, or utility fees. Read your lease agreement carefully and ask your landlord about any fees you don’t understand.

4. Utility Bills

Even if you’re not responsible for paying all utilities, you may still be responsible for some, such as trash or water. Make sure you understand what utilities you’re responsible for and set up a system to pay them on time.

5. Eviction

The most serious consequence of not paying rent or following your lease agreement is eviction. This can have a negative impact on your credit score and make it difficult to find housing in the future. If you’re struggling to make rent, talk to your landlord as soon as possible. They may be willing to work with you to find a solution.

6. Unauthorized Pets

Some leases prohibit pets. If you have a pet and don’t disclose it to your landlord, you could be in violation of your lease and face fines or even eviction. If you have a pet, be upfront with your landlord and make sure it’s allowed.

7. Subletting

Subletting your apartment without your landlord’s permission can also lead to legal issues. Check your lease to see if subletting is allowed and, if so, what the process is.

By taking steps to avoid these common rental debt traps, you can enjoy the benefits of renting without the financial stress. Remember to read your lease agreement carefully, communicate with your landlord, and be responsible with your finances.

Building a Safety Net for Unexpected Rental Costs

As a renter, you likely know that unexpected expenses can pop up at any time. A leaky faucet, a broken appliance, or even a sudden job loss can quickly throw your budget off track. While you can’t predict every eventuality, building a safety net for unexpected rental costs can provide you with some much-needed peace of mind.

Here are a few tips for building a safety net:

-

Build an Emergency Fund:

Start by setting aside a portion of your income each month for emergencies. Aim for at least three to six months’ worth of living expenses, including rent. This fund will act as your safety net to cover unexpected costs.

-

Create a Budget:

Track your income and expenses carefully. By knowing where your money goes, you can identify areas where you can cut back and save more for your emergency fund. Use budgeting apps or spreadsheets to stay organized.

-

Negotiate a Lease Agreement:

When you sign a lease, discuss potential repairs and maintenance costs. Some landlords may offer to cover certain expenses or offer a discount for early payment. This can help reduce financial burdens in the future.

-

Consider Renters Insurance:

Renters insurance can provide coverage for unexpected events like fire, theft, or natural disasters. This can protect your belongings and provide financial assistance if your dwelling becomes uninhabitable.

-

Explore Financial Resources:

If you find yourself in a financial crunch, there are resources available to help. Consider contacting your local social services agency or reaching out to non-profit organizations for assistance.

By taking these steps, you can build a strong safety net for unexpected rental costs and protect yourself from financial hardship. Remember, it’s always better to be prepared than to be caught off guard.

Maximizing Rental Savings with Loyalty Programs

In today’s competitive rental market, savvy travelers are always searching for ways to save money. Loyalty programs offer a valuable tool for maximizing savings and enhancing the rental experience. These programs reward frequent renters with exclusive benefits, discounts, and perks, making them an attractive option for those who travel regularly.

How Loyalty Programs Work

Most rental car loyalty programs operate on a points-based system. You earn points for each rental, and these points can be redeemed for various rewards, such as free rental days, upgrades, discounts, or even merchandise. The more you rent, the more points you accumulate, leading to greater savings over time.

Benefits of Loyalty Programs

Loyalty programs offer a wide range of benefits that can significantly enhance the rental experience. These benefits typically include:

- Discounts: Members often receive discounts on rental rates, insurance, and other services.

- Free Rental Days: Accumulated points can be redeemed for free rental days, allowing you to save significantly on your next trip.

- Upgrades: Loyalty programs often offer complimentary vehicle upgrades, allowing you to enjoy a more luxurious and comfortable rental experience.

- Priority Service: Members may receive priority service at rental counters, reducing wait times and ensuring a smoother rental process.

- Exclusive Offers: Loyalty programs frequently send exclusive offers and promotions to members, providing access to special deals and discounts.

Choosing the Right Loyalty Program

With numerous rental car companies offering loyalty programs, it’s important to choose the program that best suits your needs. Consider factors such as the points earning structure, redemption options, and benefits offered by each program. Research different companies and compare their programs before making a decision.

Tips for Maximizing Loyalty Program Benefits

To maximize the benefits of loyalty programs, follow these tips:

- Sign Up for Multiple Programs: Consider joining programs from multiple rental car companies to maximize your earning potential.

- Rent Frequently: The more you rent, the faster you accumulate points, leading to greater savings.

- Utilize Bonus Offers: Many programs offer bonus points for special promotions or during specific periods. Take advantage of these offers to boost your points balance.

- Track Your Points: Regularly monitor your points balance and redemption options to ensure you’re maximizing your benefits.

Conclusion

Rental car loyalty programs offer a smart way to save money and enhance your rental experience. By joining a program, you can earn valuable rewards, discounts, and perks that can make your travels more enjoyable and affordable. Choose the program that aligns with your rental habits and take advantage of the benefits it offers to maximize your savings.

Tips for Negotiating Lower Monthly Rent

Finding a place to live that fits your budget can be difficult, especially in competitive rental markets. You may be tempted to accept the first apartment you find, but don’t rush into signing a lease without exploring your options. You might be surprised to find that you can negotiate a lower monthly rent.

Here are some tips for negotiating lower monthly rent:

Do your research.

Before you start negotiating, it’s important to know what the market rate is for similar apartments in your area. You can use websites like Zillow, Trulia, and Apartments.com to get an idea of rental prices. It’s also a good idea to check out local real estate websites and publications for listings.

Be prepared to walk away.

The best way to get a good deal is to be willing to walk away if you’re not happy with the price. If you’re not prepared to walk away, the landlord will know that you’re desperate and may not be willing to negotiate.

Be polite and respectful.

Even if you’re feeling frustrated, it’s important to be polite and respectful when negotiating. Remember that you’re trying to build a relationship with the landlord, and you want to make a good impression.

Be flexible.

Be willing to compromise on other things, such as the length of the lease or the security deposit. If you’re flexible, you’re more likely to get a deal.

Offer to pay rent upfront.

Landlords are often willing to negotiate if you offer to pay rent upfront. This shows that you’re a serious tenant and that you’re committed to the apartment.

Offer to sign a longer lease.

Landlords often prefer tenants who sign longer leases. If you’re willing to sign a longer lease, you may be able to negotiate a lower monthly rent.

Offer to make improvements to the apartment.

If you’re willing to make improvements to the apartment, such as painting or landscaping, the landlord may be willing to negotiate a lower rent.

Offer to pay a higher security deposit.

If you’re willing to pay a higher security deposit, the landlord may be willing to negotiate a lower monthly rent. This is a good option if you’re planning to stay in the apartment for a long time.

Ask about concessions.

Landlords sometimes offer concessions, such as free rent or a discounted rent for the first month. Ask if the landlord is willing to offer any concessions.

Don’t be afraid to ask!

The worst thing that can happen is the landlord says no. But if you don’t ask, you’ll never know if you could have gotten a better deal.

Financial Planning for Car Rentals on a Budget

Renting a car can be a convenient and affordable way to get around, but it’s important to plan ahead to ensure you’re getting the best deal and staying within your budget. Here are some tips for financial planning when renting a car on a budget:

1. Research and Compare Prices

Don’t just settle for the first rental company you see. Take some time to research and compare prices from different companies. Websites like Kayak, Expedia, and Priceline offer comparison tools that can help you find the best deals.

2. Consider Off-Season Rentals

Rental car prices are typically higher during peak season, so consider renting your car during the off-season if possible. This can save you a significant amount of money.

3. Look for Discounts and Promotions

Many rental car companies offer discounts for AAA members, seniors, military personnel, and other groups. Be sure to ask about any available discounts before you book your rental. Also, keep an eye out for promotional offers, such as discounts for booking in advance or for renting for a certain number of days.

4. Choose a Smaller Car

The size of the car you rent can affect the price. A smaller car will generally be cheaper to rent than a larger SUV or truck. If you’re only traveling with one or two people and don’t need a lot of space, a smaller car can be a good choice.

5. Avoid Additional Fees

Rental car companies often charge additional fees for things like insurance, airport fees, and extra drivers. Try to avoid these fees by purchasing your own insurance, parking your car off-site, and only adding authorized drivers.

6. Read the Fine Print

Before you sign the rental agreement, be sure to read the fine print carefully. Pay attention to the terms and conditions, including the insurance coverage, mileage limits, and any other restrictions.

7. Consider Alternative Options

If you’re on a tight budget, you might want to consider alternative options to renting a car, such as using public transportation, ride-sharing services, or renting a bicycle.

Leveraging Tax Deductions as a Renter

While many people associate tax deductions with homeowners, renters can also take advantage of several deductions that can significantly reduce their tax liability. These deductions can help you save money and potentially offset the costs of renting. Here are some of the most common tax deductions available to renters:

1. Medical Expenses

If you incurred significant medical expenses, you might be able to deduct a portion of these expenses on your taxes. The deduction is generally limited to the amount exceeding 7.5% of your adjusted gross income. Keep detailed records of all your medical expenses, including doctor’s visits, prescriptions, and hospital stays.

2. State and Local Taxes (SALT)

The SALT deduction allows you to deduct up to $10,000 of your state and local taxes, including property taxes, income taxes, and sales taxes. While homeowners often benefit from the property tax portion, renters can still deduct their state and local income taxes or sales taxes.

3. Home Office Expenses

If you work from home, you can claim the home office deduction. This deduction allows you to write off a portion of your rent as a business expense. To qualify, you must use a dedicated space in your home exclusively for business purposes. You can use the simplified method or the actual expense method to calculate your deduction.

4. Moving Expenses

While the moving expense deduction was suspended for most taxpayers after 2017, members of the armed forces still qualify for this deduction. If you were relocated by your employer, you might be eligible for a deduction on the expenses related to your move.

5. Student Loan Interest

If you’re paying off student loans, you can deduct up to $2,500 in interest payments on eligible student loans. This deduction can help reduce your tax liability and make your student loan payments more manageable. Remember, this deduction is only available if you’re filing as single, married filing separately, or head of household.

6. Charitable Contributions

Whether you’re a renter or a homeowner, you can deduct contributions to eligible charitable organizations. Keep all receipts and documentation of your donations, as you’ll need them to claim this deduction.

7. Other Deductions

Other potential deductions for renters include alimony payments, job-related expenses, and certain property taxes if they’re not included in your rent.

Tips for Maximizing Your Deductions

To maximize your tax deductions, consider these tips:

- Keep detailed records of all your expenses. This includes receipts, invoices, and other documentation.

- Consult with a tax professional to ensure you’re taking advantage of all available deductions.

- File your taxes electronically to help reduce errors and ensure your deductions are processed correctly.

While renting may seem less tax-advantageous than homeownership, there are still numerous deductions available to renters. By understanding these deductions and taking the time to claim them, you can significantly reduce your tax liability and save money. Remember to keep accurate records and consult with a tax professional to ensure you’re maximizing your benefits.

Tools for Tracking and Managing Rental Expenses

As a landlord, effectively managing your rental property involves meticulous tracking and management of expenses. From maintenance costs to property taxes, keeping a detailed record of expenditures is crucial for financial planning, tax purposes, and maximizing profitability. Fortunately, various tools and resources are available to streamline this process, ensuring you stay organized and on top of your financial obligations.

Spreadsheet Software

A fundamental approach to tracking rental expenses is utilizing spreadsheet software like Microsoft Excel or Google Sheets. These programs offer customizable templates and formulas for creating detailed expense reports. You can categorize expenses, track payments, calculate profit margins, and generate reports for analysis. This method provides a hands-on, adaptable solution with a high level of control.

Accounting Software

For landlords with a larger portfolio or seeking more robust features, accounting software presents a comprehensive solution. Programs like QuickBooks Online or Xero offer dedicated functionalities for property management, including expense tracking, invoice generation, rent collection, and tenant management. These platforms automate many tasks, saving time and reducing the risk of errors.

Mobile Apps

Modern mobile apps are designed to simplify expense tracking on the go. Apps like MileIQ, Expensify, and Shoeboxed streamline expense logging through features like automatic mileage tracking, receipt scanning, and expense categorization. These apps integrate with cloud-based services, providing access to your expense data anytime, anywhere.

Property Management Software

For landlords managing multiple properties, property management software offers a centralized platform for tracking expenses, collecting rent, managing tenant communications, and generating financial reports. Programs like AppFolio, Buildium, and Rent Manager provide comprehensive solutions for automating various property management tasks.

Tips for Effective Expense Tracking

- Categorize Expenses: Organize expenses into meaningful categories, such as repairs, utilities, property taxes, insurance, and marketing.

- Keep Receipts: Maintain a system for collecting and storing receipts, both physical and digital.

- Regularly Update: Make a habit of recording expenses promptly to avoid missing any entries.

- Reconcile Statements: Regularly compare bank statements with your expense records to ensure accuracy.

- Analyze Data: Regularly analyze expense trends to identify areas for cost savings or potential problems.

By implementing effective tools and practices for tracking rental expenses, landlords can gain better control over their financial health, make informed decisions, and ensure their investments remain profitable.