Living in a high-demand city comes with exciting opportunities but also presents unique financial challenges. Finding affordable housing can feel like a constant struggle, and keeping up with rising rent costs can drain your budget. But don’t despair! With some strategic planning and smart financial habits, you can thrive as a renter in a competitive urban environment. This guide provides top financial tips for navigating the complexities of renting in high-demand cities, helping you save money, manage your finances effectively, and enjoy the urban lifestyle without breaking the bank.

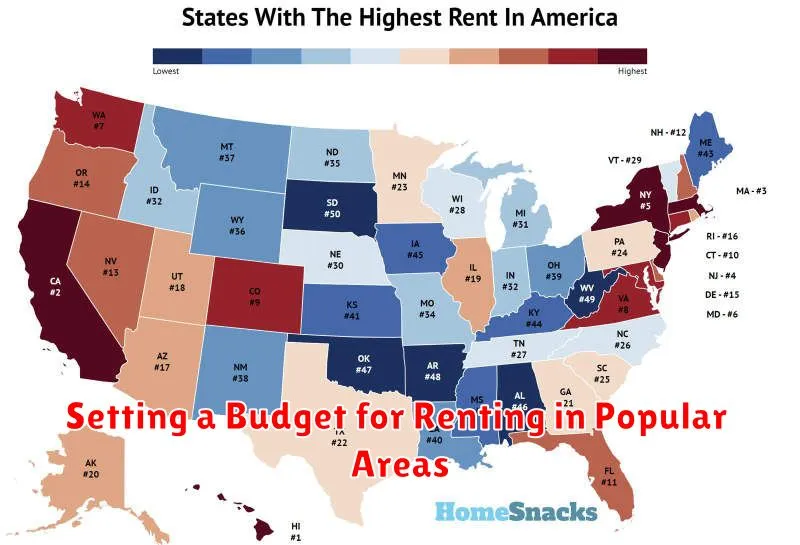

Setting a Budget for Renting in Popular Areas

Finding a place to live in a popular area can be exciting and challenging. While the excitement of being close to everything is enticing, it’s important to be realistic about the cost of living in a popular area. It can be expensive, especially when it comes to rent. Setting a realistic budget is crucial to making sure you don’t overspend and find yourself in a difficult financial situation.

Before you start looking at properties, consider your overall financial situation. How much can you comfortably afford to spend on rent each month? Remember that rent is just one part of your monthly expenses; you also need to factor in other costs like utilities, transportation, groceries, and entertainment. It’s essential to create a budget that accounts for all your expenses, not just rent.

Once you have a general idea of your budget, you can start researching rent prices in the areas you’re interested in. Websites like Zillow, Trulia, and Apartments.com offer comprehensive listings and data on average rent prices in different neighborhoods. Look for properties that fit within your budget range and consider the trade-offs between location, amenities, and size.

Remember, rent prices can fluctuate depending on factors like the time of year, the type of property, and the demand in the area. Be prepared to be flexible with your budget, and don’t be afraid to negotiate with landlords or property managers.

While it’s tempting to focus solely on finding the cheapest option, consider your overall lifestyle and priorities. If you value being close to public transportation, parks, or entertainment, you might need to adjust your budget accordingly. Sometimes, it’s worth paying a bit more to live in a location that better meets your needs.

Setting a budget is the first step to finding a rental property that works for you financially. By carefully considering your expenses and being realistic about your options, you can find a place that is both affordable and enjoyable to live in.

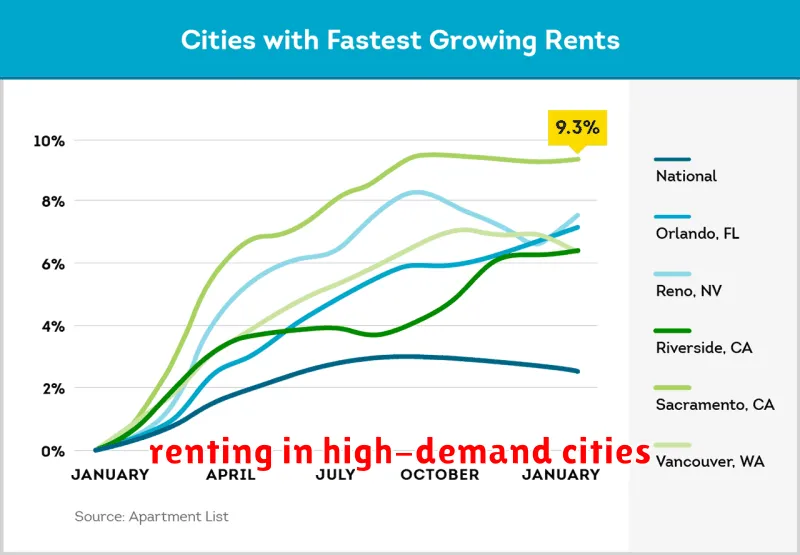

Understanding Rental Trends in Big Cities

The rental market in big cities is a dynamic landscape, constantly evolving with factors like economic conditions, demographics, and even global events. Understanding these trends is crucial for both renters and landlords, as it can inform decisions on everything from choosing a location to setting rental rates.

One of the most prominent trends in recent years has been the rise of urban revitalization. As cities work to attract new residents and businesses, they often invest in infrastructure, public transportation, and amenities. This revitalization often leads to increased demand for housing, particularly in formerly neglected neighborhoods, driving up rental prices.

Another key factor is the growing popularity of co-living spaces. This trend is driven by factors like affordability and a desire for social connection, particularly among young professionals and students. Co-living spaces offer shared living arrangements with amenities like common kitchens and social areas, providing an alternative to traditional apartments.

Technology is also playing a significant role in shaping the rental market. Online platforms have made it easier than ever to find and rent properties. Additionally, smart home technology is becoming increasingly popular, offering features like remote access and energy efficiency, which are attractive to renters.

Despite these trends, the rental market is not without its challenges. Affordability remains a major concern in many big cities, particularly for low- and middle-income earners. The gap between wages and housing costs is widening, making it difficult for some to find suitable and affordable accommodation.

Understanding these rental trends is essential for both landlords and tenants. Landlords need to stay informed about market conditions to set competitive rental rates and attract tenants. Renters, on the other hand, can use this information to make informed decisions about their housing choices, considering their budget, lifestyle, and priorities.

How to Avoid Overpaying in Competitive Markets

In competitive markets, it can be tempting to jump at the first offer you receive. But this can often lead to overpaying. To avoid this, it’s important to do your research and understand the true value of what you’re buying. Here are a few tips to help you avoid overpaying:

1. Set a Budget and Stick to It: Before you start shopping, determine how much you’re willing to spend. This will help you avoid getting carried away by the excitement of a competitive market. Stick to your budget, even if it means passing on an offer that seems tempting but is outside your price range.

2. Research the Market: Take the time to compare prices and features from different sellers. This can be done online, through consumer reports, or by talking to other buyers. By understanding the market, you can identify fair prices and avoid paying too much.

3. Negotiate: Don’t be afraid to negotiate with sellers. In competitive markets, sellers may be willing to negotiate to close a deal. Be prepared to walk away if the seller isn’t willing to meet your price, but don’t be afraid to ask for a better deal.

4. Look for Incentives: Many sellers offer incentives to attract buyers. These can include discounts, rebates, or free upgrades. Be sure to ask about any available incentives before making an offer.

5. Be Patient: Don’t rush into a decision. Take your time to weigh your options and make sure you’re comfortable with the price you’re paying. In a competitive market, it’s important to be patient and wait for the right deal to come along.

By following these tips, you can increase your chances of getting a good deal in a competitive market. Remember, the key is to be informed, be prepared to walk away, and be patient.

Finding Affordable Neighborhoods in Expensive Cities

Moving to a big city can be an exciting prospect, but the cost of living can be daunting. Many people find themselves priced out of their dream neighborhoods, leaving them wondering where they can afford to live. Luckily, there are ways to find affordable neighborhoods in even the most expensive cities.

One strategy is to look for neighborhoods that are just outside the city center. These areas often offer lower rents and home prices while still being within easy reach of the city’s attractions and amenities. You may need to rely on public transportation or a car to get around, but the savings could be significant. For example, a one-bedroom apartment in the heart of Manhattan could cost $3,000 per month, while a similar apartment in a nearby borough like Queens could cost $1,500 per month.

Another way to find affordable housing is to consider sharing a living space. This could mean living with roommates or finding a sublet. These options can significantly reduce your monthly expenses, allowing you to live in a more desirable neighborhood. Living with roommates is a popular option for young professionals and students, and it offers the added benefit of creating a social network.

Finally, don’t underestimate the power of negotiation. When searching for an apartment, be prepared to ask for a lower rent or a better deal. Landlords are often willing to negotiate, especially if they’re eager to fill a vacant unit. You can also negotiate with landlords to make repairs or improvements to the apartment, further reducing your expenses.

Finding affordable neighborhoods in expensive cities requires research and creativity. But by exploring these strategies, you can find a place to live that fits your budget and lifestyle. Remember, there are options beyond the most popular and expensive neighborhoods, and the right place for you may be waiting just around the corner.

Tips for Negotiating Rent in High-Demand Areas

Living in a high-demand area can be exciting, but it also comes with its fair share of challenges, particularly when it comes to finding affordable housing. Rents in these areas tend to be higher, and competition for available units can be fierce. But don’t despair! With a little strategy and preparation, you can still negotiate a favorable rent.

Here are some key tips for navigating the rental market in high-demand areas:

Research Thoroughly

Before you even start looking at apartments, take the time to thoroughly research the market. Understand the average rent for similar units in your desired neighborhood. Utilize online resources like Zillow, Trulia, and Apartments.com to gather data and get a sense of the current rental landscape.

Be Prepared to Move Quickly

In high-demand areas, properties often don’t stay on the market for long. Be prepared to act fast once you find a place that meets your criteria. This might involve being ready to submit an application or even making an offer within a short timeframe.

Highlight Your Strengths

Landlords are more likely to negotiate with tenants who present themselves as ideal candidates. Emphasize your strong credit history, stable income, and responsible rental history. If you have any other positive factors, such as a strong reference from a previous landlord, be sure to include them in your application or during your conversation.

Consider Lease Length

Landlords may be more inclined to negotiate rent if you’re willing to commit to a longer lease term. A longer lease provides them with greater stability and predictable income. Propose a longer lease term and see if it opens up the possibility for rent reduction.

Ask About Incentives

Landlords often offer incentives to attract tenants, particularly in competitive markets. Don’t hesitate to ask about potential concessions, such as free rent for the first month or a reduced security deposit.

Be Professional and Courteous

Throughout the entire process, maintain professionalism and courtesy. Landlords are more likely to work with tenants who are respectful and easy to work with. Avoid being overly aggressive or demanding during negotiations.

Don’t Be Afraid to Walk Away

If you’re not comfortable with the rent or terms, you always have the option to walk away. Remember, you’re not obligated to accept a lease agreement that doesn’t work for you.

Finding affordable housing in a high-demand area can be challenging, but it’s not impossible. By being prepared, strategic, and persistent, you can increase your chances of securing a favorable rent and finding your dream home.

Balancing Proximity and Affordability

Finding a place to live that meets both your financial needs and your desire for proximity to work, entertainment, and loved ones can be a real challenge. Affordability and proximity often seem to exist in a tug-of-war, making it difficult to find the perfect balance.

This is especially true in major cities, where housing costs can skyrocket and commuting times can become unbearable. But fear not, there are strategies you can employ to find a happy medium between these two crucial factors. Let’s delve into some key considerations:

1. Define Your Priorities

Before embarking on your housing search, take some time to reflect on your priorities. Ask yourself:

- How important is it for you to live close to your workplace?

- What kind of commute are you willing to tolerate?

- Are there specific amenities or neighborhoods that are essential to you?

- What is your budget, and are you willing to compromise on certain aspects to achieve it?

By understanding your non-negotiables and areas of flexibility, you can narrow down your search and make more informed decisions.

2. Explore Different Neighborhoods

Don’t limit yourself to just one or two neighborhoods. Consider venturing beyond your initial comfort zone to explore areas that might offer a better balance between affordability and proximity. Look for neighborhoods with good public transportation options or a mix of residential and commercial areas.

3. Consider Alternative Housing Options

Instead of focusing solely on traditional apartments or houses, consider alternative housing options like shared housing, co-living spaces, or even renting a room in a house. These options often offer greater affordability, particularly in urban areas.

4. Be Flexible with Your Commute

If you’re willing to be flexible with your commute, you can unlock a wider range of possibilities. Consider options like biking, walking, or using public transportation to minimize the financial burden of living close to work.

5. Don’t Underestimate the Power of Negotiation

Don’t be afraid to negotiate with landlords or property managers. If you’re willing to sign a longer lease or pay your rent upfront, you might be able to secure a more affordable deal.

6. Seek Out Housing Resources

Utilize resources like online real estate websites, local community centers, and government assistance programs to find affordable housing options. Many cities offer programs that provide subsidies or rental assistance for low-income residents.

Finding a balance between affordability and proximity is an ongoing process. It requires careful planning, research, and a willingness to be adaptable. But by using these strategies, you can increase your chances of finding a home that meets both your financial and lifestyle needs.

Financial Planning for Urban Living Expenses

Living in an urban area can be exciting and offer a wealth of opportunities, but it also comes with a unique set of financial challenges. From high rent and transportation costs to the temptation of trendy restaurants and entertainment, urban living expenses can quickly add up. This is where meticulous financial planning becomes crucial for ensuring a sustainable and comfortable lifestyle.

Here are some essential tips for effectively managing your finances in an urban environment:

1. Budget Like a Pro

Creating a detailed budget is the foundation of sound financial planning. Track your income and meticulously list all your expenses, both fixed and variable. This includes rent, utilities, groceries, transportation, entertainment, and any subscriptions. Analyze your spending patterns and identify areas where you can cut back. Even small savings can add up over time.

2. Prioritize Rent and Housing

Housing is often the largest expense in an urban setting. Aim for a rent-to-income ratio that is manageable. Consider sharing an apartment with roommates or exploring alternative housing options like co-living spaces to reduce costs. Negotiate with your landlord for a better rate or explore opportunities to rent out a spare room to offset your expenses.

3. Optimize Transportation Costs

Transportation is another major expense in cities. Opt for public transportation, biking, or walking whenever possible. Consider purchasing a bike or utilizing carpooling services to minimize your reliance on private vehicles. Explore transportation discounts and passes offered by your city or employer.

4. Embrace the Thrifty Lifestyle

Living in a city doesn’t mean you have to spend extravagantly. Learn to be resourceful and embrace a thrifty lifestyle. Cook at home more often instead of relying on expensive restaurants. Look for free or discounted events, activities, and entertainment options. Take advantage of city-wide deals and discounts on groceries, dining, and entertainment.

5. Explore Financial Resources

Many resources are available to help you manage your finances in an urban setting. Check out financial literacy programs offered by local organizations or community centers. Seek guidance from a financial advisor who can create a personalized plan tailored to your specific needs. Utilize budgeting apps and tools to track your spending and stay on top of your financial goals.

6. Save and Invest Wisely

Despite the higher expenses, it’s essential to prioritize saving and investing. Set aside a portion of your income for emergencies, retirement, or other long-term financial goals. Explore different investment options, such as stocks, bonds, or real estate, to grow your wealth over time.

Living in an urban environment can be a rewarding experience, but it requires a conscious effort to manage your finances effectively. By adhering to these tips, you can create a sustainable and fulfilling lifestyle while navigating the unique challenges of urban living.

The Role of Rent Control in High-Cost Cities

Rent control is a policy that limits the amount landlords can charge for rent. It is often implemented in cities with high housing costs, where tenants may struggle to afford rent. The goal of rent control is to make housing more affordable for low- and middle-income families. However, rent control is a controversial policy, and there is no consensus on its effectiveness.

Arguments for Rent Control

Proponents of rent control argue that it can help to stabilize housing costs and prevent displacement. They argue that landlords are able to charge exorbitant rents in high-cost cities, leaving many people unable to afford housing. Rent control can help to protect tenants from rent increases that are not justified by market conditions. Additionally, rent control can help to preserve the character of neighborhoods by preventing the displacement of long-term residents.

Arguments Against Rent Control

Opponents of rent control argue that it can lead to a decrease in the supply of affordable housing. They argue that landlords are less likely to invest in maintaining their properties or building new ones when rent control is in place. Additionally, opponents argue that rent control can lead to a decrease in the quality of housing. They argue that landlords are less likely to make repairs when they are not able to charge market rents. Finally, opponents argue that rent control can lead to a black market for housing. They argue that landlords may try to circumvent rent control regulations by charging tenants under-the-table fees or by converting apartments to other uses.

The Impact of Rent Control

The impact of rent control on housing affordability is complex and depends on a variety of factors. There is evidence that rent control can have a positive impact on affordability in the short term, but it can also lead to negative consequences in the long term. Studies have shown that rent control can lead to a decrease in the supply of housing, a decrease in the quality of housing, and an increase in the black market for housing.

Rent control is a complex policy with both potential benefits and drawbacks. It is important to carefully consider the potential consequences before implementing rent control. While rent control can help to protect tenants from rising rents, it can also have unintended consequences, such as a decrease in the supply of affordable housing. Ultimately, the decision of whether or not to implement rent control is a difficult one that must be made on a case-by-case basis.

Leveraging Public Transit to Cut Costs

In today’s economy, finding ways to save money is more important than ever. One often-overlooked area where significant savings can be realized is transportation. While owning a car provides convenience, it comes with a hefty price tag, including fuel, maintenance, insurance, and parking. Instead of relying solely on private vehicles, consider incorporating public transit into your transportation strategy. This can be a surprisingly effective way to cut costs and reduce your environmental impact.

Financial Benefits of Public Transit

The financial advantages of public transit are undeniable. By opting for buses, trains, or subways, you can eliminate the expense of car ownership entirely. You’ll save money on:

- Fuel: Public transportation runs on a different scale, often utilizing fuel-efficient systems or renewable energy sources.

- Maintenance: No more oil changes, tire rotations, or expensive repairs.

- Insurance: You won’t need to pay for car insurance, which can save hundreds of dollars annually.

- Parking: Forget the headache and cost of finding and paying for parking in urban areas.

Beyond the Money: Additional Perks

Beyond financial savings, public transit offers several additional benefits:

- Reduced Stress: Leave the stress of driving behind and relax while you travel. You can read, work, or simply unwind during your commute.

- Increased Productivity: Many public transportation options provide Wi-Fi, allowing you to catch up on work or emails during your commute.

- Environmental Consciousness: Public transit significantly reduces carbon emissions compared to individual car travel.

- Community Engagement: Public transit connects you to your community, allowing you to observe and experience different parts of your city.

Making Public Transit Work for You

While public transit offers numerous advantages, it’s important to consider your individual needs and adapt your approach to maximize its benefits. Here are some tips:

- Plan your routes: Use online tools or apps to map out efficient travel routes and schedules.

- Utilize multiple modes: Combine public transit with walking or biking for shorter distances to optimize your travel time.

- Explore options: Different cities offer various public transportation systems, so explore the options available in your area.

- Take advantage of discounts: Many transit systems offer discounted fares for students, seniors, or frequent riders.

Embrace a Sustainable Future

By embracing public transit, you’re not just saving money but also contributing to a more sustainable future. Reduced traffic congestion, decreased pollution, and improved public health are just some of the positive outcomes of a shift towards efficient transportation systems.

Exploring Roommate Options for Financial Savings

Living on your own can be incredibly liberating, but it can also come with a hefty price tag. Rent, utilities, and groceries can quickly add up, making it a significant financial burden. This is where the idea of having a roommate comes in. Sharing an apartment or house with another person can drastically cut down on your living expenses, allowing you to save money and achieve your financial goals.

Benefits of Having a Roommate

Beyond the obvious financial advantage, having a roommate can offer a range of benefits. You’ll have someone to share your space with, potentially leading to a more vibrant social life. You can divide chores, making household management less stressful. Moreover, having a roommate can provide a sense of security and companionship, especially if you live alone.

Finding the Right Roommate

While having a roommate offers numerous advantages, finding the right person is crucial. It’s important to consider your lifestyle, habits, and preferences. Ask yourself questions like:

- What are my non-negotiables? (e.g., smoking, pets, party frequency)

- What kind of living environment do I prefer? (e.g., clean and organized, relaxed and casual)

- What are my financial expectations? (e.g., splitting expenses equally, budgeting for shared amenities)

Roommate Options

There are several ways to find a roommate:

- Online platforms: Websites and apps specifically designed for roommate matching can connect you with potential housemates based on your preferences.

- Social networks: Utilize your existing social circles to ask for recommendations or post a request for a roommate.

- Local communities: Bulletin boards at universities, community centers, and local shops can be good places to find leads.

Setting Clear Expectations

Before moving in with a roommate, it’s vital to establish clear expectations and communicate openly. Discuss:

- Financial responsibilities: How will rent, utilities, and other expenses be split?

- House rules: Set guidelines for noise levels, guest policies, and shared spaces.

- Chore division: Determine how you’ll handle cleaning, cooking, and other household tasks.

Having a roommate can be a great way to save money, enjoy companionship, and experience a different living dynamic. By finding the right roommate and setting clear expectations, you can ensure a positive and mutually beneficial living experience.