Are you a young professional finally on your own and starting to rent your first apartment? Congratulations! It’s an exciting time, but it’s also important to be smart with your finances. Renting can come with unexpected costs, so being prepared can make all the difference. This guide will walk you through essential financial tips for young professionals renting apartments, helping you manage your money effectively, avoid common pitfalls, and set yourself up for long-term financial success.

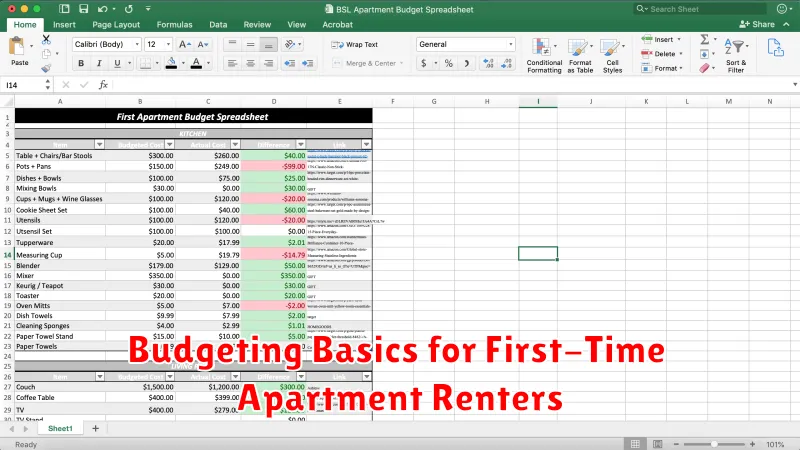

Budgeting Basics for First-Time Apartment Renters

Moving into your first apartment is an exciting time, but it’s also crucial to be financially prepared. One of the most important aspects of managing your finances is creating a solid budget. This will help you ensure you can afford your rent, utilities, and other essential expenses while still enjoying your new space.

1. Track Your Income and Expenses

Before you start budgeting, take a good look at your finances. Keep track of your income, which includes your salary, any additional income streams, and even any money you receive from family or friends. Then, meticulously list all your expenses, including everything from rent and utilities to groceries, transportation, and entertainment.

2. Determine Your Housing Budget

A general rule of thumb is to allocate no more than 30% of your gross income towards housing, including rent and utilities. Consider factors like your desired neighborhood, apartment size, and amenities when setting this budget. Remember, you don’t want to sacrifice other essential needs just to live in a fancy apartment. Use online tools and rental websites to research average rents in your desired area.

3. Factor in Other Essential Expenses

Beyond rent, you need to account for recurring expenses like:

- Utilities: Electricity, gas, water, trash, and internet. Check with potential landlords for estimated costs.

- Groceries: Plan your meals to avoid unnecessary spending. Consider bulk buying and cooking at home.

- Transportation: Factor in costs like gas, public transportation, and car maintenance.

- Healthcare: Health insurance premiums and potential medical expenses.

- Personal Care: Toiletries, clothing, and grooming expenses.

- Entertainment: This category can be flexible, but setting a limit is wise.

4. Set Up a Budget and Track Your Spending

Once you have a clear picture of your income and expenses, you can create a budget. There are various methods, from using spreadsheets to budgeting apps. The key is to track your spending consistently and stick to your plan. You might also consider setting up a savings account for unexpected expenses or emergency situations.

5. Review and Adjust Your Budget

Your financial situation can change over time, so it’s essential to review your budget regularly. If you experience an increase in income or a decrease in expenses, you can adjust your budget accordingly. This will help you stay on track and maintain financial stability.

6. Consider a Roommate

If you find yourself struggling to make ends meet, sharing an apartment with a roommate can significantly reduce your housing costs. This can free up more funds for other expenses and allow you to enjoy your new apartment without financial strain. Be sure to communicate clearly with potential roommates about your budget and expectations.

Managing your finances when you’re renting your first apartment can be challenging, but by following these budgeting basics, you can set yourself up for financial success and enjoy the exciting experience of living on your own!

Understanding Monthly Costs Beyond Rent

Moving into a new apartment is exciting, but it’s crucial to remember that rent isn’t the only cost you’ll face each month. Many hidden expenses can quickly add up, putting a strain on your budget if you’re not prepared. Understanding these additional costs will help you plan your finances effectively and avoid any unpleasant surprises.

Utilities

Utilities like electricity, gas, water, and internet are essential for daily life and can vary significantly depending on your location, usage, and the provider. Some landlords include certain utilities in the rent, but often, you’ll need to budget for them separately.

Groceries

Feeding yourself is a fundamental expense. Factor in the cost of groceries, taking into account your dietary needs and preferences. Consider meal prepping or exploring budget-friendly grocery options to save money.

Transportation

Getting around requires transportation, which can be a considerable cost depending on your chosen method. Public transportation, car ownership, ride-sharing, and walking all have different price tags. Calculate your transportation expenses based on your lifestyle and commute.

Healthcare

Healthcare is essential. Even if you have health insurance, you’ll likely have co-pays, deductibles, and prescription costs. Factor these expenses into your monthly budget.

Entertainment and Social Activities

While not strictly necessities, entertainment and social activities enrich your life. Allocate a reasonable budget for dining out, movies, concerts, and other outings. Prioritize activities that bring you joy while staying within your means.

Personal Care

Personal care items like toiletries, haircuts, and clothing contribute to your monthly expenses. Consider using generic brands, scheduling appointments in advance, and shopping for clothing during sales to manage these costs.

Savings and Emergency Fund

It’s crucial to set aside a portion of your income for savings and an emergency fund. This will provide a safety net for unexpected expenses and future goals. Aim to save at least 10% of your income each month.

Debt Repayment

If you have any outstanding debts, such as student loans, credit card bills, or personal loans, factor in your monthly payments. Prioritize paying down high-interest debts to save on interest charges.

By understanding these monthly costs beyond rent, you can create a realistic budget and avoid financial stress. Being aware of all your expenses will help you make informed decisions and manage your finances responsibly.

Choosing Affordable Neighborhoods for Young Professionals

Navigating the housing market as a young professional can be a daunting task, especially in cities where rent and home prices soar. Finding an affordable neighborhood that caters to your lifestyle and career aspirations is crucial. This guide will provide insights into choosing affordable neighborhoods that are perfect for young professionals.

Consider Your Budget and Lifestyle

Before diving into neighborhood research, it’s essential to determine your budget and lifestyle preferences. Consider factors like:

- Monthly rent or mortgage payments: Set a realistic budget based on your income and expenses.

- Commute time: Factor in the cost of transportation and the time spent commuting to work.

- Amenities: Think about the amenities that are important to you, such as parks, gyms, restaurants, and nightlife.

- Safety and crime rates: Research the crime statistics of potential neighborhoods.

Explore Up-and-Coming Neighborhoods

Up-and-coming neighborhoods are often more affordable than established areas. Look for areas that are experiencing gentrification or have potential for future growth. These neighborhoods might have a mix of old and new buildings, offering diverse architectural styles and affordable housing options.

Consider Smaller Cities or Suburbs

If you’re open to living outside the hustle and bustle of a major city, consider exploring smaller cities or suburbs. These areas often have lower costs of living, including housing, transportation, and groceries. You might even find more space and a quieter environment.

Utilize Online Resources

Numerous online resources can help you find affordable neighborhoods. Explore websites like Zillow, Trulia, and Redfin to compare rent and home prices, explore neighborhood maps, and read reviews. You can also use social media to connect with young professionals living in different neighborhoods and get their perspectives.

Network and Ask for Recommendations

Networking with friends, colleagues, and acquaintances who live in the city can provide valuable insights. Ask for recommendations for affordable neighborhoods that fit your lifestyle and budget. They might have firsthand experience with specific areas and can offer valuable advice.

Choosing an affordable neighborhood is a significant step in your journey as a young professional. By carefully considering your budget, lifestyle preferences, and utilizing the resources available, you can find a place that offers a balance of affordability, convenience, and a vibrant community. Remember to explore up-and-coming areas, consider smaller cities or suburbs, and leverage online resources and personal connections to make an informed decision.

How to Save on Initial Moving Costs

Moving can be an expensive endeavor, but with careful planning and savvy strategies, you can significantly reduce your initial moving costs. Here are some tips to help you save money on your move:

1. Choose the Right Time to Move

Moving during the off-season (typically from September to April) can save you money on both transportation and labor. Peak season (May to August) sees higher demand, leading to inflated prices.

2. Downsize and Declutter

The more you move, the more it costs. Take this opportunity to declutter your home. Donate, sell, or discard items you no longer need. This will not only reduce your moving expenses but also streamline the process.

3. Pack Your Own Boxes

Packing your own belongings can save you a significant amount of money. Purchase sturdy boxes from moving companies or local stores at a discounted price. If you’re moving locally, consider borrowing boxes from friends or neighbors.

4. Explore Alternative Moving Options

Traditional full-service moving companies can be expensive. Explore alternative options like renting a moving truck or hiring movers for loading and unloading only. Consider hiring a moving company that specializes in labor-only services.

5. Utilize Free Resources

Take advantage of free resources like craigslist or Facebook Marketplace to find free moving boxes or offer free items to neighbors. Look for free packing materials at local businesses like grocery stores or liquor stores.

6. Research and Negotiate with Movers

Obtain quotes from multiple moving companies and compare their prices. Don’t be afraid to negotiate with the company for a better rate. Ask about any discounts for military personnel, senior citizens, or other special promotions.

7. Be Prepared for Unexpected Costs

It’s crucial to account for potential unexpected costs, such as packing materials, tolls, and parking fees. Having a buffer in your budget for unforeseen expenses can prevent financial stress.

Evaluating Long-Term Financial Goals for Renting

If you’re a renter, it’s important to consider how your current living situation affects your long-term financial goals. While homeownership often comes to mind as a key financial goal, renting can be a strategic choice for many individuals and families. Evaluating the pros and cons of renting can help you determine if it aligns with your financial aspirations.

Financial Advantages of Renting

Renting offers several financial advantages that can contribute to your long-term goals:

- Lower upfront costs: Renting typically requires a security deposit and first month’s rent, which are significantly lower than a down payment on a home.

- Predictable monthly expenses: Rent payments are usually fixed, making it easier to budget and plan for other financial goals.

- Flexibility and mobility: Renting provides greater flexibility to move if your circumstances change, such as a job relocation or a growing family.

- Lower maintenance costs: Landlords are typically responsible for major repairs and maintenance, freeing you from these expenses.

Financial Considerations for Renters

While renting offers advantages, it’s crucial to consider the potential drawbacks:

- Rent increases: Rent prices can fluctuate, leading to higher housing costs in the future.

- Lack of equity building: Unlike owning a home, rent payments don’t contribute to equity building, meaning you won’t be building wealth through your housing investment.

- Limited customization: Renters typically have limited control over renovations and upgrades, which can be a drawback for those seeking personalization.

Strategic Planning for Long-Term Goals

When evaluating renting, it’s essential to align it with your long-term financial goals. Here are some strategies:

- Invest your savings: The money you would have used for a down payment can be invested, potentially generating higher returns over time.

- Prioritize paying down debt: Use the freed-up cash flow from renting to pay down high-interest debt, improving your financial health.

- Maximize your retirement contributions: The financial flexibility of renting allows you to increase your retirement savings contributions.

- Plan for future housing goals: Consider your future housing aspirations and determine how renting fits into those plans.

Renting can be a financially sound decision for many individuals and families, especially if it aligns with their long-term goals. By carefully evaluating the financial advantages and considerations, renters can make informed decisions and optimize their financial well-being.

Tips for Finding Apartments with Flexible Leases

Finding an apartment can be a stressful experience, and it can be even more challenging when you’re looking for a lease that fits your unique needs. Traditional 12-month leases can be restrictive, especially if you’re unsure about your future plans. Fortunately, there are apartments with flexible lease options available, allowing you to rent for shorter terms or with the ability to break your lease under certain circumstances.

Here are some tips for finding apartments with flexible leases:

1. Start Your Search Online

Many online apartment listing websites allow you to filter your search by lease term. You can often find listings that specify shorter-term options, such as 6 months, 9 months, or even month-to-month leases. Some websites also offer features that let you specify your desired lease length.

2. Contact Property Managers Directly

Once you’ve found potential apartments, contact the property managers directly to inquire about their lease options. Be upfront about your need for a flexible lease and ask about any specific policies they have in place. You can also inquire about the possibility of negotiating a shorter lease term or breaking a lease early.

3. Consider Furnished Apartments

Furnished apartments often cater to short-term renters, making them a good option if you need a flexible lease. These apartments typically offer shorter lease terms and may have less restrictive lease agreements.

4. Explore Short-Term Rental Options

If you’re looking for a truly flexible option, consider short-term rental platforms like Airbnb or VRBO. These platforms offer a wide range of properties with varying lease lengths, providing you with the flexibility to move when you need to.

5. Be Prepared to Pay a Premium

It’s important to note that apartments with flexible leases may come with a higher price tag. Landlords may charge a premium for the flexibility they offer. However, the added cost may be worth it if it provides you with the peace of mind and flexibility you need.

6. Read the Fine Print

Before signing any lease agreement, carefully review the terms and conditions. Pay close attention to the lease duration, any early termination fees, and any specific requirements for breaking a lease. Understanding the details of the lease will help you avoid any unpleasant surprises down the road.

Finding an apartment with a flexible lease can take some extra effort, but it’s definitely possible. By utilizing these tips and being proactive in your search, you can find a rental that fits your unique needs and offers the flexibility you desire.

Understanding Your Rights as a Renter

Being a renter can be a great experience, but it’s important to understand your rights and responsibilities. Knowing your rights can help you avoid problems and ensure you have a safe and enjoyable living experience. Here are some key things you should know about your renter’s rights:

Right to a Safe and Habitable Living Environment

Landlords have a legal obligation to provide a safe and habitable living space. This includes things like:

- Working plumbing, heating, and electrical systems

- Proper ventilation

- Protection from the elements (like a roof over your head and working windows)

- Freedom from pests and rodents

If your landlord fails to maintain these standards, you have the right to take action, which may include:

- Requesting repairs in writing

- Withholding rent (in some cases)

- Taking legal action

Right to Privacy

Landlords generally cannot enter your rental unit without your permission, except in emergency situations (like a fire or a major leak) or with proper legal notice.

Right to Quiet Enjoyment

You have the right to enjoy your rental unit without unreasonable interference from your landlord or other tenants. This includes protection from excessive noise, harassment, or disruptions.

Right to a Lease Agreement

Landlords are required to provide you with a written lease agreement that outlines the terms of your tenancy, including the rent amount, the duration of the lease, and any other relevant details.

Right to Security Deposit Return

Your landlord is required to return your security deposit within a specific timeframe (usually 30 days) after you move out, as long as you have left the unit in good condition. However, your landlord can deduct from your deposit to cover any damages beyond normal wear and tear.

Right to End Your Lease Early

In some situations, you may have the right to break your lease early. These situations usually involve things like domestic violence, military deployment, or if your landlord is violating your rights.

Knowing Your Rights: Importance and Resources

Understanding your renter’s rights is crucial for protecting your interests and ensuring a positive rental experience. If you have any questions or concerns, be sure to consult your local tenant laws or reach out to a legal aid organization or housing advocacy group for guidance.

Using Financial Tools to Manage Expenses

Managing your finances can be a daunting task, but it’s essential for achieving financial stability and reaching your financial goals. In today’s digital age, there are many financial tools available to help you track your expenses, budget, and make informed financial decisions. These tools can empower you to take control of your finances and live a more financially secure life.

Budgeting Apps

Budgeting apps have become increasingly popular in recent years, providing users with a convenient way to track their spending and create personalized budgets. These apps typically allow you to categorize your expenses, set spending limits, and monitor your progress towards your financial goals. Some popular budgeting apps include Mint, Personal Capital, and YNAB (You Need A Budget).

Expense Tracking Tools

Expense tracking tools are designed to help you keep tabs on your spending patterns. Some of these tools can connect to your bank accounts to automatically record your transactions, while others require manual input. Expense tracking tools can provide insights into where your money is going, allowing you to identify areas where you can cut back. Some popular expense tracking tools include Expensify, Wave, and Zoho Expense.

Financial Management Software

Financial management software provides a more comprehensive approach to managing your finances. These programs often include features for budgeting, expense tracking, bill payment, investment tracking, and tax preparation. Some popular financial management software options include Quicken, Moneydance, and Microsoft Money.

Online Banking

Online banking platforms have become an essential tool for managing your finances. Online banking allows you to view your account balances, transfer funds, pay bills, and even set up spending alerts. Many online banks offer mobile apps, giving you access to your accounts anytime, anywhere.

Benefits of Using Financial Tools

Using financial tools offers several benefits, including:

- Increased financial awareness: Financial tools help you understand your spending habits and identify areas where you can improve.

- Improved budgeting: Budgeting tools help you create and stick to a budget, ensuring that you’re spending within your means.

- Enhanced financial control: Financial tools give you more control over your finances, allowing you to make informed decisions about your money.

- Reduced debt: By tracking your expenses and budgeting effectively, you can reduce your debt levels over time.

- Achieving financial goals: Financial tools can help you set and reach your financial goals, whether it’s saving for retirement, buying a home, or paying off student loans.

In conclusion, using financial tools is an effective way to manage your expenses and achieve your financial goals. By taking advantage of the many available tools, you can gain a better understanding of your finances, create a budget, track your spending, and make informed financial decisions that will lead to a more secure future.

Setting Up Emergency Savings for Apartment Living

Apartment living can be exciting and convenient, but it can also be expensive. Unexpected costs can pop up at any time, from appliance malfunctions to plumbing problems. To avoid financial stress and ensure you can handle these situations without breaking the bank, it’s crucial to have an emergency savings fund in place.

How much do you need? A good rule of thumb is to aim for three to six months’ worth of living expenses in your emergency savings. This amount should cover essentials like rent, utilities, groceries, and transportation. To calculate your target, add up your monthly expenses and multiply by the desired number of months (three or six).

Setting Up a Savings Account:

- Choose a high-yield savings account: Look for accounts that offer competitive interest rates to help your money grow.

- Set up automatic transfers: Schedule regular transfers from your checking account to your savings account. Even small amounts can add up over time.

- Don’t touch it! Emergency savings should be reserved for true emergencies. Avoid dipping into this fund for non-essential expenses.

Saving Strategies for Apartment Living:

- Track your spending: Use budgeting apps or spreadsheets to monitor where your money is going.

- Cut unnecessary expenses: Identify areas where you can reduce spending, like eating out less or cancelling subscriptions.

- Look for ways to earn extra income: Consider a side hustle or taking on freelance work to boost your savings.

- Take advantage of discounts: Look for deals on groceries, entertainment, and other necessities.

Emergency Savings Benefits for Apartment Living:

- Peace of mind: Knowing you have a financial cushion can ease your stress and worries about unexpected expenses.

- Avoid debt: By having emergency savings, you can avoid going into debt for unforeseen costs.

- Financial stability: A strong emergency fund can help you weather unexpected financial storms and maintain stability in your apartment living.

Building an emergency savings fund takes time and effort, but it’s an essential investment in your financial well-being. By implementing these strategies and staying disciplined with your savings, you can confidently navigate the ups and downs of apartment living with the peace of mind that comes from knowing you’re prepared for anything.

How to Build Credit Through Timely Rent Payments

Building good credit is essential for many aspects of life, from securing a loan to renting an apartment. While many people focus on credit cards and loans to establish credit, did you know that your rent payments can also contribute to your credit score? This is because you can report your rent payments to credit bureaus through services like Rent Reporting and Experian RentBureau.

Here’s how you can take advantage of this opportunity to build credit:

1. Choose a Landlord Who Participates in Rent Reporting

Not all landlords participate in rent reporting services. When searching for an apartment, inquire about the landlord’s policy regarding credit reporting. If they don’t currently report, you could ask them to consider it. Many landlords are happy to cooperate as it can benefit them too.

2. Enroll in a Rent Reporting Service

Once you’ve found a landlord who reports, you’ll need to enroll in a rent reporting service. These services typically charge a small monthly fee and act as a middleman between you and the credit bureaus. They collect your rent payment information from your landlord and report it to your credit file.

3. Pay Rent on Time Consistently

The most important factor in building credit is consistency. Make sure you pay your rent on time every month. Late payments can negatively impact your credit score, so it’s crucial to stay on top of your rent obligations.

4. Monitor Your Credit Report Regularly

It’s essential to monitor your credit report regularly to ensure that your rent payments are being reported accurately. You can access your credit report for free from each of the three major credit bureaus: Experian, Equifax, and TransUnion.

5. Consider Other Credit Building Strategies

While rent reporting can be a valuable tool for building credit, it’s not the only strategy. Explore other options like secured credit cards or a secured loan to further strengthen your credit profile.

Building credit through timely rent payments is a simple yet effective way to improve your financial standing. By taking advantage of rent reporting services and maintaining a consistent payment history, you can establish a solid credit score that will serve you well in the future.