Moving into a new apartment can be an exciting experience, but it also comes with a hefty price tag. From security deposits to moving expenses, unexpected costs can quickly add up. To ensure a smooth and financially savvy move, it’s essential to implement smart financial planning strategies. This article will delve into essential financial tips for moving into a new apartment, covering budgeting, saving, and negotiating to help you navigate this exciting transition while staying on top of your finances.

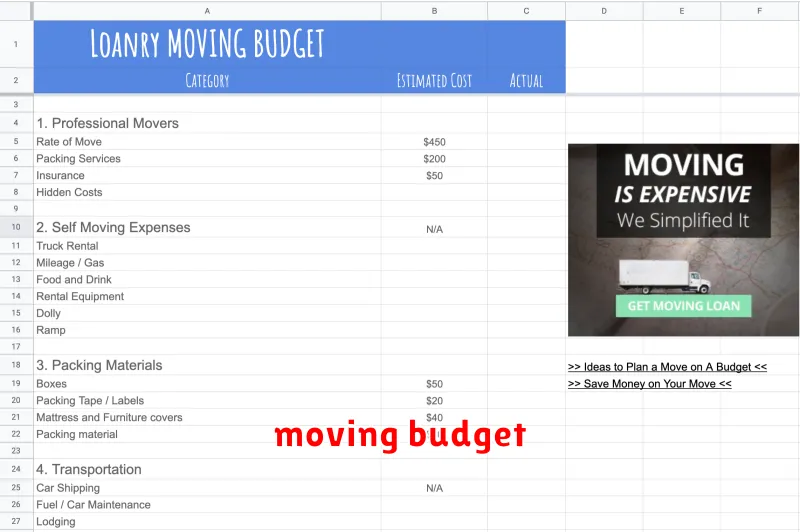

Creating a Moving Budget

Moving can be a stressful and expensive process. It’s important to create a moving budget to help you stay on track financially. Here are some tips to help you create a moving budget:

1. Determine Your Moving Costs

The first step is to determine your moving costs. These costs can vary depending on the distance of your move, the size of your home, and the type of moving services you choose. Consider the following expenses:

- Moving company fees: This includes the cost of packing, loading, transporting, and unloading your belongings.

- Packing supplies: Boxes, tape, bubble wrap, and other packing materials can add up quickly.

- Transportation: If you’re driving yourself, you’ll need to account for gas, tolls, and parking fees.

- Storage: If you need to store your belongings temporarily, you’ll need to factor in storage unit fees.

- New home expenses: This could include deposits, insurance, and utilities.

2. Research and Compare Moving Companies

Once you know what services you need, start researching moving companies. You can get quotes online or call moving companies directly. Compare prices and services to find the best option for your needs. Don’t be afraid to ask questions and get everything in writing. You can also use a moving company directory to find reputable companies in your area.

3. Factor in Unexpected Expenses

It’s always a good idea to factor in unexpected expenses when creating a moving budget. This could include things like:

- Last-minute packing: You may need to purchase additional packing supplies or hire help.

- Food and drinks: Moving can be tiring, so you’ll need to factor in food and drinks for yourself and your family.

- Extra travel: You may need to make extra trips back and forth to your old home or to your new home.

4. Create a Budget Spreadsheet

Once you have a good idea of your moving costs, create a budget spreadsheet to track your expenses. This will help you stay on top of your spending and avoid overspending. A simple spreadsheet can be made in Google Sheets or Microsoft Excel. You can also find free moving budget templates online.

5. Save Money Where You Can

Moving can be expensive, but there are ways to save money. Consider the following:

- Pack yourself: You can save money by packing your belongings yourself. This can be a lot of work, but it will save you money on moving company fees.

- Sell or donate unwanted items: Getting rid of belongings you no longer need can save money on packing and moving.

- Get help from friends and family: Ask your friends and family for help with packing and loading. This will also save you on moving company fees.

- Look for discounts and promotions: Many moving companies offer discounts for seniors, military members, and students.

Moving can be stressful, but it doesn’t have to break the bank. By creating a moving budget and following these tips, you can stay on track financially and make your move a success.

Understanding Moving-Related Costs for Renters

Moving can be a stressful and expensive endeavor, especially for renters. It’s crucial to budget for various expenses beyond just the cost of rent. This guide provides an overview of common moving-related costs renters may encounter.

Moving Services

- Professional movers: Hiring professional movers can significantly reduce physical strain and save time. However, their services can be expensive, depending on the distance, volume of belongings, and any special requirements.

- Moving trucks/vans: If you choose to move yourself, renting a truck or van is essential. Consider factors like truck size, rental duration, and potential insurance costs.

Packing Supplies

- Boxes: Cardboard boxes are a necessity for packing. Purchase different sizes to accommodate various items.

- Packing tape: Securely sealing boxes with packing tape is vital to prevent damage during transport.

- Bubble wrap: Protect fragile items with bubble wrap.

- Packing paper: Use packing paper for cushioning and wrapping items within boxes.

Transportation & Travel

- Gas: If driving yourself, factor in fuel costs. Consider the distance, fuel efficiency of your vehicle, and potential traffic.

- Tolls: Research potential toll costs on your route.

- Parking: Plan for parking fees at both your old and new residences, especially if you’re in a city.

Utilities

- Security deposit: Most rental agreements require a security deposit. This amount varies depending on the property.

- First month’s rent: You will need to pay the first month’s rent upon moving in.

- Last month’s rent: Some leases require payment for the last month’s rent upfront.

Other Expenses

- Cleaning supplies: You might need to clean your old apartment before moving out.

- New furniture: Consider the need for new furniture or decor for your new place.

- Insurance: Renter’s insurance is essential to protect your belongings.

- Moving insurance: If using a moving company, inquire about their insurance policies.

By budgeting for all these costs, you can ensure a smoother transition and avoid unexpected financial strain. Remember, early planning and meticulous budgeting can significantly help in managing your moving expenses as a renter.

Finding Affordable Moving Services

Moving can be a stressful and expensive process. Finding affordable moving services can be a challenge, but it’s definitely possible. Here are a few tips to help you find the best deal on your move.

Get Quotes from Multiple Companies

It’s important to get quotes from multiple moving companies before making a decision. This will give you a good idea of the average cost of moving and help you compare prices. Be sure to get quotes from both local and national moving companies.

Consider Using a Moving Broker

A moving broker can help you find moving companies that fit your needs and budget. They work with a network of movers and can often find you a better deal than you would be able to find on your own.

Don’t Be Afraid to Negotiate

Most moving companies are willing to negotiate their prices. If you’re not happy with the initial quote, don’t be afraid to ask for a better deal.

Look for Discounts

Many moving companies offer discounts to seniors, military personnel, and students. Ask about any available discounts before you book your move.

Do Your Own Packing

Packing your own belongings is a great way to save money. If you’re willing to pack everything yourself, you can save hundreds of dollars.

Consider a DIY Move

If you’re feeling ambitious, you can always move yourself. This is the most affordable option, but it can be a lot of work. If you do choose to move yourself, make sure to get help from friends and family.

Tips for Saving Money

Here are a few additional tips for saving money on your move:

- Move during the off-season. Moving prices are typically lower during the spring and fall.

- Schedule your move on a weekday. Moving companies often charge more for weekend moves.

- Get rid of any unwanted items before you move. This will reduce the amount of stuff you need to move and save you money on packing and transportation.

Moving can be a big undertaking, but it doesn’t have to be expensive. By following these tips, you can find affordable moving services and save money on your move.

How to Save on Packing Supplies

Moving can be a stressful and expensive undertaking. One of the biggest expenses often comes from packing supplies. But don’t worry, there are ways to save money without sacrificing quality. Here are some tips on how to save on packing supplies:

1. Reuse and Recycle

Before you head to the store, take a look around your house. You might be surprised at how many reusable items you already have. Old boxes from online orders, newspapers, and even towels can be used to protect your belongings during the move. Check with local businesses for free boxes too. Many stores get shipments in cardboard boxes and may be happy to donate them to you.

2. Buy in Bulk

If you are moving a lot of stuff, buying packing supplies in bulk can save you a significant amount of money. Many online retailers and big box stores offer discounts for large orders.

3. Look for Sales and Discounts

Keep your eyes peeled for sales and discounts. Many retailers offer special deals on packing supplies, especially during peak moving season. You can also sign up for email newsletters from your favorite stores to be alerted to upcoming promotions. Also, check for coupons online or in local newspapers.

4. Consider Alternatives

There are several alternatives to traditional packing supplies. For example, you can use old clothing and blankets as padding instead of bubble wrap. Look for reusable packing containers or even rent them.

5. Ask for Help

Don’t be afraid to ask for help from friends and family. They might have boxes they are willing to donate or help you pack using your own supplies. If you’re really short on boxes, you might be able to find them at a local thrift store or online marketplace for a low price.

By following these tips, you can save a significant amount of money on packing supplies without sacrificing quality. So, start planning your move today and save some cash!

Setting Up Utilities on a Budget

Moving into a new place is exciting, but it can also be expensive. One of the biggest expenses you’ll face is setting up utilities. From electricity and gas to water and internet, these services can quickly add up. However, there are ways to save money and set up your utilities on a budget.

1. Shop Around for the Best Deals

Don’t just settle for the first utility company you find. Take the time to compare rates and plans from different providers. You can use online comparison tools or contact companies directly to get quotes. Consider factors like:

- Monthly fees: Some companies charge a monthly fee, while others don’t.

- Usage charges: The cost per kilowatt-hour (kWh) or therm can vary significantly.

- Discounts and incentives: Some companies offer discounts for seniors, veterans, or customers who sign up for paperless billing.

2. Consider Alternative Energy Sources

If you’re looking for a more sustainable and potentially cheaper option, consider exploring alternative energy sources. Solar panels, wind turbines, and geothermal energy can help you reduce your reliance on traditional utility companies and potentially save money on your energy bills in the long run.

3. Negotiate Your Rates

Don’t be afraid to negotiate with utility companies. They may be willing to offer you a lower rate if you’re a new customer or if you’re willing to sign a longer-term contract. Be prepared to explain your needs and budget, and be assertive but polite.

4. Manage Your Usage Wisely

Once you’ve set up your utilities, it’s important to manage your usage wisely to avoid high bills. Here are some tips:

- Unplug appliances and electronics when not in use.

- Use energy-efficient appliances and light bulbs.

- Take shorter showers and wash clothes in cold water.

- Insulate your home to reduce heat loss.

5. Take Advantage of Discounts and Incentives

Many utility companies offer discounts and incentives for customers who use energy efficiently. Some common programs include:

- Energy audits: These can help you identify areas where you can save energy.

- Rebates: These can help you offset the cost of energy-efficient appliances and upgrades.

- Low-income assistance programs: These can provide financial assistance to customers who are struggling to pay their bills.

By following these tips, you can set up utilities on a budget and save money on your monthly expenses. Remember to compare rates, negotiate, manage your usage wisely, and take advantage of available discounts and incentives.

Managing Security Deposits and Initial Payments

When you’re a landlord, one of the most important things you need to do is to make sure you’re properly managing your security deposits and initial payments. This includes collecting the correct amount of money, keeping track of it, and returning it to the tenant when they move out.

There are a few things you need to know about managing security deposits and initial payments:

Security Deposits

A security deposit is a sum of money that a tenant pays to the landlord at the beginning of a lease. The purpose of the security deposit is to protect the landlord from damage to the property. If the tenant damages the property, the landlord can use the security deposit to cover the cost of repairs.

Security deposits are typically regulated by state law. In most states, landlords are required to return the security deposit to the tenant within a certain timeframe after the lease ends, as long as the property is in good condition.

Initial Payments

An initial payment is a payment that the tenant makes at the beginning of the lease, in addition to the security deposit. The initial payment may cover the first month’s rent, last month’s rent, or both.

It’s important to make sure that you’re collecting the correct amount of money for both security deposits and initial payments. You should also keep track of all payments, including the date they were received and how they were paid. This will help you avoid any disputes with your tenants later on.

Tips for Managing Security Deposits and Initial Payments

Here are a few tips for managing security deposits and initial payments:

- Keep accurate records. Keep track of all payments, including the date they were received, the amount, and how they were paid. This will help you avoid any disputes with your tenants later on.

- Return the security deposit promptly. In most states, landlords are required to return the security deposit to the tenant within a certain timeframe after the lease ends, as long as the property is in good condition. Make sure you’re aware of the laws in your state.

- Use a separate bank account. It’s a good idea to use a separate bank account for your security deposits. This will help you keep track of your money and avoid any legal issues.

- Get your tenant’s signature. When you receive a security deposit or initial payment, have the tenant sign a receipt acknowledging that they have paid the money. This will help you avoid any disputes later on.

- Check your state’s laws. Make sure you’re familiar with the laws in your state regarding security deposits and initial payments.

Managing security deposits and initial payments can be a bit of a hassle, but it’s important to do it properly. By following the tips above, you can avoid any legal issues and ensure that you’re complying with all of the relevant laws.

Tips for Minimizing Costs During the First Month

Moving into a new place can be exciting, but it can also be expensive. Here are some tips to help you minimize costs during your first month:

1. Plan Your Move Carefully

A well-planned move can save you money in the long run. Research and compare different moving companies, consider renting a truck, or enlist the help of friends and family. Pack strategically to avoid unnecessary trips and ensure you have all the essentials on hand.

2. Prioritize Your Needs

Resist the urge to buy everything at once. Focus on essential furniture, appliances, and supplies. You can always purchase additional items gradually as you settle in.

3. Cook at Home

Eating out can quickly drain your budget. Make a grocery list and prepare meals at home. This also helps you control portion sizes and avoid unnecessary spending.

4. Explore Free Activities

Take advantage of free entertainment options in your new city. Visit parks, attend free concerts or events, explore local museums with free admission days, or go for a hike in nature.

5. Negotiate Bills and Services

Don’t be afraid to negotiate with your utility providers, internet service providers, and other service providers. There might be special offers or discounts for new customers.

6. Utilize Resources

Check out local community centers, libraries, and other resources that offer free programs and services. You might find free fitness classes, workshops, or educational opportunities.

7. Create a Budget and Track Expenses

Developing a budget and tracking your expenses can help you identify areas where you can save money. Monitor your spending and adjust your budget as needed.

Moving into a new place can be a significant financial undertaking. By implementing these tips, you can effectively minimize costs and avoid unnecessary expenses during your first month. Remember, patience and planning are key to a successful and affordable transition.

Evaluating Insurance Options for New Apartments

Moving into a new apartment is an exciting time, but it’s also crucial to ensure you’re adequately protected. Renter’s insurance is essential for safeguarding your belongings and providing financial protection in case of unexpected events. Before signing up for any policy, it’s vital to evaluate your insurance options carefully.

Understand Your Landlord’s Insurance

First, check with your landlord to understand what insurance coverage they provide. Many landlords carry building insurance, but it typically doesn’t cover your personal belongings. Understanding your landlord’s coverage will help you determine what additional insurance you need.

Evaluate Your Needs

Consider your specific needs and possessions when choosing a policy. Ask yourself:

- What is the value of your personal belongings?

- Do you have any high-value items like electronics, jewelry, or artwork?

- Are you concerned about liability in case of injury to a visitor?

The answers to these questions will influence the type and level of coverage you require.

Compare Different Policies

Don’t settle for the first policy you find. Compare different insurance providers to ensure you’re getting the best value and coverage for your needs. Look for policies that offer:

- Personal Property Coverage: This protects your belongings against theft, fire, and other perils.

- Liability Coverage: This protects you if someone is injured in your apartment.

- Additional Living Expenses: This covers temporary housing costs if your apartment becomes uninhabitable.

- Personal Injury Protection: This covers medical expenses if you are injured.

Compare the coverage limits, deductibles, and premiums of different policies to find the best fit for your budget and needs.

Consider Optional Coverage

Some policies offer optional coverage for specific risks like floods, earthquakes, or identity theft. Assess whether these additional coverages are necessary based on your location and personal circumstances.

Get Quotes and Read Policy Documents

Once you’ve narrowed down your choices, get quotes from several providers. Read the policy documents carefully to understand the coverage details, exclusions, and limitations. Don’t hesitate to ask questions to clarify anything you don’t understand.

Investing in renter’s insurance is a smart decision for protecting your belongings and your financial security. By carefully evaluating your options, comparing policies, and understanding the coverage details, you can find the right insurance policy to provide peace of mind and protect your investment in your new apartment.

Budgeting for Furnishing a New Apartment

Moving into a new apartment is an exciting time, but it can also be overwhelming, especially when it comes to furnishing it. You want to create a space that is both stylish and functional, but you also need to be mindful of your budget. To help you stay on track, here is a guide on how to budget for furnishing your new apartment.

1. Determine Your Budget

The first step is to figure out how much you can afford to spend. Consider your overall financial situation, including your income, expenses, and savings. Be realistic about your budget, and don’t overspend. If you’re unsure where to start, you can use a budgeting app or online tool to track your spending and create a plan.

2. Prioritize Your Needs

Before you start shopping, think about what you absolutely need for your apartment. This might include essentials like a bed, sofa, dining table, and chairs. You can then create a list of “wants” that you can add to your apartment gradually over time. Prioritizing your needs will help you avoid impulse purchases and stay within your budget.

3. Shop Around and Compare Prices

Once you know what you need, it’s time to start shopping. Don’t settle for the first store you visit. Compare prices at different retailers, both online and offline. Consider both new and used furniture options, as you can often find great deals on gently used pieces.

4. Consider Multifunctional Furniture

If you’re working with a limited space or budget, consider investing in multifunctional furniture. For example, a sofa bed can serve as both a seating area and a guest bed. A coffee table with storage can provide extra space for books and other items. This approach will help you maximize your space and save money.

5. Don’t Be Afraid to DIY

If you’re feeling crafty, you can also save money by DIYing some of your furniture. There are countless tutorials online for building shelves, painting furniture, or reupholstering chairs. DIY projects can be a fun and rewarding way to personalize your apartment and add your own style.

6. Factor in Delivery and Assembly Costs

When budgeting for furniture, don’t forget to factor in delivery and assembly costs. These can add up quickly, especially for larger items. Consider shopping at stores that offer free delivery or assembly. If you need to hire someone for assembly, be sure to get quotes from multiple professionals before making a decision.

7. Allow for Flexibility

While it’s important to have a budget, don’t be afraid to be flexible. You might find an amazing deal on a piece of furniture that you didn’t originally plan on buying. If it fits within your overall budget and you love it, go for it. Remember, your home should be a reflection of your style and personality.

8. Don’t Overlook the Details

While furniture is a big part of decorating your apartment, don’t overlook the details. Items like rugs, curtains, lighting, and artwork can all add personality and style to your space. You can often find affordable decor at thrift stores, flea markets, or online marketplaces.

9. Be Patient and Enjoy the Process

Furnishing your new apartment is a process, so be patient. Don’t feel like you need to do everything at once. Start with the essentials and gradually add pieces as you can afford them. Remember to enjoy the process of creating a home that you love.

Using Financial Tools to Track Moving Expenses

Moving can be a stressful and expensive process. Keeping track of all your moving expenses is essential to stay on budget and avoid any surprises. Thankfully, there are many financial tools available to help you manage your moving costs.

Here are some helpful tools to help you track your moving expenses:

Spreadsheets

A simple spreadsheet can be a great way to track your moving expenses. You can create columns for each expense category, such as transportation, packing materials, cleaning supplies, and storage. This way, you can easily input your expenses and see a running total.

Budgeting Apps

Budgeting apps, like Mint or YNAB (You Need A Budget), can be helpful in tracking your moving expenses. These apps allow you to categorize your spending and set budget limits for each category. They also provide features such as expense reports and charts to give you a visual overview of your spending.

Expense Tracking Apps

Expense tracking apps, like Expensify or Shoeboxed, are designed specifically for tracking business expenses. But, they can also be useful for tracking moving expenses. These apps allow you to snap photos of receipts and categorize them by type of expense.

Dedicated Moving Cost Calculator

Many moving companies and online resources offer free moving cost calculators that can help you estimate your moving expenses. These calculators take factors such as distance, weight, and type of move into account. They can provide you with a rough estimate of how much your move will cost.

Tips for Tracking Moving Expenses

Here are a few tips for effectively tracking your moving expenses:

- Keep all your receipts, even for small purchases.

- Categorize your expenses as you go to make it easier to analyze your spending later.

- Use a separate bank account or credit card for moving expenses to make it easier to track spending.

- Review your expenses regularly and make adjustments to your budget as needed.

By using these financial tools and tips, you can effectively track your moving expenses, stick to your budget, and stay on top of your moving finances.