Living in a rental apartment can be an exciting and convenient chapter in your life, but managing your monthly expenses can sometimes feel like a juggling act. Rent, utilities, groceries, and entertainment – the list seems endless! But don’t worry, with a little planning and some smart financial strategies, you can easily stay on top of your finances and enjoy your rental experience to the fullest. This article will provide you with actionable tips for renters to effectively manage their monthly expenses and ensure a financially stress-free living situation. Get ready to learn how to budget, save, and make the most of your hard-earned money while living in your apartment!

Setting Up a Budget for Monthly Rental Expenses

Moving into a new place can be both exciting and overwhelming. One of the biggest hurdles is setting up a budget that works for your monthly rental expenses. This can feel daunting, but with a little planning and organization, you can create a system that allows you to stay on top of your finances and avoid unnecessary stress. This article will walk you through the steps to set up a budget that works for you.

1. Track Your Current Spending

Before you start setting up a budget, it’s crucial to understand your current spending habits. Take some time to track your spending for a month. This can be done manually using a notebook or spreadsheet, or you can use a budgeting app. The goal is to identify where your money is going and see if there are any areas where you can cut back.

2. Identify Your Fixed Expenses

Fixed expenses are costs that remain relatively constant each month, such as rent, utilities, and internet. It’s important to factor these expenses into your budget first, as they are often the most significant.

3. Estimate Your Variable Expenses

Variable expenses are costs that can fluctuate from month to month, such as groceries, transportation, entertainment, and dining out. Estimate how much you typically spend on these categories each month.

4. Set Realistic Goals

Once you have a good understanding of your spending habits, it’s time to set realistic goals. You may want to set goals for reducing your spending in certain categories, saving for a specific purpose, or simply trying to live within your means.

5. Create a Budget

There are various budgeting methods to choose from, so find one that works for you. Some popular options include the 50/30/20 method, the zero-based budgeting method, and the envelope system. These methods provide a framework for allocating your income and tracking your spending.

6. Review and Adjust Your Budget Regularly

Your budget is not set in stone. It’s important to review your budget regularly and make adjustments as needed. Life changes, so your financial needs will also change.

Setting up a budget for your monthly rental expenses can be a valuable tool for financial planning. By following these steps, you can create a system that allows you to control your finances, reach your financial goals, and avoid unnecessary stress. Remember that budgeting takes time and effort, but the benefits are well worth it.

Understanding Utility Costs and How to Save

Utility costs can be a significant part of your monthly expenses, and it’s essential to understand how to manage them effectively. By understanding your utility usage and implementing simple changes, you can significantly reduce your bills and save money. This article will delve into the various aspects of utility costs and provide practical tips on how to save.

Types of Utilities

Utilities typically encompass essential services such as:

- Electricity: Powers your appliances, lighting, and electronic devices.

- Natural Gas: Used for heating, cooking, and sometimes water heating.

- Water: Essential for drinking, sanitation, and household tasks.

- Waste Removal: Includes garbage and recycling collection services.

- Internet and Phone: Communication and online access.

Factors Influencing Utility Costs

Several factors influence your utility costs, including:

- Usage Habits: Your consumption patterns directly impact your bills. Excessive use of appliances, leaving lights on, and running water unnecessarily all contribute to higher costs.

- Home Size and Insulation: Larger homes with poor insulation require more energy to heat and cool, increasing utility expenses.

- Climate: Extreme temperatures necessitate more energy for heating or cooling, affecting your bills.

- Appliance Efficiency: Older, less efficient appliances consume more energy, leading to higher costs. Replacing them with energy-efficient models can save you money in the long run.

- Pricing and Tariffs: Utility providers often have varying pricing structures and tariffs that can influence your bills.

Tips to Save on Utility Costs

Here are some effective ways to reduce your utility costs:

- Reduce Usage: Implement simple habits like turning off lights when leaving a room, unplugging unused electronics, and taking shorter showers. These small changes can significantly impact your consumption.

- Upgrade Appliances: Invest in energy-efficient appliances, such as refrigerators, washing machines, and dishwashers. These appliances can save you money on electricity and water bills.

- Improve Home Insulation: Seal leaks and gaps in your home’s insulation to prevent heat loss in the winter and heat gain in the summer. This can dramatically improve your home’s energy efficiency.

- Use Natural Lighting: Maximize natural light during the day by opening curtains and blinds, reducing the need for artificial lighting.

- Install a Smart Thermostat: A smart thermostat can automatically adjust the temperature based on your schedule, optimizing your heating and cooling usage.

- Consider Solar Energy: Explore the benefits of solar panels. Installing solar panels can significantly reduce your electricity bills and even generate income through selling excess energy back to the grid.

- Shop Around for Providers: Compare rates and plans offered by different utility providers to find the most cost-effective option for your needs.

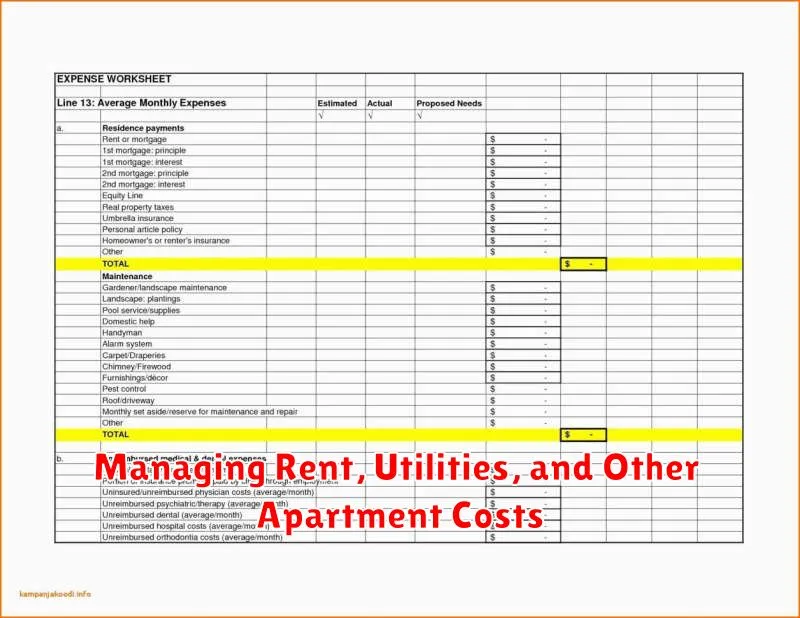

Managing Rent, Utilities, and Other Apartment Costs

Moving into a new apartment can be an exciting time, but it’s important to remember that it also comes with a lot of financial responsibility. One of the biggest financial burdens is managing your rent, utilities, and other apartment costs. This can be a daunting task, especially if you’re new to budgeting or have never lived on your own before.

This article will provide some helpful tips and strategies for effectively managing your apartment costs, making sure you stay on top of your finances while enjoying your new living space.

Creating a Budget

The first step to managing your apartment costs is to create a realistic budget. This means carefully tracking your income and expenses to understand where your money is going.

Start by listing all of your monthly income sources, such as your salary, freelance work, or any other income you receive. Then, list all of your monthly expenses, including:

- Rent

- Utilities (electricity, gas, water, internet, etc.)

- Groceries

- Transportation

- Entertainment

- Debt payments

- Other recurring expenses

Once you have a complete list of your income and expenses, you can calculate your net income (income minus expenses). This will give you a clearer picture of how much money you have left over each month for savings or discretionary spending.

Negotiating Your Rent

Your rent is likely the biggest expense associated with your apartment, so it’s important to find ways to keep it manageable. In some cases, you may be able to negotiate your rent. Here are some tips:

- Ask for a discount: If you’re willing to sign a longer lease or pay your rent upfront, you may be able to negotiate a lower monthly rate.

- Look for specials or promotions: Many landlords offer move-in specials or promotions, such as a free month of rent or a discounted security deposit.

- Consider subletting: If you need to reduce your rent, you can consider subletting a room to another tenant.

Saving on Utilities

Utilities can be a significant expense, but there are several ways to reduce your costs:

- Be energy-efficient: Turn off lights when you leave a room, unplug electronics when not in use, and use energy-saving appliances.

- Negotiate rates: Shop around for different utility providers and compare their rates to find the best deals.

- Conserve water: Take shorter showers, fix leaks, and use water-saving appliances.

Other Apartment Costs

Beyond rent and utilities, there are several other costs associated with living in an apartment:

- Moving costs: This includes the cost of moving trucks, movers, packing materials, and any other expenses related to your move.

- Security deposit: This is a refundable deposit that your landlord holds to cover any potential damage to the apartment.

- Pet fees: If you have pets, you may be required to pay a monthly pet rent or a one-time pet deposit.

- Maintenance and repairs: Your landlord is responsible for major repairs, but you may be responsible for minor maintenance issues.

Budgeting Tips for Apartment Costs

Here are some additional tips for managing your apartment costs effectively:

- Set a budget for each category: This will help you track your spending and avoid overspending in any one area.

- Use a budgeting app: Many budgeting apps are available to help you track your income and expenses and create a budget.

- Automate payments: Set up automatic payments for your rent, utilities, and other recurring expenses to avoid late fees.

- Find roommates: Sharing an apartment with roommates can significantly reduce your overall housing costs.

Managing apartment costs can be challenging, but by following these tips and strategies, you can keep your finances in order and enjoy your new living space without stressing over your budget.

Tips for Reducing Utility Bills in Apartments

Living in an apartment can be convenient, but it often comes with the added expense of utility bills. These bills can add up quickly, especially if you’re not mindful of your energy consumption. However, there are several simple steps you can take to reduce your utility bills and save money without sacrificing comfort.

1. Unplug Electronics

Even when they’re not in use, many electronics continue to draw power, known as “phantom load.” This can be a significant drain on your energy bill. To combat this, make sure to unplug any devices you’re not using, such as phone chargers, laptops, and coffee makers.

2. Adjust Your Thermostat

One of the biggest contributors to high utility bills is heating and cooling. Set your thermostat to a comfortable temperature, but don’t go overboard. For example, you can lower the thermostat by a few degrees when you’re away from home or sleeping. You can also consider using a programmable thermostat to automate these adjustments and save energy automatically.

3. Embrace Natural Light

Maximize the use of natural light by keeping curtains and blinds open during the day. You can also use light-colored walls and furniture to reflect natural light and reduce the need for artificial lighting.

4. Install Low-Flow Showerheads and Faucets

A significant portion of your water bill comes from showers and baths. Installing low-flow showerheads and faucets can reduce water consumption without compromising your comfort. These upgrades are often inexpensive and can make a significant difference over time.

5. Wash Clothes in Cold Water

Most of the energy used to wash clothes goes towards heating the water. Washing your clothes in cold water can significantly reduce your energy consumption. It’s also gentler on your clothes and helps them retain their color longer.

6. Air Dry Your Laundry

Drying your clothes in a dryer is another energy-intensive process. Consider air-drying your laundry whenever possible. This can save you money and reduce your carbon footprint. You can also hang wet clothes on a drying rack or outside on a clothesline, weather permitting.

7. Be Mindful of Your Appliance Use

Use your appliances wisely. Avoid running your dishwasher or washing machine with only a few items inside. Instead, wait until you have a full load. Similarly, use the microwave or oven instead of the stove when possible, as these appliances typically use less energy.

8. Check for Leaks

Water leaks can significantly increase your water bill. Check your faucets, pipes, and appliances for any signs of leaks and have them fixed promptly. Consider using a water meter to monitor your water usage closely.

9. Seal Windows and Doors

Drafty windows and doors can let in cold air during the winter and warm air during the summer. Use weather stripping or caulk to seal any gaps and reduce your heating and cooling costs.

10. Talk to Your Landlord

Some landlords are willing to invest in energy-efficient upgrades for their properties. Discuss your concerns and potential savings with your landlord, and see if you can work together to reduce your utility bills. For example, they might be willing to install energy-efficient lighting, appliances, or insulation.

How to Handle Unexpected Apartment Expenses

Moving into a new apartment can be an exciting experience, but it can also come with unexpected costs. These expenses can range from minor repairs to major appliance breakdowns, and they can quickly derail your budget. To avoid financial stress, it’s important to have a plan in place for handling unexpected apartment expenses.

Create an Emergency Fund: The first step to handling unexpected apartment expenses is to create an emergency fund. This fund should be separate from your regular savings and should be dedicated to covering unforeseen costs. A good rule of thumb is to aim for three to six months’ worth of living expenses in your emergency fund.

Read Your Lease Agreement: Carefully review your lease agreement to understand your responsibilities as a tenant. The lease will specify what you are responsible for maintaining and what your landlord is responsible for. If you are unsure about anything, don’t hesitate to ask your landlord for clarification.

Communicate with Your Landlord: If you have a problem with your apartment, such as a leaky faucet or a broken appliance, contact your landlord immediately. The sooner you report the problem, the sooner it can be fixed. Most landlords are willing to work with tenants to resolve issues quickly and efficiently.

Consider Renter’s Insurance: Renter’s insurance can help protect you from financial losses due to unexpected events such as theft, fire, or water damage. This insurance can cover the cost of repairs or replacement of your belongings, as well as provide liability protection.

Negotiate Payment Plans: If you are unable to cover an unexpected expense all at once, talk to your landlord or contractor about setting up a payment plan. They may be willing to work with you to make payments more manageable.

Stay Organized: Keep track of all your receipts and documentation related to apartment expenses. This information will be helpful if you need to make a claim with your renter’s insurance or if you are disputing a charge with your landlord.

By taking these steps, you can prepare for unexpected apartment expenses and avoid financial stress. Having a plan in place will give you peace of mind and help you enjoy your new apartment without worrying about unexpected costs.

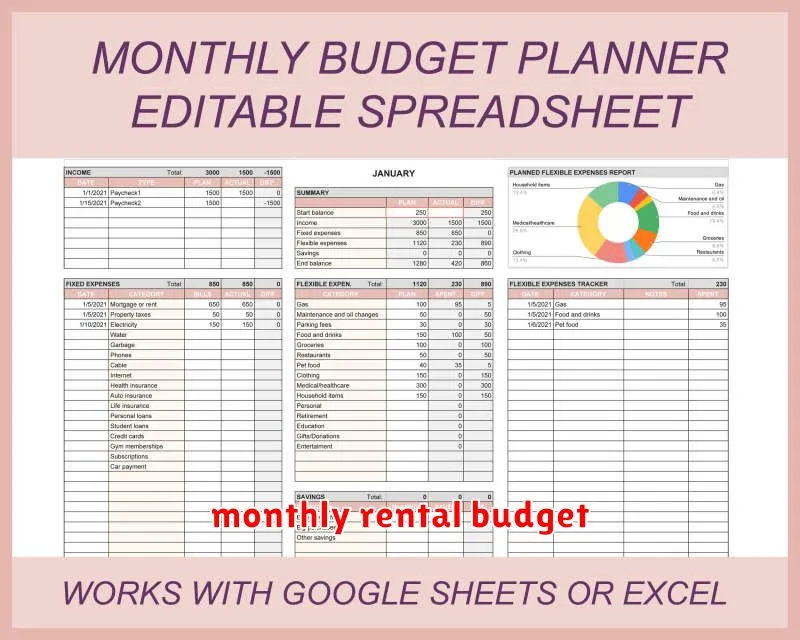

Using Financial Tools to Track Apartment Spending

As a renter, you’re likely aware that rent is often the largest expense in your monthly budget. But what about all the other costs associated with living in an apartment? From utilities to internet service and even toiletries, there are countless expenses that can quickly add up. This is where financial tools can be incredibly helpful. By using these tools, you can effectively track your apartment spending and gain valuable insights into your overall financial health.

One popular method for tracking your spending is using a budgeting app. These apps allow you to categorize your expenses, set budgets, and monitor your progress over time. Many budgeting apps also offer features like automatic expense tracking, which can save you a lot of time and effort. Popular options include Mint, YNAB, and Personal Capital.

Another helpful tool is a spreadsheet. While a spreadsheet may not be as user-friendly as a budgeting app, it provides you with more control and flexibility. You can create custom categories, track specific expenses, and analyze your data in various ways. For example, you could create a separate column for your rent, utilities, groceries, and entertainment spending. Then, you can easily calculate the total amount spent in each category over a specific period.

Beyond tracking your spending, you can also use financial tools to plan for future expenses. For instance, if you know your rent is going up next year, you can use a budgeting app or spreadsheet to adjust your budget accordingly. This will help you avoid any financial surprises and ensure you have enough money set aside for your rent increase.

In addition to budgeting apps and spreadsheets, there are other financial tools that can be helpful for tracking your apartment spending. For example, you can use a credit card rewards program to earn points or cash back on your apartment expenses. These rewards can be redeemed for travel, merchandise, or even statement credits, helping you save money in the long run.

Ultimately, the best financial tool for tracking your apartment spending depends on your individual needs and preferences. Whether you choose a budgeting app, spreadsheet, or other tool, the key is to find a system that works for you and that you’re comfortable using. By tracking your apartment spending, you can gain valuable insights into your financial habits, make informed decisions about your finances, and ultimately save money.

Setting Financial Goals for Monthly Savings

Saving money is an essential part of achieving financial security and peace of mind. By setting clear financial goals, you can motivate yourself to save consistently and reach your desired financial outcomes. Whether you’re aiming for a down payment on a house, a dream vacation, or simply building an emergency fund, having a plan in place is crucial. Here’s a step-by-step guide to setting effective financial goals for monthly savings.

1. Define Your Financial Goals

Start by clearly defining what you want to achieve with your savings. What are your financial aspirations? Are you saving for a specific purchase, like a car or a home? Do you want to invest in your education or retirement?

2. Set Specific, Measurable, Achievable, Relevant, and Time-Bound (SMART) Goals

SMART goals are essential for setting yourself up for success. Make sure your goals are:

- Specific: Clearly define what you’re saving for.

- Measurable: Set a specific amount of money you want to save.

- Achievable: Make sure your goal is realistic and attainable within your budget.

- Relevant: Ensure your goal aligns with your overall financial objectives.

- Time-Bound: Set a deadline for reaching your goal. This will provide a sense of urgency and accountability.

3. Determine Your Monthly Savings Amount

Once you know your goals, calculate how much you need to save each month to reach them within your desired timeframe. Use online savings calculators or create a simple budget spreadsheet to track your progress.

4. Create a Budget

A budget is essential for managing your finances effectively. Track your income and expenses to understand where your money is going. Identify areas where you can cut back and allocate those savings towards your financial goals.

5. Automate Your Savings

To make saving easier, automate your savings by setting up recurring transfers from your checking account to your savings account. This ensures that you save consistently without having to manually transfer funds every month.

6. Monitor Your Progress and Adjust as Needed

Regularly review your progress towards your goals. If you’re not on track, consider adjusting your budget or increasing your savings contributions. Flexibility is key to achieving your financial objectives.

Setting financial goals and saving monthly is a crucial step towards achieving your financial aspirations. By following these steps, you can create a structured savings plan that helps you reach your goals and build a secure financial future.

Tips for Lowering Grocery Costs While Renting

Grocery costs can be a significant portion of your budget, especially if you’re renting. Renting often comes with limitations on storage space and cooking facilities, which can make it challenging to prepare meals at home. However, there are several strategies you can implement to lower your grocery costs while renting.

1. Plan Your Meals and Make a List

Before you head to the grocery store, take some time to plan your meals for the week. This will help you avoid impulse purchases and ensure you have all the ingredients you need. Create a detailed grocery list based on your meal plan. Stick to the list and resist buying items that aren’t on it.

2. Shop Around for Deals

Don’t settle for the first grocery store you come across. Compare prices at different stores in your area, including discount supermarkets, warehouse clubs, and online retailers. Look for weekly specials and coupons, and take advantage of loyalty programs.

3. Consider a Subscription Box

Subscription boxes can be a convenient and cost-effective way to get groceries delivered to your door. Many services offer curated boxes tailored to your dietary needs and preferences. Research different subscription boxes and choose one that fits your budget and lifestyle.

4. Utilize Your Freezer

If you have limited refrigerator space, a freezer can be a lifesaver for stretching your grocery budget. Freeze fruits, vegetables, and leftovers to extend their shelf life and reduce food waste. You can also purchase frozen foods, which are often cheaper than fresh options.

5. Cook in Bulk

Cooking in bulk can save you time and money. Prepare large batches of meals and portion them out for easy lunches and dinners throughout the week. Consider making a big pot of soup, chili, or lasagna to freeze and enjoy later.

6. Embrace the “Use-It-Up” Principle

Instead of throwing away leftovers or ingredients about to expire, get creative with your cooking. Use up leftover vegetables in stir-fries, soups, or stews. Try repurposing stale bread into breadcrumbs or croutons. Remember to keep an eye on expiration dates and prioritize using older ingredients first.

7. Grow Your Own Produce

Even if you have limited outdoor space, you can still grow herbs, vegetables, and fruits in containers or window boxes. This can be a great way to save money and add fresh produce to your meals.

Lowering your grocery costs while renting can be a challenge, but it’s achievable with a little planning and creativity. By implementing these tips, you can save money and enjoy delicious and nutritious meals without breaking the bank.

How to Avoid Common Money Traps in Rentals

Renting can be a great way to live, but it’s also important to be aware of the potential money traps that can come along with it. By understanding these common pitfalls, you can avoid them and save yourself a lot of money in the long run. Here are a few tips to help you avoid common money traps in rentals:

Read the Lease Carefully

The lease is a legally binding document that outlines the terms of your agreement with the landlord. It’s important to read it carefully and understand everything it says. Pay particular attention to clauses related to:

- Rent increases: What are the terms of rent increases? When can the landlord increase your rent?

- Late fees: How much are late fees? What are the grace periods?

- Security deposits: How much is the security deposit? What can it be used for?

- Pet policies: Are pets allowed? What are the restrictions?

- Maintenance: Who is responsible for repairs? How are repairs handled?

If you have any questions about the lease, don’t hesitate to ask your landlord or a legal professional.

Understand Your Responsibilities

As a renter, you are responsible for maintaining the property in a reasonable condition. This includes things like keeping the unit clean, repairing minor damage, and reporting any major problems to your landlord. If you fail to fulfill your responsibilities, you could be liable for damages or even eviction.

Be Aware of Hidden Fees

Landlords can sometimes charge fees that aren’t explicitly mentioned in the lease. These fees can include things like:

- Application fees

- Credit check fees

- Move-in fees

- Pet fees

- Late fees

Before you sign a lease, make sure you understand all the fees that you will be responsible for. You may also want to ask for an itemized list of fees in writing.

Keep Good Records

It’s important to keep good records of your rental payments, maintenance requests, and any other communication with your landlord. This will help you protect yourself in case of any disputes. You can keep these records in a file or use a digital system like a spreadsheet or a cloud-based document storage service.

Communicate with Your Landlord

Good communication is key to a successful landlord-tenant relationship. If you have any questions or concerns, don’t hesitate to contact your landlord. It’s also a good idea to keep your landlord informed of any changes to your living situation, such as adding a pet or having guests stay for an extended period.

Don’t Be Afraid to Ask for Help

If you are having trouble with your landlord or you are unsure about your rights, there are several resources available to help you. You can contact your local housing authority, a legal aid society, or a tenant advocacy group. These organizations can provide you with information, guidance, and support.

Financial Benefits of Paying Rent on Time

Paying rent on time can have a significant impact on your financial well-being, both in the short and long term. Here are some of the key benefits:

Avoid Late Fees

The most immediate benefit of paying rent on time is avoiding late fees. Landlords typically charge late fees, which can range from a small percentage of the rent to a hefty sum. By paying on time, you can save yourself this unnecessary expense.

Maintain a Positive Relationship with Your Landlord

Paying rent on time demonstrates your responsibility and respect for the lease agreement. This can help build a positive relationship with your landlord, making it easier to address any issues that may arise during your tenancy.

Build Credit History

Some landlords report rent payments to credit bureaus, which can help you build a positive credit history. A good credit score can benefit you in the long run, as it can lead to lower interest rates on loans, credit cards, and other financial products.

Increase Your Chances of Approval for Future Housing

Landlords often check potential tenants’ rental history to assess their reliability. A record of on-time payments can increase your chances of being approved for future housing, even if you have a limited credit history.

Peace of Mind

Knowing that your rent is paid on time can provide you with peace of mind and reduce financial stress. It allows you to budget effectively and allocate your finances to other priorities.

Paying rent on time is essential for maintaining a stable financial situation. It can save you money on late fees, improve your credit score, and make it easier to secure future housing. By prioritizing timely rent payments, you can set yourself up for a brighter financial future.