Are you tired of living with your parents or just looking for a more affordable way to live? Renting an apartment with roommates can be a great solution! But with shared expenses comes the need for clear communication and effective financial strategies. This article will explore financial strategies for renting an apartment with roommates, covering topics like budgeting, rent splitting, utilities, and more. Whether you’re a first-time renter or a seasoned roommate veteran, these tips will help you avoid financial headaches and ensure a smooth and financially responsible living experience.

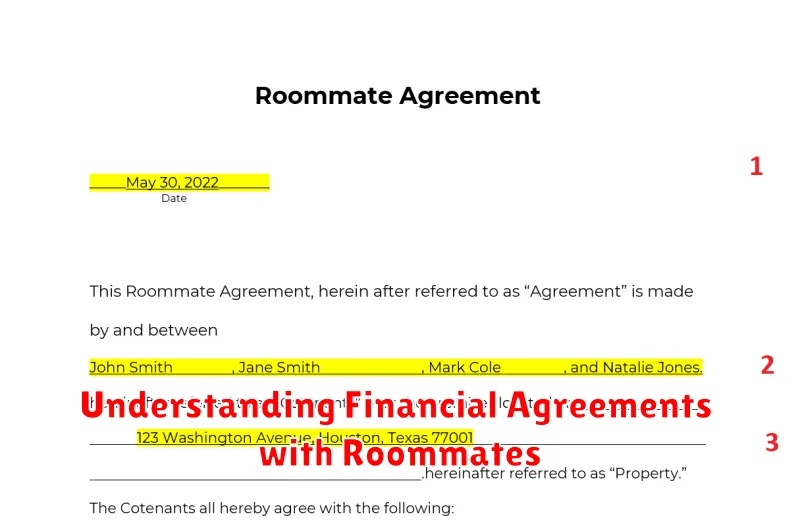

Understanding Financial Agreements with Roommates

Living with roommates can be a great way to save money on rent and utilities, but it’s important to have clear financial agreements in place from the start. This can help prevent misunderstandings and conflicts down the road.

Here are some key financial agreements to consider with your roommates:

Rent and Utilities

The most obvious financial agreement is how you’ll split the rent and utilities. You can decide to split these expenses evenly, or you can base it on the size of each person’s room or their individual usage. For example, if one roommate has a larger room, they might agree to pay a slightly higher percentage of the rent. You can also decide to split utilities based on individual usage, such as having each roommate pay for their own electricity or internet usage. You should be clear on how much each person is responsible for paying and when the payments are due.

Groceries and Other Shared Expenses

If you plan to share groceries, it’s important to decide how you’ll handle the expenses. You can create a rotating grocery list, where each roommate takes turns buying groceries for the week, or you can set up a system where everyone contributes a certain amount of money each week. You can also create a communal fund for other shared expenses, such as cleaning supplies, toiletries, and entertainment. Having a clear system in place will help ensure that everyone contributes fairly.

Financial Responsibilities

It’s also important to be clear about who is responsible for which financial obligations. For example, if you’re renting an apartment, you need to decide who will be the main leaseholder. If you’re planning to buy furniture or appliances together, you should decide how the purchase will be financed and who will be responsible for making the payments. It’s also a good idea to discuss how you’ll handle late payments and other financial emergencies.

Communication is Key

Communication is essential for a successful roommate relationship. Make sure to talk openly and honestly with your roommates about your financial expectations and concerns. Don’t be afraid to negotiate and compromise. You can even put your agreements in writing, either in a formal roommate agreement or just a simple list of shared responsibilities. This can help avoid any misunderstandings and make sure that everyone is on the same page.

Having clear financial agreements with your roommates can save you a lot of stress and conflict. By taking the time to discuss your expectations and responsibilities, you can create a harmonious living situation that is beneficial for everyone involved.

How to Divide Rent and Utilities Fairly

Sharing an apartment with roommates can be a great way to save money and meet new people. However, it can also lead to disagreements about how to divide rent and utilities fairly. Here are a few tips on how to avoid conflict and ensure that everyone is paying their fair share.

1. Decide on a Rent Splitting Method

There are several ways to divide rent, but the most common are:

- Equal split: This is the simplest method, but it may not be fair if some roommates have larger bedrooms or use more utilities.

- Split based on square footage: If you have a larger room, you might want to pay a little more for the extra space. This method is more fair but requires more work to calculate.

- Roommate-specific rates: Each roommate can have their own rate based on their room size and usage of common areas. This method is the most complex but can be the fairest.

It’s important to discuss your options with your roommates and agree on a method that everyone feels comfortable with.

2. Establish a System for Utilities

Once you’ve decided on a rent split, you need to figure out how to divide utilities. You can use one of these methods:

- Equal split: Everyone pays an equal share of the total utility bill.

- Usage-based split: If you have individual meters for water, electricity, or gas, you can split the bill based on your actual usage. This is the most fair method but may require extra effort.

- Percentage-based split: You can agree on a percentage of the utility bill that each roommate is responsible for. This method is simple but may not be fair if someone uses more utilities than others.

Consider your usage habits and choose a system that feels fair to all roommates.

3. Keep Track of Expenses

It’s essential to keep track of all expenses related to your apartment, including rent, utilities, internet, and any other shared bills. This helps ensure that everyone is aware of their financial obligations and prevents disagreements.

Use a spreadsheet, shared app, or a simple notepad to document all expenses and keep everyone in the loop. This transparency and accountability help maintain a positive living environment.

4. Communicate Regularly

Communication is key when it comes to sharing an apartment. Discuss any changes in your financial situation, usage patterns, or potential issues with your roommates. Be respectful and open to compromise.

Regular communication helps prevent misunderstandings and allows you to adjust your system as needed. Open discussions and a willingness to listen to each other are crucial to maintaining a harmonious living arrangement.

5. Seek Professional Advice

If you can’t come to an agreement on how to divide rent and utilities, consider seeking professional advice from a mediator or a housing counselor. They can help you understand your rights and responsibilities and negotiate a fair solution.

Remember, open communication, fairness, and a willingness to compromise are essential for a positive and enjoyable shared living experience.

Setting Up a Budget for Shared Living

Sharing a living space with others can be a great way to save money and build community, but it’s important to set up a clear and transparent budget to ensure everyone is on the same page. This article will guide you through the essential steps of creating a shared living budget.

1. Define Your Shared Expenses

Start by identifying all the recurring costs you’ll share with your housemates. This includes:

- Rent: The most significant expense.

- Utilities: Electricity, water, gas, internet, and trash collection.

- Groceries: If you plan to share meals or groceries.

- Household Supplies: Cleaning products, toilet paper, laundry detergent.

- Maintenance: Repairs, cleaning services, and any other upkeep costs.

2. Estimate Monthly Costs

Gather information on the average monthly costs for each expense. You can use past bills, online tools, or contact your landlord for estimates.

3. Determine Individual Contributions

Once you know the total monthly expenses, divide them by the number of housemates to determine the individual contribution. You can:

- Split Costs Evenly: This is the simplest option, but may not be fair if some people use more utilities than others.

- Create a Customized Split: You can adjust the split based on usage, income, or other factors, but ensure it’s transparent and agreed upon by everyone.

4. Establish Payment Methods

Choose a convenient method for collecting and managing shared expenses. Options include:

- Cash: Simple, but requires trust and keeping track of payments.

- Shared Bank Account: Each housemate contributes a set amount, making payments easier.

- Online Payment Platforms: Apps like Venmo or Splitwise can simplify splitting costs and tracking payments.

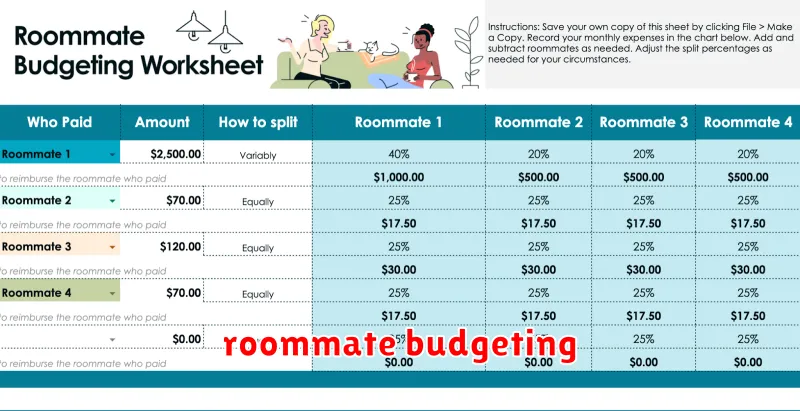

5. Create a Budget Spreadsheet

Use a spreadsheet to track your budget, expenses, and contributions. This helps:

- Visualize Your Budget: See how your money is being allocated.

- Monitor Spending: Stay on top of your budget and adjust it if needed.

- Ensure Transparency: Make the spreadsheet accessible to all housemates.

6. Review and Adjust Your Budget

Review your budget regularly, at least once a month. Make adjustments based on changes in spending, income, or household needs.

7. Communicate Openly

Open communication is vital for a successful shared living budget. Discuss expenses, contributions, and concerns openly to ensure everyone is comfortable and on the same page.

By following these steps, you can establish a clear and transparent budget for shared living, ensuring financial harmony and a positive living experience.

Tips for Managing Shared Expenses Effectively

Sharing expenses is common in various situations, whether you’re living with roommates, splitting bills with a partner, or contributing to a group project. Effective management of shared expenses ensures fairness, transparency, and a harmonious experience for all involved. Here are some valuable tips to help you navigate this aspect of shared living or working:

1. Establish Clear Communication:

Open and honest communication is the foundation of any successful shared expense system. Discuss your expectations, financial situations, and desired methods of tracking and splitting bills. Set clear guidelines for what expenses are shared and what are individual responsibilities.

2. Choose a Tracking Method:

Various methods can be employed to track shared expenses. Consider options like:

- Shared Spreadsheet: A digital spreadsheet where everyone can input their contributions and view the balance.

- Expense-Tracking App: Apps like Splitwise or Tricount offer features for tracking shared expenses, splitting bills, and sending reminders.

- Cash Envelope System: A physical method using envelopes for each expense category and allocating a fixed amount for shared expenses.

3. Set Regular Payment Schedules:

Determine a consistent schedule for settling shared expenses. Weekly, bi-weekly, or monthly payment cycles can ensure timely payments and avoid accumulating large balances.

4. Be Transparent with Receipts:

Maintain receipts for all shared purchases and make them accessible to everyone involved. This fosters accountability and allows everyone to verify the accuracy of expense entries.

5. Divide Expenses Fairly:

Agree on a fair method for splitting expenses, whether it’s based on equal contributions, income proportions, or negotiated percentages. Ensure everyone feels comfortable and that the division reflects individual circumstances.

6. Address Discrepancies Promptly:

If discrepancies or disagreements arise regarding expenses, address them promptly and respectfully. Open communication and willingness to compromise are crucial for resolving issues amicably.

7. Adapt and Adjust as Needed:

Shared expense systems are not set in stone. As circumstances change, be willing to revisit the agreed-upon methods and adjust them to ensure they continue to work effectively for everyone.

Managing shared expenses effectively requires communication, organization, and mutual understanding. By implementing these tips, you can create a system that promotes fairness, transparency, and a harmonious experience for all involved.

How to Avoid Financial Conflicts with Roommates

Living with roommates can be a great way to save money and meet new people. However, it can also lead to financial conflicts if you’re not careful. Here are a few tips to help you avoid financial problems with your roommates:

1. Have a Clear Financial Agreement

Before you even move in, sit down with your roommates and discuss your financial expectations. This should include things like:

- How much rent each person will pay

- How you will split utilities

- Whether you will share groceries and other household expenses

- How you will handle late payments

It’s best to put this agreement in writing and have everyone sign it. This will help to avoid misunderstandings and disputes down the road.

2. Use a Shared Account or App

There are several apps and tools available to help you manage shared expenses with your roommates. Some popular options include:

- Splitwise

- Venmo

- Bill.com

These apps can help you keep track of who owes what and make it easy to settle up at the end of the month.

3. Communicate Openly and Honestly

If you have any concerns about money, don’t be afraid to talk to your roommates about it. The sooner you address problems, the easier they are to solve. It’s important to be open and honest about your finances and to listen to your roommates’ concerns as well.

4. Set a Budget

It’s a good idea to set a budget for your shared expenses. This will help you to stay on track and avoid overspending. You can use a budgeting app or create a spreadsheet to track your spending.

5. Be Respectful of Each Other’s Finances

Everyone’s financial situation is different. Be respectful of your roommates’ financial choices and avoid making judgments. Remember that you are all in this together and that communication and compromise are key to avoiding conflicts.

By following these tips, you can help to prevent financial conflicts with your roommates and create a harmonious living situation.

Choosing Compatible Roommates for Financial Stability

Living with roommates can be a great way to save money on rent and utilities, but it’s important to choose roommates who are financially responsible and compatible with your lifestyle. In this article, we’ll discuss some key factors to consider when choosing roommates to ensure financial stability and a harmonious living situation.

1. Financial Responsibility:

The first and most important aspect is to find roommates who are financially responsible. Ask about their credit history, income, and spending habits. Do they have a history of paying bills on time? Are they comfortable discussing their financial situation? You want to be confident that your roommates will contribute their fair share of rent and utilities.

2. Shared Values:

When it comes to money, values matter! Discuss your thoughts on budgeting, saving, and spending. For example, do you prioritize saving for the future, or are you more comfortable living a little more lavishly? Are you both comfortable with shared expenses, or do you prefer to keep things separate? Finding alignment in these areas can make a big difference in your financial stability and overall peace of mind.

3. Communication and Trust:

Open and honest communication is crucial for any roommate situation, especially regarding finances. Establish clear communication channels for discussing bills, expenses, and any financial concerns. It’s important to feel comfortable discussing these things openly and respectfully.

4. Shared Lifestyle:

Consider your lifestyles and routines. If you’re a minimalist who prefers quiet evenings at home, you might not be the best fit for a roommate who loves hosting parties and having friends over often. Your living habits can impact your shared expenses, so it’s important to find compatibility in this area.

5. Background Check and References:

Don’t be afraid to do a background check on potential roommates. Ask for references from previous landlords or roommates to get a sense of their past behavior and financial responsibility.

Conclusion:

Choosing compatible roommates is a crucial step in achieving financial stability and a harmonious living environment. Take the time to carefully consider your needs and values, and choose roommates who share those qualities. Open communication, financial responsibility, and shared lifestyles are key factors in creating a positive and successful roommate experience.

Planning for Unexpected Costs in Shared Apartments

Sharing an apartment can be a great way to save money and make new friends. However, it’s important to be prepared for unexpected costs that can arise when living with roommates. These costs can range from minor repairs to major emergencies, and they can quickly add up if you’re not prepared.

Here are a few tips for planning for unexpected costs in shared apartments:

1. Create a Shared Budget

The first step is to create a shared budget with your roommates. This budget should include all of your monthly expenses, such as rent, utilities, groceries, and entertainment. It’s also a good idea to include a line item for unexpected costs.

2. Establish a Shared Savings Account

Once you have a budget, you can start saving for unexpected costs. Consider opening a shared savings account that everyone can contribute to. This account should have enough money to cover a few months’ worth of expenses in case of an emergency.

3. Create a Shared Emergency Fund

In addition to a shared savings account, it’s also a good idea to create a shared emergency fund. This fund should be used for major emergencies, such as a fire or a natural disaster. It’s important to decide upfront how much you’ll contribute to the emergency fund and how it will be accessed in case of an emergency.

4. Establish Clear Communication

Clear communication is essential when it comes to shared finances. Make sure to have open and honest conversations with your roommates about your financial goals and expectations. This will help to avoid misunderstandings and ensure that everyone is on the same page.

5. Consider a Shared Lease Agreement

When signing a lease agreement, make sure to include a clause that outlines how unexpected costs will be handled. This clause should specify how the costs will be divided among the roommates and how they will be paid. This can help to avoid disputes in the future.

6. Prepare for Common Unexpected Costs

Some common unexpected costs that can arise in shared apartments include:

- Repairs to appliances, such as the washing machine or dishwasher

- Replacing broken furniture or fixtures

- Paying for unexpected pest control

- Covering the cost of unexpected damage

- Paying for emergency medical care for a roommate

By planning ahead and being prepared for unexpected costs, you can help to minimize stress and ensure that your shared apartment experience is a positive one.

Evaluating the Benefits of a Joint Lease

A joint lease is a lease agreement signed by two or more individuals, who are all jointly responsible for the rent and other obligations outlined in the lease. This type of lease can be beneficial in several ways, but it’s important to consider the potential drawbacks before signing on the dotted line.

Benefits of a Joint Lease

Here are some potential benefits of a joint lease:

- Shared Costs: By splitting the rent and other expenses, individuals can save money. This is especially beneficial if one individual is unable to afford the entire cost of rent on their own.

- Improved Credit Score: When two individuals share a lease, their credit history is combined, which can lead to an improved credit score for both parties, as long as both parties pay rent on time and maintain good financial habits.

- Increased Security: A joint lease can provide a greater sense of security, especially for those who are renting alone. Having a roommate can offer companionship and a sense of safety.

- Flexibility: Joint leases can offer flexibility, as the terms of the lease can be tailored to fit the needs of both parties. For example, a joint lease might include a clause that allows one party to sublet their room to another individual if they move out.

Drawbacks of a Joint Lease

While there are benefits to a joint lease, there are also some potential drawbacks to consider:

- Shared Responsibility: Both individuals are equally responsible for the rent, even if one party moves out or is unable to pay their share.

- Potential Conflict: Living with another person can lead to disagreements or conflict, which can affect the living situation. It’s important to carefully consider the compatibility of the individuals involved before signing a joint lease.

- Financial Risk: If one person fails to pay their share of the rent, the other person is responsible for the entire amount. This can create a financial burden and damage the credit score of the individual who is paying the entire rent.

Important Considerations

Before entering into a joint lease, it is essential to have a clear and open conversation with your potential roommate to discuss the following:

- Financial responsibilities: Determine how rent and other expenses will be split, and establish a payment plan.

- Living arrangements: Discuss your expectations for cleanliness, noise level, and other aspects of daily living.

- Communication: Establish clear communication channels for resolving any issues that may arise.

- Legal agreement: Consult with an attorney to ensure that the lease agreement is fair and protects both parties’ interests.

A joint lease can be a beneficial arrangement for individuals seeking to share the cost of rent or increase their sense of security. However, it’s important to carefully weigh the potential benefits and drawbacks before signing a joint lease agreement. By thoroughly considering all factors and communicating clearly with your potential roommate, you can increase the chances of a positive and successful shared living experience.

Setting Rules for Managing Shared Purchases

Sharing purchases with others can be a great way to save money and get the things you need. But it’s important to set some ground rules to make sure that everyone is on the same page. This can help avoid misunderstandings and conflicts later on.

Here are a few tips for setting rules for managing shared purchases:

1. Determine Who Is Responsible for What

The first step is to decide who is responsible for each aspect of the purchase. For example, one person could be responsible for ordering the items, while another could be responsible for paying for them. You could also agree to split the responsibilities evenly.

2. Establish a Budget

It’s important to establish a budget for shared purchases. This will help you keep track of your spending and make sure that you don’t overspend. It’s best to agree on a specific amount to spend each month or for each item.

3. Decide on a Payment Method

There are several different payment methods you can use for shared purchases. You could each contribute an equal share, or one person could pay for everything and then be reimbursed by the others. Whatever method you choose, make sure that it’s clear and transparent.

4. Keep Track of Purchases

Keeping track of your shared purchases is essential. You can do this by using a spreadsheet, a shared document, or an app. This will help you stay organized and make sure that everyone is on the same page.

5. Set Clear Expectations

It’s important to set clear expectations about how the shared purchase will be used. For example, if you’re buying a piece of equipment, decide who will be responsible for storing and maintaining it. This will help to prevent conflicts and ensure that everyone is happy with the arrangement.

Setting rules for managing shared purchases can be a great way to ensure that everyone is on the same page and that the experience is positive for everyone involved. It’s essential to have an open and honest conversation with the people you’re sharing purchases with so that you can set up a system that works for everyone.

Using Apps to Track Shared Expenses

Sharing expenses with friends or roommates can be a hassle. You may forget who owes whom, or you may not have time to keep track of everything. Fortunately, there are many apps available to help you track shared expenses and make sure everyone pays their fair share.

Expense-Tracking Apps make it easy to record your expenses, categorize them, and split bills with others. They can also help you identify areas where you can save money.

Here are some of the best expense-tracking apps:

- Splitwise: This app is great for tracking expenses with friends or roommates. It allows you to create groups, add expenses, and easily settle up with each other.

- Mint: While Mint is primarily known for its budgeting features, it can also be used to track expenses. It allows you to categorize expenses, set budgets, and view your spending habits.

- YNAB (You Need a Budget): YNAB is another budgeting app that can help you track shared expenses. It uses a zero-based budgeting method, which means that all of your income is allocated to a specific purpose.

In addition to tracking expenses, some apps offer features like:

- Bill splitting: These apps can automatically split bills among group members.

- Payment reminders: Some apps will send you reminders when a payment is due.

- Debt management: If you have debt, these apps can help you track it and create a repayment plan.

Using an expense-tracking app can help you save time and money. It can also help you stay organized and avoid arguments with your friends or roommates.