Are you a first-time renter looking for financial advice to navigate the world of apartment rentals? This article is your guide to making smart financial decisions that will help you secure a great apartment without breaking the bank. We’ll delve into essential tips, from understanding your budget to negotiating your rent, ensuring you have a smooth and financially responsible rental experience. So, let’s dive in and get you on the right track!

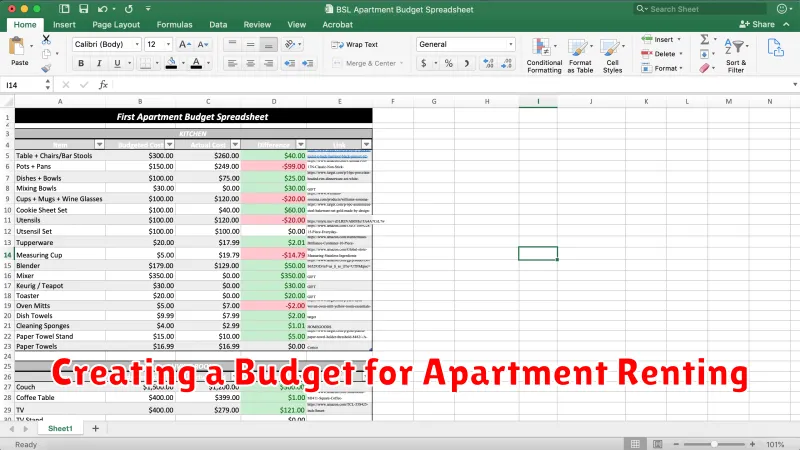

Creating a Budget for Apartment Renting

Finding a new apartment can be exciting, but it’s important to create a budget before you start your search. This will help you narrow down your options and make sure you can afford the rent and other associated costs. Here’s a step-by-step guide on creating a budget for apartment renting:

1. Track Your Expenses

The first step is to track your current expenses for a month. Use a spreadsheet or budgeting app to track every penny you spend. This will give you a realistic picture of your monthly income and outgoings.

2. Determine Your Housing Budget

Once you know your current expenses, you can determine how much you can afford to spend on rent. A general rule of thumb is to spend no more than 30% of your gross monthly income on housing. However, it’s best to aim for 25% or less to leave room for other expenses and unexpected costs.

3. Factor in Other Costs

Besides rent, there are other costs associated with apartment renting, such as:

- Security deposit

- First and last month’s rent

- Utilities (electricity, gas, water, internet)

- Renter’s insurance

- Parking

- Moving costs

Factor these costs into your budget to get a clear picture of your total expenses. Be sure to research the average cost of utilities in your desired area.

4. Consider Future Expenses

It’s also essential to think about future expenses, such as:

- Potential rent increases

- Emergency repairs

- Furniture and home decor

Building a little buffer into your budget can help you handle these unexpected costs.

5. Review and Adjust

After you’ve created your budget, review it regularly and adjust it as needed. Your financial situation may change, and your expenses may fluctuate. It’s important to stay on top of your budget and make necessary adjustments to ensure you’re on track.

6. Set Financial Goals

Once you have a clear picture of your expenses, set financial goals. This might include saving for a down payment on a home, paying off debt, or investing in your future. Having clear goals can motivate you to stick to your budget and achieve your financial aspirations.

Creating a budget for apartment renting is crucial for managing your finances effectively and making informed decisions. By following these steps, you can ensure that you find a comfortable and affordable place to live while staying on top of your financial obligations.

Understanding Security Deposits and How to Save

Moving into a new place can be exciting, but it also comes with a lot of costs, including the security deposit. A security deposit is a sum of money you pay to your landlord when you move into a rental property. It’s meant to cover any potential damages you might cause to the property during your tenancy. While it’s a standard practice in many places, understanding the intricacies of security deposits can help you save money and avoid potential headaches.

The amount of the security deposit varies depending on several factors, including the location, type of property, and the landlord’s policies. Some states have limits on the amount of security deposit that can be charged. It’s crucial to research your local laws and understand the terms of your lease agreement. The agreement should clearly state the amount of the security deposit, how it will be used, and the conditions under which it will be returned to you.

How to Save on Your Security Deposit

While you can’t completely avoid paying a security deposit, there are ways to minimize your out-of-pocket expenses:

- Negotiate the Amount: In some cases, you can negotiate a lower security deposit, especially if you have a good credit score and a solid rental history. Be prepared to explain why you deserve a lower deposit and offer a compromise if necessary.

- Be a Responsible Tenant: The best way to ensure you get your security deposit back is to be a responsible tenant. This includes adhering to the terms of your lease, respecting the property, and reporting any issues promptly.

- Document Everything: Take photos and videos of the property’s condition before you move in. This documentation can be helpful if any disputes arise regarding damages. Save all communication with your landlord, including emails and text messages.

- Clean Thoroughly: Before you move out, make sure the property is clean and in good condition. This includes deep cleaning, fixing any minor repairs, and removing all your personal belongings. Leaving the property in a clean and habitable state will increase your chances of getting your full deposit back.

- Do a Final Walk-Through: Request a final walk-through with your landlord to ensure you both agree on the condition of the property before you vacate. Having a written record of any agreed-upon repairs or damages can be valuable in resolving disputes.

What Happens to Your Security Deposit?

Your security deposit should be returned to you within a reasonable time frame after you move out. However, the landlord has the right to deduct expenses for any damages that exceed normal wear and tear, unpaid rent, or other lease violations. Make sure you understand the specific rules and regulations regarding security deposit refunds in your state.

Don’t Be Afraid to Ask Questions

If you have any questions about the security deposit, don’t hesitate to ask your landlord or a real estate professional. Understanding the process can help you save money and avoid potential complications in the future. By taking proactive steps and being a responsible tenant, you can maximize your chances of getting your security deposit back in full.

Finding Apartments with Low Initial Costs

Moving into a new apartment can be exciting, but it also comes with significant upfront costs. These can include a security deposit, first month’s rent, and potentially application fees, pet deposits, and moving expenses. For those on a tight budget, these costs can feel overwhelming. Thankfully, there are ways to find apartments with lower initial costs.

Negotiate with Landlords: Don’t be afraid to ask for a lower security deposit or to waive application fees. Many landlords are willing to negotiate, especially in a competitive market.

Look for Rent Specials: Many landlords offer move-in specials to attract new tenants. These can include discounts on rent, free months of rent, or waived fees. Be sure to inquire about any special offers when you’re viewing properties.

Consider Smaller Units: Smaller apartments generally have lower rent, and therefore lower initial costs. Evaluate your needs and prioritize space versus affordability.

Explore Off-Peak Seasons: Moving during the off-season (generally fall or winter) can often lead to better deals, as landlords are more eager to fill vacancies.

Utilize Online Resources: Websites like Apartments.com, Zillow, and Trulia allow you to filter your search based on price and specific criteria. Some websites even offer rent calculators to help you estimate total costs.

Ask About Payment Plans: Some landlords may offer payment plans for the security deposit or first month’s rent, making it easier to manage your finances.

Get Creative with Moving Costs: Consider free or low-cost moving options such as borrowing a truck, using a moving company for just the heavy items, or enlisting help from friends and family.

Finding an apartment with low initial costs requires research, planning, and negotiation. By utilizing the tips above, you can increase your chances of finding an affordable and comfortable place to call home.

How to Negotiate Rent as a First-Time Renter

Negotiating rent can seem daunting, especially as a first-time renter. You might be worried about appearing unprofessional or coming across as demanding. But the truth is, rent negotiation is a common practice, and it can save you significant money over the course of your lease.

Here’s a step-by-step guide to help you confidently navigate rent negotiations:

1. Research the Market

Before you even step foot in a potential apartment, do your homework. Check online real estate listings and resources like Zillow, Trulia, and Apartments.com to get an idea of average rental rates for similar properties in your desired area. This research will give you a solid foundation for your negotiations.

2. Be Prepared to Walk Away

While it’s good to be enthusiastic about finding a place, don’t let your excitement cloud your judgment. Having another option, even if it’s just a backup apartment you’re mildly interested in, can give you bargaining power. This allows you to politely walk away from a deal if the rent isn’t negotiable.

3. Timing Is Key

Timing matters when it comes to rent negotiation. You’re more likely to succeed during off-peak seasons or when apartments have been on the market for a while. Landlords are more motivated to fill a vacant unit and might be more open to compromise.

4. Know Your Leverage

Identify factors that could strengthen your position. Do you have a stellar credit score? Are you willing to sign a longer lease? Are you willing to pay a larger security deposit? Leverage these factors to your advantage during your negotiations.

5. Be Professional and Courteous

Even if you’re disappointed with the initial rent offer, maintain a professional and courteous demeanor. Landlords are more likely to negotiate with someone who demonstrates respect and understanding.

6. Present Your Case

Once you’ve done your research and are ready to negotiate, clearly state your reasons for wanting a lower rent. Mention the market research you’ve done, any unique benefits you bring as a tenant, or any factors affecting the desirability of the unit.

7. Be Flexible and Open to Compromise

Negotiation is a two-way street. Be prepared to compromise. You might not get the exact rent you want, but you could potentially negotiate a lower monthly rent, a reduced security deposit, or a rent-free month.

8. Get Everything in Writing

Once you’ve reached an agreement, ensure it’s documented in the lease agreement. This protects both you and the landlord and prevents any misunderstandings in the future.

Negotiating rent doesn’t have to be a stressful experience. By following these tips, you can confidently approach the process and potentially save yourself a significant amount of money.

Understanding Monthly Expenses Beyond Rent

When planning your budget, it’s easy to focus solely on rent. However, there are many other recurring expenses that contribute to your overall financial well-being. This article will delve into understanding these monthly expenses beyond rent, helping you gain a comprehensive view of your financial commitments.

Essential Utilities

Essential utilities are fundamental to daily life. These include:

- Electricity: Powers your appliances, lights, and electronics.

- Water: For drinking, bathing, and other household uses.

- Gas: Often used for heating and cooking.

- Internet and Cable: Provides communication and entertainment.

- Trash Removal: Ensures proper waste disposal.

Groceries and Food

Food is a necessity, and grocery expenses can be a significant part of your budget. Consider these factors:

- Dietary Preferences: Eating habits impact grocery costs.

- Meal Planning: Planning meals in advance can help minimize waste and save money.

- Bulk Buying: Buying in bulk can offer cost savings, but ensure you use everything to avoid waste.

Transportation

Getting around adds to your monthly expenses. Consider:

- Car Payment: If you own a car, include your monthly payment.

- Gas: Fuel costs vary depending on driving habits and gas prices.

- Public Transportation: Bus, train, or subway fares are recurring expenses.

- Car Insurance: Essential for legal protection and financial coverage.

- Car Maintenance: Regular car maintenance is crucial for safety and longevity.

Healthcare

Healthcare is an important aspect of overall well-being. Consider:

- Health Insurance: Monthly premiums are a recurring cost.

- Prescription Medications: If you take medications regularly, include this expense.

- Doctor’s Visits: Routine checkups and treatments contribute to healthcare costs.

Personal Care

Personal care products are essential for hygiene and appearance. These can include:

- Toiletries: Shampoo, soap, toothpaste, etc.

- Hair Salon or Barber: Hair cuts and styling.

- Cosmetics: Makeup, skincare products.

Entertainment and Recreation

While not strictly essential, entertainment and recreation expenses contribute to quality of life. Consider:

- Movies or Shows: Streaming services, theater tickets.

- Restaurants: Dining out is a common entertainment expense.

- Hobbies: Activities you enjoy, like sports or art.

Debt Payments

If you have outstanding debt, include monthly payments in your budget. This might include:

- Student Loans: Repaying student loans is a common expense.

- Credit Card Payments: Managing credit card debt is essential.

- Personal Loans: Payments on loans taken for various purposes.

Other Expenses

Beyond the categories above, consider miscellaneous expenses:

- Subscriptions: Monthly subscriptions to services like fitness apps or online platforms.

- Gifts: Expenses for birthdays, holidays, or other special occasions.

- Savings: Setting aside a portion of your income for savings or emergencies.

Understanding your monthly expenses beyond rent provides a comprehensive picture of your financial situation. Tracking these expenses, even seemingly small ones, allows you to make informed financial decisions. By being mindful of your spending habits, you can create a more balanced budget and achieve your financial goals.

Exploring Financial Assistance Programs for Renters

Finding affordable housing can be a challenge, especially in today’s economic climate. Rising rent prices and limited housing options can make it difficult for individuals and families to secure a safe and stable place to live. Fortunately, various financial assistance programs are available to help renters cover their housing costs. This article explores some of these programs and provides guidance on how to access them.

Government-Funded Programs

The federal government offers several programs designed to assist low-income renters. One notable program is the Housing Choice Voucher Program, commonly known as Section 8. This program provides rental subsidies to eligible individuals and families, allowing them to rent in the private market. To qualify for Section 8, applicants must meet specific income and family size requirements. The program is administered locally through public housing agencies.

Another significant government program is the Emergency Rental Assistance Program (ERAP). This program was established in response to the COVID-19 pandemic to help renters who were struggling to pay their rent due to financial hardship. ERAP provides direct financial assistance to landlords on behalf of eligible tenants. Eligibility criteria and program availability vary by state, so it’s essential to check with your local housing authority for details.

State and Local Programs

In addition to federal programs, many states and local governments offer their own rental assistance programs. These programs can vary widely in their eligibility requirements, the amount of assistance provided, and the application process. Some states provide rental subsidies, while others offer emergency rental assistance to prevent evictions. It’s essential to research the programs available in your specific location.

Non-Profit Organizations

Non-profit organizations play a crucial role in providing financial assistance and housing support to renters in need. These organizations often offer a range of services, including rental counseling, eviction prevention, and financial literacy programs. Some non-profits may also have access to emergency funds that can help renters cover their rent or utility bills.

Tips for Finding and Accessing Programs

Finding and accessing financial assistance programs can be challenging, but here are some helpful tips:

- Contact your local housing authority. They can provide information about available programs and help you with the application process.

- Research state and local programs. Check your state and local government websites for information about rental assistance programs.

- Reach out to non-profit organizations. Many non-profits specialize in providing housing assistance to low-income individuals and families.

- Gather necessary documentation. Be prepared to provide proof of income, residency, and other relevant information.

- Be patient and persistent. The application process can take time, so be patient and follow up regularly.

Navigating the complexities of housing affordability can be daunting, but there are resources available to help. By exploring the various financial assistance programs offered at the federal, state, and local levels, as well as through non-profit organizations, renters can find the support they need to secure a safe and stable home.

Tips for Choosing Affordable Apartments

Finding an affordable apartment can be a challenge, especially in competitive rental markets. However, with some research and planning, you can find a comfortable and safe place to live without breaking the bank. Here are some tips to help you choose affordable apartments:

1. Set a Realistic Budget: Before you start your search, determine how much you can afford to spend on rent each month. Consider your income, expenses, and financial goals. It’s essential to allocate a reasonable percentage of your income for housing, typically around 30%.

2. Research Different Neighborhoods: Prices can vary significantly between neighborhoods. Explore areas that might be slightly outside the city center or in less popular areas. You might find more affordable options without sacrificing convenience or quality.

3. Consider Roommates: If you’re comfortable with sharing space, having roommates can significantly reduce your monthly expenses. Look for apartments with multiple bedrooms or find roommates through online platforms or social groups.

4. Explore Online Resources: Websites like Zillow, Apartments.com, and Craigslist offer a wide range of apartments for rent. You can filter your search by price, location, and amenities to find suitable options.

5. Negotiate with Landlords: Don’t hesitate to negotiate with landlords, especially if you’re willing to sign a longer lease or offer a larger security deposit.

6. Look for Incentives: Some landlords offer incentives like free rent for the first month or discounted rent for early signups. Inquire about any available incentives to save money.

7. Consider Utilities: Be aware of whether utilities are included in the rent or if you’ll be responsible for paying them separately. Factor these costs into your overall budget.

8. Check for Hidden Fees: Some apartments have hidden fees, such as pet deposits, application fees, or parking fees. Be sure to inquire about any additional costs before signing a lease.

9. Visit the Apartment in Person: Before making a decision, schedule a visit to the apartment to assess its condition, neighborhood, and amenities. This will help you get a better feel for the property.

10. Read the Lease Agreement Carefully: Before signing a lease, review it carefully to understand your rights and responsibilities. Pay attention to clauses related to rent increases, lease renewals, and termination.

Finding an affordable apartment can be challenging, but by following these tips, you can increase your chances of finding a comfortable and affordable place to call home. Remember to be patient, persistent, and do your research to make the best decision for your budget and lifestyle.

Creating a Financial Plan for Moving Expenses

Moving can be a stressful and expensive endeavor. To ensure a smooth and financially sound transition, it’s crucial to create a comprehensive financial plan. This plan will outline your moving expenses, income sources, and strategies for managing your finances throughout the process.

1. Estimate Your Moving Expenses

Start by meticulously estimating your moving expenses. This includes:

- Transportation Costs: Hiring a moving truck, renting a moving van, or paying for professional movers.

- Packing Supplies: Boxes, tape, bubble wrap, packing peanuts, and other materials.

- Shipping Costs: Shipping fragile or valuable items, and costs for moving belongings across long distances.

- Cleaning Fees: Professional cleaning services for your old or new home.

- Storage Costs: If you need to store belongings temporarily.

- Insurance: Covering potential damage or loss of belongings during the move.

- Utilities: Connecting utilities (electricity, gas, water) at your new home.

- Security Deposit and First Month’s Rent: If you’re renting, these upfront costs are essential.

- Closing Costs: If you’re buying a home, these fees include legal and administrative charges.

- Travel Expenses: Costs for traveling to your new location, including flights, hotels, or gas.

2. Determine Your Income Sources

Next, assess your available income sources to fund your move. This might include:

- Savings: Set aside a dedicated savings account specifically for moving expenses.

- Moving Loans: Explore options for personal or home improvement loans designed for moving costs.

- Selling Belongings: Consider selling unwanted items through online marketplaces or yard sales.

- Moving Assistance: Check if your employer offers relocation benefits or assistance with moving expenses.

3. Create a Budget and Track Your Expenses

Once you’ve estimated your expenses and identified your income sources, create a detailed budget. This will help you allocate your funds efficiently. Keep track of all your moving expenses, and make sure you’re staying within your budget. You can use spreadsheets or budgeting apps to monitor your spending.

4. Seek Out Discounts and Savings

Don’t be afraid to shop around for the best deals. Research different moving companies, compare prices for packing supplies, and look for discounts on transportation and storage. Explore options like online marketplaces for buying used moving supplies.

5. Plan for Unexpected Expenses

It’s always wise to have a contingency fund for unforeseen expenses. Unexpected repairs, delays, or emergencies can arise during a move. Set aside a small buffer in your budget to handle such situations.

6. Consider a Moving Timeline

Establish a realistic timeline for your move. This will help you stay organized and avoid last-minute stress. Break down your tasks into smaller, manageable steps, and set deadlines for each stage.

7. Review and Adjust Your Plan

As you progress through your move, regularly review your financial plan. Adjust your budget and timelines as needed, based on changing circumstances or unexpected expenses. Being flexible will ensure you stay on track.

By carefully planning your finances, you can minimize the stress and financial burden associated with moving. Remember, a well-structured financial plan is your key to a smooth and successful transition to your new home.

Long-Term Savings Strategies for Renters

Saving money can feel like a daunting task, especially when you’re a renter. You might think that since you don’t own a home, you don’t need to worry about things like retirement or a down payment. But that’s not true! There are plenty of long-term savings strategies that renters can use to reach their financial goals.

Start Small, Build Big

The key to saving money is to start small and build a consistent habit. Set aside a small amount of money each month, even if it’s just $50. As your income grows, you can increase your savings contributions.

Automate Your Savings

One of the easiest ways to ensure that you’re saving regularly is to automate your savings. Set up automatic transfers from your checking account to your savings account. This way, you’ll never have to think about it, and the money will be saved before you even have a chance to spend it.

Take Advantage of Employer-Sponsored Savings Plans

If your employer offers a 401(k) or other retirement savings plan, take advantage of it! These plans often come with matching contributions from your employer, which means free money for you.

Consider a Roth IRA

A Roth IRA is a great option for those who are in a lower tax bracket now but expect to be in a higher tax bracket in retirement. With a Roth IRA, you contribute after-tax dollars, and your earnings grow tax-free. You can withdraw your contributions at any time, tax-free and penalty-free.

Set Financial Goals

It’s easier to stay motivated when you have clear financial goals. What are you saving for? A down payment on a house? Retirement? A vacation? Once you know your goal, you can create a plan to reach it.

Track Your Spending

Knowing where your money is going is essential for saving. Track your spending for a few months to see where you can cut back. You might be surprised at how much money you’re spending on things you don’t really need.

Negotiate Your Rent

Your rent is probably your biggest expense. Negotiate with your landlord to see if you can lower your rent. You might be able to get a lower rate if you sign a longer lease or if you’re a good tenant.

Make Smart Money Moves

Renting doesn’t have to mean you can’t save for the future. By making smart money moves, you can build a solid financial foundation that will serve you well for years to come.

Using Financial Tools to Track Rental Expenses

Owning a rental property can be a lucrative investment, but it also requires meticulous financial management. To ensure profitability and avoid financial headaches, it’s crucial to track your rental expenses effectively. Thankfully, numerous financial tools can help you streamline this process and gain a clear picture of your rental income and expenses.

Here are some of the most effective financial tools for tracking rental expenses:

Spreadsheet Software

Spreadsheets like Microsoft Excel or Google Sheets offer a simple and customizable way to track your rental expenses. You can create separate columns for different expense categories like mortgage payments, property taxes, insurance, repairs, and maintenance. You can also use formulas to calculate your net income and track your cash flow.

Accounting Software

For more robust financial management, consider accounting software such as QuickBooks Online or Xero. These platforms offer a comprehensive suite of features including expense tracking, invoicing, bank reconciliation, and reporting. They also allow you to categorize expenses, generate financial statements, and track your rental property’s overall performance.

Budgeting Apps

Many budgeting apps, such as Mint or Personal Capital, can be used to track your rental expenses. These apps connect to your bank accounts and credit cards, automatically categorizing transactions. You can set up custom budgets for each rental property and monitor your spending against those budgets.

Property Management Software

If you manage multiple rental properties, consider property management software like Rent Manager or AppFolio. These platforms offer a centralized platform for managing tenants, collecting rent payments, tracking expenses, and generating reports. They can also automate tasks like sending lease renewal notices and scheduling maintenance requests.

Tips for Effective Expense Tracking

Here are some tips for effective expense tracking:

- Categorize Expenses: Group expenses into relevant categories like utilities, repairs, marketing, and insurance. This will help you analyze your spending patterns and identify areas for potential cost savings.

- Keep Records: Save all receipts and invoices for future reference. This documentation can be invaluable for tax purposes and for resolving any disputes.

- Review Expenses Regularly: Monitor your expenses on a monthly or quarterly basis. This will help you identify any trends and ensure that you’re not overspending in certain areas.

- Use Separate Accounts: Consider setting up separate bank accounts for each rental property. This can help you track income and expenses more effectively and avoid mixing personal finances with your rental business.

By utilizing these financial tools and adopting effective expense tracking practices, you can gain greater control over your rental property’s finances, optimize profitability, and minimize potential financial risks. Choose the tools that best meet your needs and ensure you have a clear picture of your rental expenses to make informed decisions for a successful investment journey.