Finding a great apartment in a prime location doesn’t have to break the bank. With a little planning and strategic thinking, you can maximize your budget and secure your dream apartment in a desirable neighborhood. This article will explore some key strategies for apartment hunting in prime locations, including negotiating rental rates, exploring different housing options, and leveraging your financial resources. From understanding market trends to utilizing effective search techniques, we’ll guide you through the process of finding the perfect apartment without exceeding your budget. Let’s dive into the world of smart apartment hunting and unlock the potential to live in your ideal neighborhood.

Creating a Budget for High-Cost Areas

Living in a high-cost area can be challenging, but it doesn’t have to be impossible. With a well-crafted budget, you can navigate the higher expenses and still achieve your financial goals. Here’s a guide to creating a budget for high-cost areas:

1. Track Your Spending

The first step is to understand where your money is going. For at least a month, track all your expenses, both big and small, using a budgeting app, spreadsheet, or notebook. This will give you a clear picture of your current spending habits.

2. Identify Areas for Improvement

Once you have a complete picture of your spending, it’s time to identify areas where you can cut back. This could include reducing your dining out expenses, finding cheaper alternatives for groceries, or negotiating lower rates for your utilities.

3. Prioritize Your Needs

In high-cost areas, it’s important to prioritize your needs over wants. This means focusing on essential expenses like housing, transportation, food, and healthcare. You may need to be creative in finding affordable alternatives for non-essential items.

4. Explore Cost-Saving Strategies

There are many ways to save money in a high-cost area. Consider options like:

- Finding a roommate or sharing housing

- Exploring public transportation or carpooling

- Seeking discounts and promotions

- Negotiating lower rates with service providers

5. Set Realistic Goals

Don’t set unrealistic goals for your budget. Start with small, achievable changes and gradually increase your savings as you get more comfortable. It’s better to make gradual progress than to be overwhelmed by a drastic budget overhaul.

6. Regularly Review and Adjust

Your budget shouldn’t be static. Regularly review your spending and make adjustments as needed. You may find that your priorities change over time, or you discover new ways to save money. Be flexible and adapt your budget to your evolving circumstances.

Creating a budget for a high-cost area requires careful planning and discipline. By following these tips, you can gain control of your finances and live comfortably, even in a challenging environment.

Finding Affordable Apartments in Prime Locations

Finding a place to live can be a challenging task, especially if you’re on a budget and looking for an apartment in a prime location. Prime locations often come with higher rent prices, making it difficult to find something that fits both your needs and your wallet. However, it’s not impossible to find affordable apartments in desirable areas. With some planning and research, you can find the perfect home without breaking the bank.

Here are some tips for finding affordable apartments in prime locations:

1. Be Flexible with Your Search Criteria

Being flexible with your search criteria can significantly increase your chances of finding an affordable apartment. Consider these factors:

- Size: Downsizing to a smaller apartment can save you a substantial amount on rent. A studio or one-bedroom apartment might be all you need, especially if you prioritize location over space.

- Location: Consider slightly less popular areas within the desired neighborhood. You might find that a street just a block or two away from the main thoroughfare offers more affordable options.

- Amenities: Don’t feel pressured to choose an apartment with all the bells and whistles. Prioritize the essentials and consider if you truly need extras like a fitness center or a swimming pool.

2. Consider Alternative Housing Options

Expanding your search beyond traditional apartments can open up possibilities. Consider these alternatives:

- Roommates: Sharing an apartment with roommates can drastically reduce your rent. Look for roommate ads online or through local community groups.

- Shared Housing: This option involves renting a room in a house or apartment, often with shared common spaces. It’s a popular choice for budget-conscious individuals.

- Condo or Townhome: While you might have to pay an HOA fee, owning a condo or townhome can sometimes be more affordable than renting in a prime location.

3. Negotiate with Landlords

Don’t be afraid to negotiate with landlords, especially if you’re a strong candidate with good credit and a steady income. You might be able to secure a lower rent or ask for concessions, such as a one-month rent-free period.

4. Utilize Online Resources

Numerous online platforms specialize in helping people find apartments. These websites allow you to filter your search by price, location, and other criteria, making it easier to find affordable options. Consider using websites like:

- Apartments.com

- Zillow

- Craigslist

- Trulia

5. Network and Ask for Recommendations

Don’t underestimate the power of word-of-mouth. Reach out to your friends, family, and colleagues who live in the area. They might know of hidden gems or upcoming vacancies in buildings they’re familiar with.

Finding an affordable apartment in a prime location requires effort, but it’s possible. By staying organized, being flexible, and utilizing the resources available, you can find the perfect home without breaking the bank.

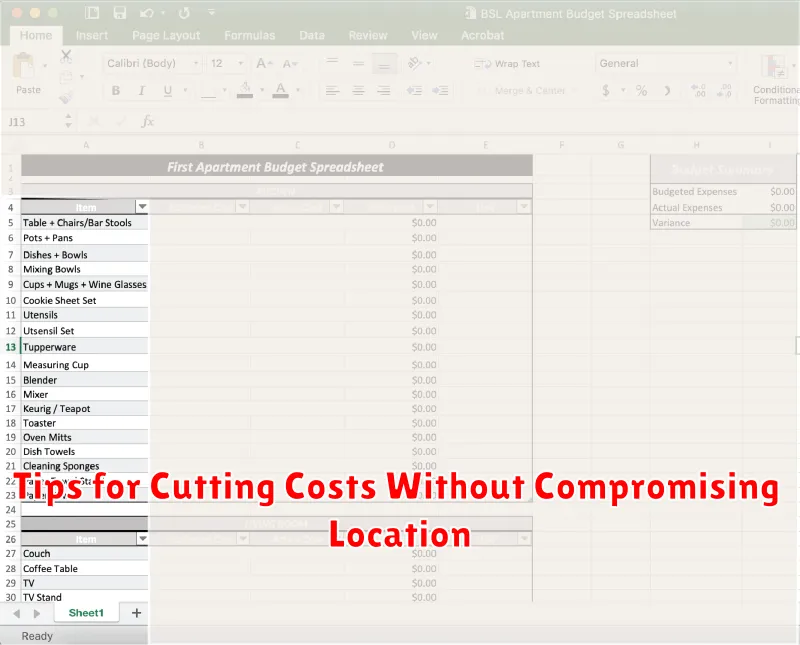

Tips for Cutting Costs Without Compromising Location

Finding the perfect place to live can be a challenge, especially when you’re on a budget. You might be willing to compromise on certain features, but the location is non-negotiable. Luckily, there are some clever strategies you can employ to cut costs without sacrificing your dream neighborhood. Here are some tips to help you achieve your housing goals.

Look Beyond the “Traditional” Housing Options

Don’t limit yourself to the usual suspects: houses and apartments. Consider options like:

- Condos: Often more affordable than single-family homes, but with amenities like gyms and pools.

- Townhouses: Offer a blend of privacy and community living at a lower price point.

- Duplexes: Share a building with another family, saving on costs like utilities and maintenance.

- Live-in arrangements: Find a roommate or housemate to split costs, or become a live-in caretaker for someone in need.

Seek Out Affordable Neighborhoods Within Your Target Area

Not all areas within your chosen city are created equal. Do your research and explore:

- Slightly further-out neighborhoods: They often offer similar amenities at a lower price.

- Up-and-coming neighborhoods: They’re usually more affordable before experiencing rapid gentrification.

- Neighborhoods with diverse housing options: You might find hidden gems like affordable townhomes or converted buildings.

Be Flexible with Your Housing Needs

Adjust your expectations to stretch your budget further:

- Consider a smaller space: A cozy studio or one-bedroom can be more affordable than a larger apartment.

- Opt for a lower-floor unit: Avoid paying a premium for top-floor apartments with great views.

- Embrace “fixer-uppers”: While they require work, you can save significantly by buying a property that needs some TLC.

Negotiate and Research Financial Assistance Programs

Don’t be afraid to haggle for a better price or seek out resources that can help you:

- Negotiate with landlords or sellers: Offer cash, a longer lease term, or a shorter closing timeframe to get a better deal.

- Explore government programs: Look for first-time homebuyer grants or rental assistance programs.

- Check with local non-profits: They might offer financial assistance or down payment assistance programs.

Finding affordable housing in a desirable location is possible, but it requires patience, research, and a willingness to be flexible. By following these tips, you can stretch your budget and achieve your housing goals without sacrificing your dream neighborhood.

How to Negotiate Lower Rent in Desirable Areas

Finding a great place to live in a desirable area can be tough, especially when it comes to rent. But don’t despair! There are some effective negotiation tactics you can use to potentially land a lower rent price. Here’s how to approach the process:

1. Research the Market

Before you even step foot in a potential rental, it’s crucial to research the current market conditions in the area. Check out online resources like Zillow, Apartments.com, and Trulia to get an idea of average rent prices for similar properties. This knowledge will give you leverage when negotiating.

2. Highlight Your Strengths

Landlords are looking for reliable tenants. Showcase your strengths as a renter. This could include a steady job, a strong credit score, and a good rental history. If you have a history of paying rent on time and taking care of properties, be sure to mention it. Landlords may be willing to compromise if they feel confident about your reliability.

3. Be Prepared to Compromise

While you might not get the exact rent you’re hoping for, be prepared to make some concessions. You could consider signing a longer lease, agreeing to pay a slightly higher security deposit, or offering to pay the first month’s rent upfront. Think of these as bargaining chips to reach a mutually beneficial agreement.

4. Be Polite and Professional

Maintain a professional demeanor throughout the entire negotiation process. A friendly, respectful approach can go a long way in building rapport with the landlord. Avoid aggressive tactics, as these can backfire and damage your chances of securing the property.

5. Timing is Key

The time of year can significantly impact your ability to negotiate. During the off-season (typically winter months), landlords may be more flexible due to lower demand for rentals. Take advantage of these periods to potentially score a better deal.

6. Don’t Be Afraid to Walk Away

If a landlord is unwilling to budge on the rent, don’t be afraid to walk away. There are other potential rental properties out there, and it’s not worth settling for an unfavorable deal. Be confident in your value as a tenant and don’t hesitate to explore other options if necessary.

7. Consider a Lease Break Clause

If you’re concerned about the possibility of needing to move sooner than anticipated, try negotiating a lease break clause. This allows you to break the lease early under certain conditions, for a fee. It gives you more flexibility, which may make the landlord more willing to negotiate on rent.

Negotiating rent in a desirable area can take some effort, but it’s definitely possible. By following these tips, you’ll increase your chances of finding a great place to live at a price that fits your budget.

Understanding Location-Based Rent Fluctuations

In the dynamic realm of real estate, rent prices are constantly in flux, influenced by a myriad of factors. Among these, location plays a pivotal role, shaping the cost of renting a property. Understanding the factors that drive location-based rent fluctuations is crucial for both tenants and landlords alike.

Demand and Supply: The fundamental principle of supply and demand applies strongly to rent prices. In areas with high demand and limited housing supply, rents tend to be higher. Conversely, in areas with abundant housing options and lower demand, rents are often more affordable. This dynamic can be observed in bustling urban centers where limited space and high population density drive up rental costs, while suburban or rural areas may offer more affordable options.

Amenities and Infrastructure: The presence of desirable amenities and robust infrastructure directly influences rental rates. Areas with excellent schools, parks, public transportation, and shopping centers tend to command higher rents. Conversely, locations lacking these amenities may experience lower rental prices. This reflects the perceived value and convenience that these factors bring to residents.

Economic Activity: The economic health of a neighborhood or region significantly impacts rental costs. Areas with thriving industries, robust job markets, and high levels of economic activity typically attract a larger pool of renters, driving up demand and, consequently, rental prices. Conversely, areas experiencing economic downturn may see a decrease in rental demand, leading to lower prices.

Neighborhood Safety and Quality of Life: Residents prioritize safety and quality of life when choosing a place to live. Neighborhoods with low crime rates, well-maintained public spaces, and a strong sense of community generally attract higher rental prices. Conversely, areas with higher crime rates or perceived safety concerns may experience lower rental rates.

Property Features: The specific characteristics of a property, such as size, age, condition, and amenities, also contribute to rent fluctuations. Newer, larger, and well-maintained properties with desirable features like in-unit laundry or outdoor space often command higher rents than older, smaller, or less updated properties. Additionally, the availability of parking, storage, and other amenities can influence rental prices.

Market Trends: Rental markets are subject to broader market trends that can influence location-based fluctuations. These trends can include economic growth, interest rates, and changes in housing policies. For example, rising interest rates may make homeownership less accessible, leading to an increase in rental demand and higher prices.

By understanding the factors that drive location-based rent fluctuations, both tenants and landlords can make informed decisions. Tenants can leverage this knowledge to identify neighborhoods that offer the best value for their needs, while landlords can strategically adjust their rental rates to reflect the market dynamics of their properties’ locations.

Balancing Rent Costs with Lifestyle Expenses

Moving to a new city or even just finding a new place in your current one can be an exciting experience. But it can also be overwhelming, especially when you’re trying to figure out how to balance rent costs with your lifestyle expenses.

You want to live in a place that’s comfortable and convenient, but you also want to be able to afford to enjoy your life outside of your apartment. There’s no magic formula, but here are a few tips to help you strike a balance:

1. Determine Your Budget

Before you start looking at apartments, it’s important to know how much you can afford to spend on rent. A good rule of thumb is to spend no more than 30% of your gross income on rent. This will leave you with enough money to cover other essential expenses like food, transportation, and utilities, as well as some discretionary spending.

There are also many online budgeting tools and calculators available that can help you create a personalized budget. These tools can be incredibly helpful in determining how much you can afford to spend on your apartment.

2. Consider the Location

The location of your apartment can have a big impact on your overall expenses. Apartments in more desirable areas are likely to be more expensive, but they may also offer more amenities and conveniences. If you’re looking to save money on rent, consider living in a less popular neighborhood or in a more affordable area outside of the city center.

Think about what’s important to you. Do you need to live close to work or public transportation? Are you willing to compromise on amenities in order to save money on rent? There are always tradeoffs to consider, and it’s important to weigh your priorities carefully when choosing an apartment.

3. Evaluate Your Lifestyle

Your lifestyle will also play a role in how much you spend on rent. If you’re a social butterfly who loves to go out to eat and attend events, you’ll need more money for discretionary spending. If you’re a homebody who enjoys staying in and cooking, you’ll have more money available for rent.

Be realistic about your spending habits and make sure your budget reflects your actual lifestyle.

4. Negotiate with Your Landlord

Don’t be afraid to negotiate with your landlord, especially if you’re looking to rent a place for a longer term. It’s common to negotiate a lower rent, or to ask for concessions like free parking or a month of free rent.

Even if you’re not able to negotiate a lower rent, you may be able to negotiate a more favorable lease term. This can be helpful if you’re planning to move in the near future, as it will give you more flexibility if your plans change.

5. Don’t Forget the Extras

Don’t forget to factor in the cost of utilities when calculating your overall rent expenses. Many apartments charge separate fees for water, gas, electric, and trash.

You may also have to pay for parking, pet fees, and other amenities. Be sure to ask your landlord about all the additional fees that may be associated with the apartment before you sign a lease.

6. Seek Out Deals and Discounts

There are many ways to save money on rent, even if you’ve already signed a lease. Look for deals and discounts on things like insurance, utilities, and internet.

You can also find ways to reduce your overall living expenses by cutting back on unnecessary spending, like dining out or buying expensive coffee. Every little bit helps!

7. Be Realistic About Your Expectations

It’s important to be realistic about your expectations when balancing rent costs with lifestyle expenses. You may not be able to afford to live in your dream apartment and still have money left over for everything else.

If you’re on a tight budget, you may have to make some sacrifices. You may need to live in a smaller apartment, share a place with roommates, or live in a less desirable neighborhood. But don’t be discouraged! There are always ways to make the most of your budget and still enjoy your life.

By following these tips, you can strike a balance between your rent costs and your lifestyle expenses. Remember, it’s all about making smart choices and finding a solution that works for you.

Evaluating Short-Term Rentals in Prime Areas

Short-term rentals have exploded in popularity in recent years, particularly in prime areas with high tourism demand. This trend presents both opportunities and challenges for property owners, investors, and local communities. Before diving into the world of short-term rentals, it’s crucial to conduct a thorough evaluation to understand the potential benefits and drawbacks.

Potential Benefits:

- Higher Revenue Potential: Short-term rentals can generate significantly higher income than traditional long-term leases, especially in popular tourist destinations.

- Flexibility and Control: Owners have greater control over their property and can adjust rental rates based on seasonality and market demand.

- Increased Property Value: Short-term rentals can enhance a property’s value by attracting a broader range of potential buyers.

Potential Challenges:

- Operational Complexity: Managing short-term rentals requires significant time and effort, including marketing, booking, cleaning, and guest communication.

- Regulatory Restrictions: Many cities and neighborhoods have implemented strict regulations on short-term rentals, including licensing requirements, occupancy limits, and noise ordinances.

- Neighbor Concerns: Short-term rentals can sometimes lead to noise complaints, parking issues, and other disruptions for neighboring residents.

- Wear and Tear: High turnover rates can accelerate property wear and tear, requiring more frequent repairs and maintenance.

Key Factors to Consider:

- Local Regulations: Research and understand all applicable local regulations regarding short-term rentals.

- Market Demand: Analyze the demand for short-term rentals in the area and potential competition.

- Property Suitability: Assess the property’s suitability for short-term rentals, including its location, size, amenities, and parking.

- Financial Viability: Develop a detailed financial plan to estimate potential revenue, expenses, and profitability.

- Management Approach: Determine whether to manage the property yourself or hire a professional management company.

Evaluating short-term rentals in prime areas is a complex decision requiring careful consideration of both the potential benefits and challenges. By conducting thorough research, understanding local regulations, and assessing property suitability, owners and investors can make informed decisions and maximize their investment potential.

What to Look for in Affordable Luxury Rentals

Looking for a luxury rental without breaking the bank can feel like a daunting task. You want the high-end amenities and finishes that come with luxury living, but you also don’t want to sacrifice your financial stability. The good news is that affordable luxury rentals are out there, and with a little research, you can find one that perfectly fits your needs and budget.

Here are some key things to look for when searching for affordable luxury rentals:

Location, Location, Location

While prime locations in the heart of the city often come with hefty price tags, you can find luxurious rentals in slightly less central neighborhoods that offer comparable amenities and a quieter lifestyle. Consider exploring areas just outside the city center or in up-and-coming districts that offer a blend of affordability and charm.

Amenities and Features

Luxury rentals often boast a wide range of amenities and features that elevate the living experience. While some of these extras might be negotiable, others are essential for creating a comfortable and enjoyable home. Consider factors like:

- In-unit laundry: Saves time and money on laundry services.

- Balcony or patio: Offers outdoor space for relaxation and entertaining.

- Modern appliances: Elevates the kitchen and overall living experience.

- High-speed internet: Essential for work, entertainment, and staying connected.

While these amenities can be valuable, remember to prioritize based on your individual needs and budget.

Building Amenities

Beyond in-unit features, building amenities can significantly impact the quality of life. Look for buildings that offer:

- Fitness center: Promotes a healthy lifestyle and convenience.

- Swimming pool: Provides a refreshing escape and social opportunity.

- Concierge service: Offers assistance with various tasks and services.

- Rooftop deck or lounge: Offers breathtaking views and a unique social space.

These amenities add value to your living experience and can be a great way to meet your neighbors and build a sense of community.

Maintenance and Support

When renting a luxury apartment, it’s crucial to ensure the property is well-maintained and supported by a responsive management team. Look for landlords or property management companies known for their professionalism and promptness in addressing any maintenance issues.

Lease Terms and Flexibility

Before signing a lease, carefully review the terms and conditions, including the lease duration and any renewal options. Consider the flexibility of the lease and whether it aligns with your current and future plans.

Finding affordable luxury rentals requires careful research and consideration. By focusing on key factors like location, amenities, building features, maintenance, and lease terms, you can find a luxurious living space that fits your budget and enhances your lifestyle.

Setting Financial Boundaries for City Living

City life can be exhilarating, but it also comes with a unique set of financial challenges. From sky-high rent and transportation costs to the allure of endless entertainment options, it’s easy to overspend and find yourself in a precarious financial situation. Setting clear financial boundaries is crucial to thriving in the urban jungle.

Here are some essential steps to take:

1. Track Your Expenses

The first step to managing your money is to understand where it’s going. Use a budgeting app, spreadsheet, or even a simple notebook to track your spending for a month. This will provide valuable insights into your spending habits and help you identify areas where you can cut back.

2. Create a Budget

Once you have a clear picture of your expenses, it’s time to create a budget. This involves allocating your income to different categories such as housing, food, transportation, entertainment, and savings. The 50/30/20 rule is a good starting point: 50% of your income goes towards necessities, 30% towards wants, and 20% towards savings and debt repayment.

3. Negotiate Rent and Bills

Don’t be afraid to negotiate! Contact your landlord to discuss a possible rent reduction or consider sharing an apartment to reduce costs. Shop around for better deals on utilities and internet plans. Every dollar you save can make a difference.

4. Find Affordable Entertainment

City life is full of exciting events, but they can also be expensive. Explore free or low-cost activities such as attending free museum days, exploring parks, and attending community events. You’ll be surprised at how much fun you can have without breaking the bank.

5. Be Mindful of Impulse Purchases

The allure of trendy shops and restaurants can be overwhelming. Before making a purchase, ask yourself: “Do I really need this?” If the answer is “no,” leave it behind. Resist the urge to keep up with the Joneses and focus on building your own financial security.

6. Automate Your Savings

Set up automatic transfers to your savings account on a regular basis. This way, you’ll be saving money consistently without even thinking about it. Even a small amount saved regularly can add up over time.

Establishing financial boundaries in city living is not about deprivation; it’s about making conscious choices that align with your financial goals. By prioritizing your needs, tracking your spending, and embracing a mindful approach to money, you can navigate the financial landscape of city life with confidence and achieve your financial aspirations.

The Importance of Comparing Neighborhood Costs

When you’re looking to buy a home, it’s easy to get caught up in the excitement of finding the perfect property. But it’s important to take a step back and consider the bigger picture: the neighborhood you’re buying into. Neighborhoods can vary drastically in terms of cost of living, and understanding these differences can be crucial to making a smart financial decision.

Why Compare Neighborhood Costs?

Comparing neighborhood costs can help you:

- Avoid sticker shock: You might find a beautiful home in a neighborhood you love, but the overall cost of living could be much higher than you anticipated. This could lead to financial stress down the line.

- Find hidden gems: Sometimes, less expensive neighborhoods offer a surprising amount of value and amenities. You might discover a neighborhood with excellent schools, walkable parks, and vibrant communities at a more affordable price point.

- Make informed decisions: By comparing costs, you can accurately assess your budget and determine which neighborhoods are realistically within reach. This will help you narrow your search and focus your time and effort on properties that fit your financial situation.

Factors to Consider When Comparing Costs

When evaluating neighborhood costs, it’s essential to look beyond just the price of homes. Here are some key factors to consider:

- Property taxes: These can vary significantly between neighborhoods and can add up over time.

- Homeowners insurance: Factors like crime rates and natural disaster risk can impact insurance premiums.

- Utilities: Gas, electricity, water, and trash collection costs can differ depending on the location and the type of housing.

- Transportation: Consider commuting costs, public transportation options, and the cost of parking.

- Groceries and dining: The price of food and dining out can be influenced by the neighborhood’s location and access to grocery stores and restaurants.

- Education: If you have children, the quality and cost of schools in the neighborhood are crucial factors.

Tips for Comparing Neighborhood Costs

Here are some practical tips for researching neighborhood costs:

- Use online tools: Websites like Zillow, Trulia, and Redfin offer comprehensive neighborhood data, including home prices, property taxes, and crime rates.

- Talk to locals: Connect with people who live in the neighborhoods you’re interested in to get firsthand insights into the cost of living.

- Visit neighborhoods in person: Get a feel for the environment and observe the local businesses and amenities.

Comparing neighborhood costs is an essential step in the home buying process. By understanding the differences in cost of living between neighborhoods, you can make an informed decision that aligns with your financial goals and lifestyle preferences. Taking the time to compare costs will help you find the perfect home in the ideal neighborhood for you and your family.