Deciding between a long-term or short-term apartment rental can be a tough choice. Both options come with their own set of financial benefits, making it difficult to determine which is best for your unique situation. While a short-term rental might seem appealing for its flexibility, a long-term lease often offers significant cost savings in the long run. This article will explore the financial benefits of both options, helping you weigh the pros and cons to make the most financially savvy decision for your next apartment rental.

Comparing Costs of Long-Term and Short-Term Rentals

When looking for a place to live, you have two main options: long-term rentals and short-term rentals. Both have their own advantages and disadvantages, and the best choice for you will depend on your individual circumstances. In this article, we’ll compare the costs of long-term and short-term rentals to help you make an informed decision.

Long-Term Rentals

Long-term rentals typically involve a lease agreement for a period of 6 months to a year or more. These rentals often come with more stability and predictability. You’ll know exactly how much your rent will be each month, and you won’t have to worry about finding a new place to live every few months. However, long-term rentals can sometimes come with higher upfront costs, such as security deposits and first month’s rent.

Short-Term Rentals

Short-term rentals typically last for a period of a few days to a few months. These rentals are often ideal for travelers or those who need temporary housing. They can be more flexible, allowing you to move around easily and try out different locations. However, short-term rentals can be more expensive on a per-night basis than long-term rentals. You may also have to pay extra fees for things like cleaning or parking.

Cost Comparison

Here’s a breakdown of the key cost differences between long-term and short-term rentals:

Long-Term Rentals

- Rent: Generally lower per month than short-term rentals.

- Utilities: Often included in the rent or paid separately at a lower rate.

- Upfront Costs: Higher, including security deposits and first month’s rent.

- Flexibility: Less flexible, as you’re tied to a lease agreement.

Short-Term Rentals

- Rent: Generally higher per night than long-term rentals.

- Utilities: Often included in the price or paid separately at a higher rate.

- Upfront Costs: Lower, as you’re only paying for the period of your stay.

- Flexibility: More flexible, as you’re not tied to a lease agreement.

Choosing the Right Option

The best type of rental for you depends on your individual needs and circumstances. Here are some factors to consider:

- Length of stay: If you’re planning to live somewhere for a year or more, a long-term rental is probably the better option. If you’re only staying for a few months, a short-term rental might be more suitable.

- Budget: Long-term rentals are generally more affordable in the long run, but short-term rentals may be more convenient if you have a limited budget.

- Flexibility: If you need to be able to move around easily, a short-term rental might be a better choice. If you prefer stability, a long-term rental might be more suitable.

By carefully considering these factors, you can choose the type of rental that best fits your needs and budget.

Budgeting for Short-Term Apartment Rentals

Short-term apartment rentals can be a great option for people who are looking for a temporary place to stay. They can be more affordable than hotels, and they offer more space and privacy. However, it’s important to budget carefully for short-term rentals, as they can still be quite expensive. Here are a few tips for budgeting for short-term apartment rentals:

1. Research Your Options

The first step in budgeting for a short-term rental is to research your options. There are many different websites and apps that list short-term rentals, so you can compare prices and find the best deal. Some popular options include Airbnb, VRBO, and HomeAway. You can also search for short-term rentals directly on the websites of apartment complexes and landlords.

2. Consider Your Needs

Once you have a good idea of your options, it’s important to consider your needs. What type of accommodation are you looking for? How many bedrooms and bathrooms do you need? Are you looking for amenities like a pool or a gym? The more specific you can be about your needs, the easier it will be to find a rental that fits your budget.

3. Factor in Additional Costs

When budgeting for a short-term rental, be sure to factor in additional costs, such as cleaning fees, security deposits, and parking fees. Some short-term rentals also have restrictions on the number of guests, so be sure to factor that in as well. In addition, make sure to research whether or not utilities are included in the rental price. If not, you will need to budget for electricity, gas, water, and internet.

4. Set a Realistic Budget

Once you have a good understanding of the costs involved, it’s time to set a realistic budget. Consider your income and expenses and determine how much you can afford to spend on a short-term rental. It’s a good idea to create a budget spreadsheet to track your expenses and make sure you’re staying on track.

5. Negotiate

Don’t be afraid to negotiate with the owner or property manager. You may be able to get a lower price, especially if you’re renting for a longer period. If you’re looking to rent during the off-season, you may also be able to get a better deal.

6. Consider Alternative Options

If you’re having trouble finding a short-term rental that fits your budget, you may want to consider alternative options. You could look into staying with friends or family, or you could try to find a sublet. Subletting is when you rent a room or apartment from someone who is already renting it. Sublets can be a great way to save money, but they can be more difficult to find.

By following these tips, you can budget for a short-term rental and find a great place to stay without breaking the bank.

Financial Pros and Cons of Long-Term Leases

A long-term lease can be a great option for businesses that need to use a property for a long period of time but don’t want to commit to buying it. However, there are also some financial pros and cons to consider before signing a long-term lease.

Pros

One of the biggest pros of a long-term lease is that it can help to lower your monthly expenses. This is because you’re not paying for the full cost of the property upfront. Instead, you’re only paying for the use of the property over a set period of time.

Another pro of a long-term lease is that it can help to improve your cash flow. This is because you’re not tying up a large amount of capital in a property purchase. Instead, you’re using that capital to invest in your business or to cover other expenses.

Finally, a long-term lease can also help to provide you with more flexibility. This is because you’re not tied down to a property for the long term. If your business needs change, you can simply move to a different location or terminate the lease.

Cons

One of the biggest cons of a long-term lease is that it can be expensive in the long run. This is because you’re essentially paying rent for the entire length of the lease. You may end up paying more than if you had purchased the property outright.

Another con of a long-term lease is that it can limit your ability to make improvements to the property. This is because you’re only renting the property, and the landlord may have restrictions on what you can do to it. You may also have to pay for repairs and maintenance, even if the damage was not caused by you.

Finally, a long-term lease can also be a risk. This is because you’re committing to a property for a long period of time, even if your business needs change. If your business fails, you may be stuck with a lease you can’t afford.

There are both financial pros and cons to consider when deciding whether to sign a long-term lease. If you’re considering a long-term lease, be sure to carefully weigh the pros and cons to make sure it’s the right decision for your business.

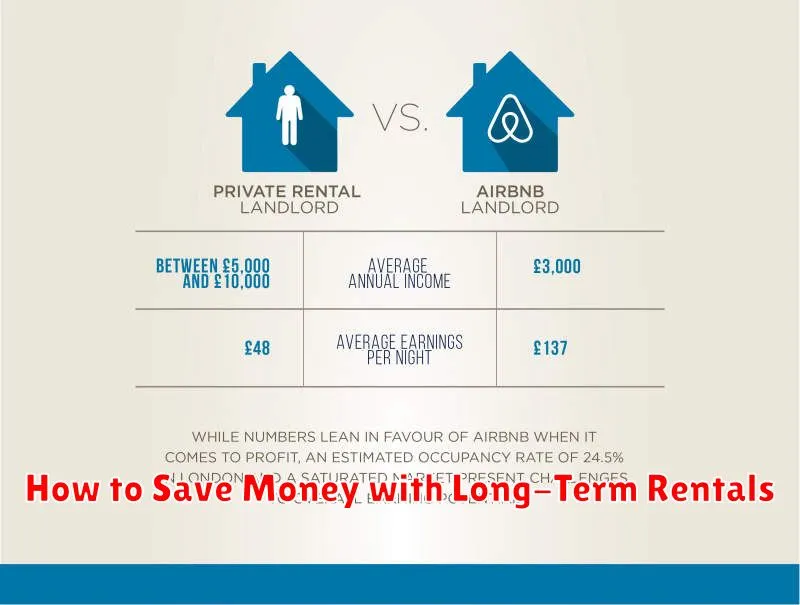

How to Save Money with Long-Term Rentals

Looking for a way to save money on housing? Consider a long-term rental. Long-term rentals can be a great way to save money on housing, especially if you plan on staying in one place for an extended period of time.

Here are a few tips for saving money with a long-term rental:

Negotiate a Lower Rent

One of the best ways to save money on a long-term rental is to negotiate a lower rent. This is especially true if you are willing to sign a longer lease. Many landlords are willing to offer a discount to tenants who are willing to commit to a longer lease term.

Ask About Utilities

Make sure you understand what utilities are included in your rent. Some landlords include all utilities, while others only include some. If you are responsible for paying for utilities, you can save money by shopping around for the best deals.

Look for Discounts

Many landlords offer discounts to tenants who pay their rent on time, or who refer new tenants to them. Ask your landlord about any discounts that may be available to you.

Shop Around

Don’t just settle for the first rental you find. Shop around and compare prices from different landlords. You may be surprised at how much you can save by doing your research.

Consider a Roommate

If you are willing to share a space, you can save money on rent by finding a roommate. This is especially true in expensive cities, where the cost of living is high.

Take Advantage of Amenities

Many long-term rental properties come with amenities such as a gym, pool, or laundry facilities. These amenities can save you money in the long run, so be sure to take advantage of them.

Flexibility vs. Stability in Rental Contracts

When seeking a new place to call home, one of the most crucial decisions you’ll face is choosing between a lease that offers flexibility or stability. Both options come with their own set of advantages and disadvantages, making it essential to carefully consider your individual circumstances and priorities.

A flexible lease, often known as a short-term lease, offers the freedom to move more frequently. Typically lasting for a shorter duration, such as six months or a year, these leases provide greater adaptability to changing life situations, such as job relocations, family growth, or simply the desire for a fresh start.

However, flexibility comes at a cost. Short-term leases often come with higher rental rates, as landlords compensate for the increased risk of vacancy. Additionally, you might face the inconvenience of having to find a new place to live every few months, potentially incurring extra moving expenses.

On the other hand, a stable lease, usually a long-term lease, offers security and predictability. Typically spanning several years, these leases provide a sense of permanence and allow you to budget for your housing expenses with greater certainty.

Stability comes with certain advantages. Long-term leases often come with lower rental rates, as landlords can confidently secure consistent income. Furthermore, you can establish a strong relationship with your landlord and build a sense of community within your building or neighborhood.

However, long-term leases can limit your freedom to move if your circumstances change. If you find yourself needing to relocate sooner than expected, you may face penalties for breaking the lease, potentially jeopardizing your financial security.

Ultimately, the choice between flexibility and stability boils down to your individual needs and preferences. If you value adaptability and are open to the potential risks, a flexible lease might be the better option. If you prioritize stability and long-term planning, a stable lease might provide the peace of mind you seek.

Take your time to assess your options and weigh the pros and cons of each approach before making a decision. Remember to factor in your personal circumstances, financial situation, and overall lifestyle goals to ensure you find a rental agreement that aligns with your needs and aspirations.

Evaluating Your Financial Goals for Rental Length

When it comes to renting a property, one of the most important factors to consider is the length of your lease. Choosing the right lease term can have a significant impact on your finances, so it’s crucial to evaluate your financial goals carefully.

One of the primary financial considerations is the cost of rent. Longer lease terms often come with a discount on monthly rent, which can be a major advantage, especially if you plan on staying in the property for an extended period. However, if you’re unsure about your future plans or anticipate needing to move sooner rather than later, a shorter lease term might be more suitable, even if it means paying a slightly higher monthly rate.

Another important factor to consider is the cost of moving. Moving can be expensive, involving expenses such as hiring movers, packing materials, and potential security deposits. If you choose a shorter lease term, you may have to move more frequently, incurring these expenses more often. However, if you anticipate a possible need to relocate, a shorter lease term could save you money in the long run by avoiding potential penalties for breaking a longer lease.

Furthermore, consider your financial stability and any potential changes in your income or expenses. If you’re facing financial uncertainty or anticipate significant changes in your income or expenses, a shorter lease term might provide you with greater flexibility. It allows you to adjust your living situation as needed without being locked into a long-term commitment.

Ultimately, the best lease length depends on your individual circumstances and financial goals. It’s essential to weigh the pros and cons carefully and choose a term that aligns with your financial objectives and future plans. By carefully evaluating your financial goals and considering the implications of different lease terms, you can make a well-informed decision that best suits your needs and financial situation.

Understanding the Risks of Short-Term Renting

Short-term rentals, like those offered through platforms like Airbnb and Vrbo, have become increasingly popular in recent years. They offer a flexible and often more affordable alternative to traditional hotels, particularly for travelers seeking unique experiences or extended stays. However, it’s crucial to understand the potential risks associated with short-term renting before booking a stay. This article will delve into some of the most significant risks and how to mitigate them.

Safety and Security Concerns

One of the primary concerns with short-term rentals is safety and security. Unlike hotels, where security measures are typically in place, short-term rentals are often located in private homes or apartments, potentially raising safety concerns.

- Unverified Hosts: While platforms like Airbnb conduct background checks, some hosts may not be properly vetted. This could lead to issues with property safety or even personal security.

- Lack of Security Features: Short-term rentals may lack basic security features found in hotels, such as security cameras, keycard access, or on-site security personnel.

- Neighborhood Safety: The location of a short-term rental can significantly impact its safety. Research the neighborhood and ensure it’s safe before booking.

Property Condition and Maintenance

Another concern with short-term rentals is the potential for issues with the property’s condition and maintenance.

- Inaccurate Listings: The photos and descriptions of short-term rentals can sometimes be misleading, leading to disappointment upon arrival. Always review multiple photos and read reviews from previous guests.

- Maintenance Issues: Short-term rentals may not receive the same level of maintenance as hotels, potentially leading to problems with plumbing, appliances, or other facilities.

- Cleanliness: While most hosts strive to maintain clean properties, cleanliness standards can vary widely. Be sure to read reviews regarding cleanliness and consider contacting the host directly to inquire about cleaning protocols.

Booking and Payment Issues

Short-term rentals can also present potential issues with booking and payment.

- Cancellation Policies: Some short-term rental bookings are subject to strict cancellation policies, potentially leading to financial losses if plans change. Carefully review cancellation policies before booking.

- Hidden Fees: Be aware of hidden fees such as cleaning fees, service fees, or taxes that may be added to the base rental price. Ensure you understand all fees before booking.

- Fraudulent Bookings: While platforms strive to prevent fraud, there is always a risk of fraudulent listings or bookings. Be cautious when dealing with unusual requests or deals that seem too good to be true.

Mitigating Risks

While short-term rentals can pose risks, taking preventive measures can help mitigate these concerns.

- Thorough Research: Carefully research potential rental properties, read reviews from previous guests, and consider the host’s profile and feedback.

- Communicate with the Host: Communicate with the host before booking to ask questions about the property, neighborhood safety, and any specific needs or requests.

- Use Trusted Platforms: Book through reputable platforms that provide some level of guest protection and offer dispute resolution mechanisms.

- Consider Insurance: Explore travel insurance options that may cover damages, cancellations, or other unforeseen circumstances related to your short-term rental.

Short-term rentals can offer an exciting and budget-friendly alternative to hotels, but it’s essential to be aware of the potential risks involved. By understanding these risks and taking appropriate precautions, you can enjoy a safe and enjoyable stay while mitigating potential issues.

Negotiating Better Rates for Long-Term Leases

Negotiating a long-term lease can be a daunting task, but it’s essential to secure a rate that’s favorable to your business. With a little preparation and negotiation savvy, you can significantly reduce your costs and ensure a successful long-term partnership with your landlord. Here are some key strategies to help you negotiate better rates for your long-term leases:

Understand the Market

Before entering negotiations, thoroughly research the rental market in your area. Analyze comparable properties and their rental rates. This will give you a solid understanding of the current market value and help you justify your desired rate.

Highlight Your Strengths

Emphasize your company’s financial stability and strong business plan. Demonstrate your commitment to the property and your ability to be a reliable tenant. Highlighting your track record and positive contributions to the community can strengthen your negotiating position.

Negotiate Incentives

Explore potential incentives that can be included in your lease agreement. These could include:

- Rent-free periods

- Tenant improvement allowances

- Options to renew or expand

- Flexible payment terms

Consider Lease Structure

Negotiate a lease structure that works in your favor. Consider a graduated lease with predetermined rent increases over time, which can help you manage your expenses as your business grows. Additionally, explore options for rent abatements or contingency clauses based on specific business milestones.

Get It in Writing

Always ensure that all negotiated terms and agreements are clearly outlined in a written lease. This protects both parties and prevents misunderstandings. Consult with an attorney to review the lease agreement before signing.

Build a Strong Relationship

Cultivating a positive and respectful relationship with your landlord can foster better communication and collaboration. Being a responsible tenant and demonstrating your commitment to the property can lead to more favorable lease terms in the future.

Negotiation Tips

- Be prepared to walk away if the terms are not acceptable.

- Focus on achieving a win-win situation for both parties.

- Be polite and professional throughout the negotiation process.

- Don’t be afraid to ask for what you want.

Negotiating a long-term lease requires careful planning and strategic negotiation. By understanding the market, highlighting your strengths, and exploring incentives, you can secure favorable rates and set the stage for a successful long-term partnership with your landlord. Remember, a well-negotiated lease can significantly impact your business’s bottom line.

Tips for Managing Short-Term Rental Costs

Owning a short-term rental property can be a lucrative investment, but it also comes with its own set of financial challenges. Managing costs effectively is crucial to ensuring profitability. Here are some essential tips to help you keep your short-term rental expenses under control:

1. Budgeting and Forecasting

A solid budget is your foundation. Carefully estimate your expenses, including mortgage payments, utilities, maintenance, cleaning, and marketing. Factor in seasonal variations and unexpected costs. Forecasting helps you anticipate peaks and valleys in demand, allowing for smarter resource allocation.

2. Optimize Cleaning Costs

Cleaning is a significant expense. Consider offering basic cleaning services, encouraging guests to clean up after themselves, or partnering with a reputable cleaning company. Research efficient cleaning products and strategies to reduce waste and time.

3. Smart Property Management

Streamline your management processes. Consider using property management software to automate tasks like booking confirmations, guest communication, and payment processing. This can save you time and reduce administrative costs.

4. Maximize Occupancy

Aim for high occupancy rates to spread your fixed costs over more bookings. Implement effective marketing strategies, optimize your listing descriptions, and leverage online travel agencies (OTAs) to attract guests. Consider offering competitive pricing and discounts during off-season periods.

5. Preventative Maintenance

Regular preventative maintenance is essential for avoiding costly repairs. Schedule regular inspections and address minor issues promptly. This proactive approach can save you significant amounts in the long run.

6. Energy Efficiency

Invest in energy-efficient appliances and fixtures. This can lower your utility bills considerably. Encourage guests to practice energy conservation by providing clear instructions and promoting eco-friendly habits.

7. Insurance Coverage

Adequate insurance is vital to protect your property and your finances. Ensure you have comprehensive coverage for liability, damage, and other potential risks. Consult with an insurance agent to determine the right level of protection for your short-term rental.

8. Financial Discipline

Maintain strict financial discipline. Track your income and expenses meticulously, and regularly review your financial statements to identify areas for improvement. Consider using a dedicated bank account for your short-term rental to separate it from your personal finances.

Planning for Unexpected Expenses in Rentals

As a renter, it’s easy to fall into the trap of thinking you only need to pay your monthly rent and utilities. But life is unpredictable, and unexpected expenses can pop up at any time. From plumbing issues to appliance breakdowns, these unforeseen costs can significantly impact your budget and financial stability.

That’s why it’s crucial to plan for unexpected expenses in rentals. Here are some practical tips to help you stay prepared:

1. Build an Emergency Fund

An emergency fund is your financial safety net. It’s a dedicated savings account that provides a cushion to cover unexpected costs without dipping into your rent money or incurring debt. Aim to save at least three to six months’ worth of living expenses in your emergency fund.

2. Understand Your Lease Agreement

Thoroughly review your lease agreement and understand your responsibilities as a tenant. This includes knowing which repairs are covered by your landlord and which ones you’re responsible for. Be aware of any clauses related to security deposits and potential deductions for damage.

3. Set Up a Separate Account for Rental Expenses

Having a dedicated account for rental expenses can help you keep track of your spending and ensure you have enough funds for potential repairs or replacements. This account can also serve as a buffer for unexpected increases in rent or utilities.

4. Negotiate a Renters Insurance Policy

Renters insurance provides financial protection against losses due to theft, fire, or other unforeseen events. It can also cover liability claims if someone gets injured on your property. While not mandatory, it’s a valuable investment for peace of mind and financial security.

5. Keep Good Records of Your Expenses

Documenting your expenses for rental repairs and maintenance can be helpful if you need to dispute charges or seek reimbursement from your landlord. Maintaining a log of repairs, dates, and costs can help you stay organized and ensure accurate accounting.

6. Communicate Effectively with Your Landlord

Open and clear communication with your landlord is essential. Inform them of any potential issues as soon as possible, and work together to find solutions. Promptly addressing problems can prevent minor issues from escalating into major, costly repairs.

By implementing these strategies, you can proactively plan for unexpected expenses in rentals and minimize the financial burden they can bring. Being prepared and financially responsible can help you maintain a stable and comfortable living environment.