Are you a renter looking for financial peace of mind? Rental insurance, also known as renters insurance, can provide crucial protection for your belongings and personal liability. From covering theft and fire damage to offering legal protection, this affordable insurance policy can offer valuable financial benefits. This article will delve into the key advantages of rental insurance and shed light on essential factors to consider before purchasing a policy. So, if you’re wondering if rental insurance is right for you, keep reading!

Understanding Different Types of Rental Insurance

As a renter, you may be wondering if rental insurance is necessary. The answer is a resounding yes! While your landlord’s insurance covers the building itself, it doesn’t cover your personal belongings. Rental insurance, also known as renters insurance, provides financial protection for your possessions in the event of a covered loss. It’s an affordable way to safeguard your investments and peace of mind. But there are different types of rental insurance, and understanding the nuances can help you choose the policy that best suits your needs.

Types of Rental Insurance

Here are the most common types of rental insurance:

1. Actual Cash Value (ACV)

ACV insurance reimburses you for the current market value of your belongings, taking into account depreciation. This means you’ll receive less than the original purchase price, as your items lose value over time due to wear and tear.

2. Replacement Cost Value (RCV)

RCV insurance provides coverage for the full replacement cost of your belongings, without deducting for depreciation. This allows you to replace damaged or stolen items with new ones of similar quality.

3. Personal Liability Coverage

This type of coverage protects you from financial losses if someone is injured on your property or you accidentally damage someone else’s property. For example, if a guest trips and falls on your stairs, personal liability coverage can help pay for their medical expenses and legal fees.

Choosing the Right Rental Insurance

When selecting rental insurance, consider the following factors:

- Value of your belongings: If you have expensive items, such as electronics, jewelry, or artwork, RCV coverage may be a better choice. If your belongings are mostly used items, ACV coverage may be sufficient.

- Your budget: RCV policies generally cost more than ACV policies.

- Your risk tolerance: If you are comfortable with the possibility of receiving less than the original purchase price for your belongings, ACV coverage may be sufficient. If you want to ensure that you can replace your belongings with new ones, RCV coverage is a better option.

It’s always advisable to talk to an insurance agent to discuss your specific needs and get personalized recommendations.

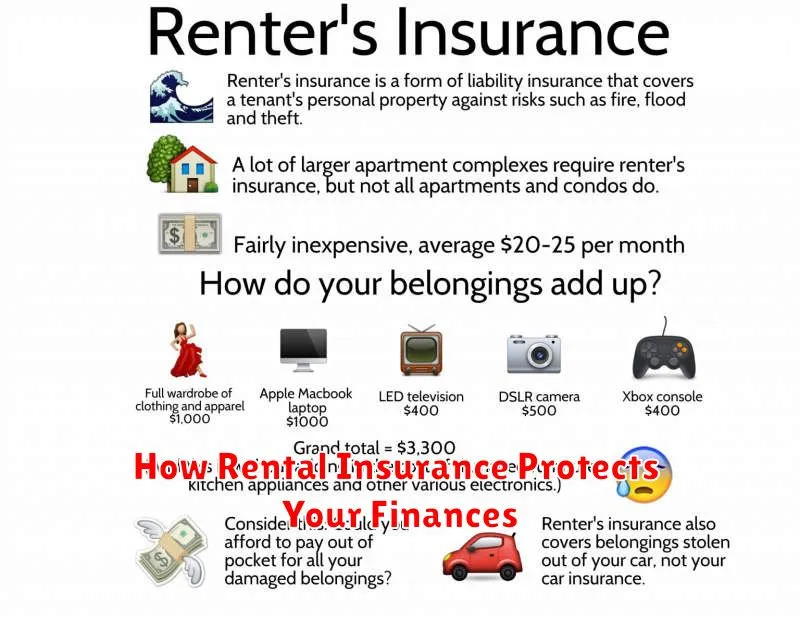

How Rental Insurance Protects Your Finances

As a renter, you might think that your landlord’s insurance covers your belongings. However, that’s not always the case. Landlord insurance only protects the building itself, not your personal property. That’s where renter’s insurance comes in. This affordable and essential insurance policy can protect your finances in case of a covered event, such as fire, theft, or natural disaster.

Here are some of the ways that rental insurance can protect your finances:

- Protection for Your Belongings: Renters insurance provides coverage for your personal possessions, such as furniture, electronics, clothing, and jewelry. If these items are damaged or stolen, your insurance will reimburse you for their value.

- Liability Coverage: If someone gets injured on your property, your renters insurance can provide liability coverage to protect you from lawsuits and legal expenses.

- Additional Living Expenses: If your apartment becomes uninhabitable due to a covered event, renters insurance can help cover your additional living expenses, such as hotel stays or temporary housing costs.

- Peace of Mind: Knowing you have renters insurance can give you peace of mind knowing that you are financially protected in the event of an unexpected disaster.

The cost of renters insurance varies depending on your location, the amount of coverage you choose, and the value of your possessions. However, it’s typically very affordable, especially when compared to the potential financial losses you could incur without it. By investing in renters insurance, you’re safeguarding yourself and your finances from the unexpected.

If you’re a renter, it’s essential to consider getting renters insurance. It’s a small investment that can make a big difference in protecting your financial well-being.

Evaluating Insurance Costs for Renters

Renting a place to live is a popular choice for many people, and it comes with its own set of financial considerations. One of the most important aspects to consider is insurance. While you may not own the property you live in, it’s crucial to protect your belongings and yourself from potential risks. Here’s a breakdown of the key factors to evaluate when assessing renters insurance costs.

What does renters insurance cover?

Renters insurance typically covers your personal belongings, such as furniture, electronics, clothing, and jewelry, from damage or theft. It can also provide liability coverage, protecting you from legal claims if someone is injured on your property. Additionally, it often offers coverage for additional living expenses if you’re displaced from your home due to a covered event.

Factors influencing insurance costs

Several factors can influence the cost of renters insurance, including:

- Location: Higher-risk areas with more crime or natural disasters may have higher premiums.

- Coverage amount: The amount of coverage you choose for your belongings directly impacts the cost. More coverage means higher premiums.

- Deductible: A higher deductible means you pay more out of pocket for claims but typically lowers your premium.

- Credit score: Similar to auto insurance, credit scores can influence renters insurance rates.

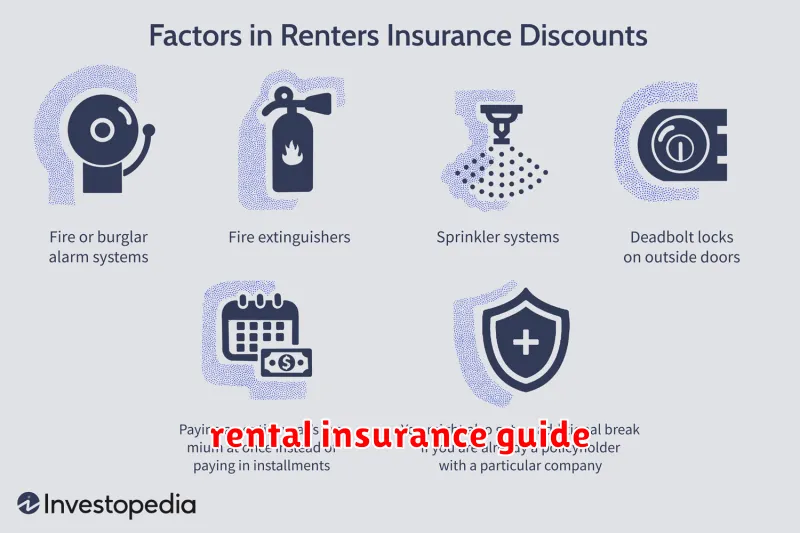

- Safety features: Homes with security systems or other safety features may qualify for discounts.

Tips for finding affordable renters insurance

Here are some tips for securing affordable renters insurance:

- Shop around: Get quotes from multiple insurance companies to compare rates and coverage options.

- Bundle policies: If you have other insurance policies, like auto or homeowners, inquire about bundling discounts.

- Increase your deductible: A higher deductible can lead to lower premiums, but make sure you can afford to pay it if needed.

- Improve your credit score: A higher credit score can improve your rates.

- Consider a basic policy: If you have few valuables, you may be able to save by opting for a basic coverage plan.

Remember, renters insurance is an essential investment. It provides peace of mind, knowing your belongings and yourself are protected in case of unforeseen events. By understanding the factors that influence costs and taking proactive steps to find affordable options, you can secure the coverage you need without breaking the bank.

What is Covered Under Typical Rental Insurance

Rental insurance, also known as renter’s insurance, is a type of insurance policy that provides financial protection to tenants in case of damage or loss to their personal property or liability claims. While it’s not required by law in most places, it’s highly recommended for all renters to protect themselves against potential risks.

Here’s a breakdown of common coverages included in a typical rental insurance policy:

Personal Property Coverage

This coverage protects your belongings from damage or loss due to various perils, including:

- Fire

- Theft

- Water damage

- Vandalism

- Natural disasters like hurricanes, tornadoes, and earthquakes (depending on the policy)

The policy typically covers the actual cash value or replacement cost of your belongings, up to the limit you choose.

Liability Coverage

This coverage protects you from financial losses resulting from injuries or property damage that you or your guests cause to others. For example, if someone trips and falls on your stairs, your liability coverage may help pay for their medical expenses and legal costs.

Additional Living Expenses (ALE)

If your dwelling becomes uninhabitable due to a covered event, ALE coverage helps pay for temporary housing, food, and other essential expenses until you can return home.

Personal Liability

This coverage extends your liability protection to situations beyond your rental property, such as if you injure someone while walking your dog. It typically provides coverage for legal defense costs and settlements.

Medical Payments

This coverage helps pay for medical expenses for guests who are injured on your property, regardless of who is at fault. It’s a supplemental coverage to your liability coverage.

Important Considerations

The specific coverages and limits available under your rental insurance policy will vary depending on your chosen insurer and the policy details. It’s crucial to understand the following:

- Deductible: This is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible typically results in lower premiums.

- Limits: These are the maximum amounts your insurer will pay for each coverage category.

- Exclusions: There are certain events or losses that are not covered by your policy. It’s essential to review the policy details carefully to understand what’s excluded.

By carefully considering the coverage options and consulting with a qualified insurance agent, you can choose a rental insurance policy that adequately protects you and your belongings.

Choosing the Right Insurance Policy for Your Needs

Insurance is a crucial aspect of financial planning, offering protection against unforeseen events that can lead to significant financial losses. With numerous insurance policies available, selecting the right one to meet your specific needs can be a challenging task. This article will guide you through the essential factors to consider when choosing an insurance policy.

1. Identify Your Needs and Risks:

The first step is to carefully assess your individual needs and potential risks. Consider factors such as your age, health, income, assets, dependents, and lifestyle. For example, if you own a home, you’ll need homeowner’s insurance. If you have a car, you’ll need auto insurance. If you have dependents, you might want to consider life insurance.

2. Types of Insurance:

There are numerous types of insurance policies available, each designed to cover specific risks. Common types include:

- Health Insurance: Covers medical expenses, including hospitalization, surgery, and medication.

- Life Insurance: Provides financial support to beneficiaries in the event of your death.

- Auto Insurance: Protects you against financial losses arising from car accidents.

- Homeowner’s Insurance: Covers damage or loss to your home and personal property.

- Renters Insurance: Protects your personal belongings in a rented property.

- Disability Insurance: Provides income replacement if you become unable to work due to disability.

3. Coverage and Limits:

Carefully examine the coverage offered by each policy and understand the limits and exclusions. Consider factors such as deductibles, co-pays, and coverage amounts. Ensure that the policy provides adequate coverage for your specific needs and risks.

4. Premiums and Costs:

Premiums are the monthly or annual payments you make for insurance coverage. Compare premiums from different insurers and consider factors such as discounts, payment plans, and potential future increases.

5. Financial Stability of the Insurer:

It’s crucial to choose an insurer with a strong financial track record. Look for companies with high ratings from reputable financial organizations, such as A.M. Best or Standard & Poor’s. A financially stable insurer is more likely to be able to pay out claims when needed.

6. Customer Service and Claims Process:

Research the insurer’s reputation for customer service and claims handling. Look for companies with positive reviews and efficient claims processing procedures. You want to ensure a smooth and hassle-free experience in the event of a claim.

7. Review and Update Your Policies:

Your insurance needs may change over time, so it’s important to regularly review and update your policies. Life events such as marriage, childbirth, homeownership, or career changes can impact your insurance requirements.

Choosing the right insurance policy is an essential part of safeguarding your financial well-being. By carefully considering your needs, risks, and the options available, you can find a policy that provides the necessary protection and peace of mind.

Comparing Insurance Providers for the Best Deals

Finding the best insurance deals can be a daunting task. With so many providers offering a wide range of plans and coverage options, it can be overwhelming to determine which one is right for you. This is where comparing insurance providers comes in.

Comparing insurance providers allows you to:

- Save Money: By comparing quotes from multiple providers, you can identify the most affordable options that meet your specific needs.

- Find the Best Coverage: Each provider offers different coverage options, so comparing them helps you find the plan that provides the most comprehensive protection.

- Discover Hidden Fees: Some providers may have hidden fees or charges, which can significantly impact your overall cost. Comparing quotes helps you identify these fees.

- Read Customer Reviews: Comparing insurance providers often includes customer reviews, which can provide valuable insights into the provider’s reputation, customer service, and claims handling process.

There are several resources available for comparing insurance providers:

- Online Comparison Websites: Websites like Policygenius, The Zebra, and Insurify allow you to compare quotes from multiple providers in one place.

- Insurance Broker: An insurance broker can work with you to compare different plans and find the best fit for your needs.

- Direct Provider Websites: You can also visit the websites of individual insurance providers to obtain quotes and compare their offerings.

When comparing insurance providers, it’s essential to consider the following factors:

- Your Needs: What type of coverage are you looking for? What are your risk tolerance and budget?

- Coverage Options: Compare the coverage options offered by different providers and ensure they meet your specific requirements.

- Deductibles and Premiums: Consider the deductible amount and premium costs associated with each plan.

- Customer Service: Look for providers with a strong reputation for customer service, responsiveness, and claims handling.

By taking the time to compare insurance providers, you can make an informed decision and secure the best deal possible. Remember that the lowest price isn’t always the best option. Consider all factors and choose the provider that offers the most comprehensive coverage at a fair price.

How to File Claims and Avoid Financial Loss

Life is full of uncertainties and sometimes unforeseen events can disrupt our lives and financial stability. When faced with a loss, it’s essential to know how to file claims effectively to mitigate financial damage. This article will guide you through the process of filing claims and provide tips on how to avoid unnecessary financial losses.

Understand Your Coverage

Before filing a claim, carefully review your insurance policy to understand your coverage. Determine what events are covered, the limits of your policy, and any deductibles you need to pay. This will help you determine if the claim is worth filing and what documentation is required.

Document the Event

Gather all necessary documentation related to the event. This might include photographs, videos, police reports, receipts, and any other relevant evidence. The more comprehensive your documentation, the stronger your claim will be.

Contact Your Insurance Company

Promptly contact your insurance company and report the event. They will provide you with instructions on how to file a claim and guide you through the process. It’s essential to be truthful and accurate in your communication with them.

Complete the Claim Form

Your insurance company will provide you with a claim form. Complete it thoroughly and accurately, providing all necessary information and supporting documentation. Double-check for any errors or omissions before submitting the form.

Be Patient and Persistent

The claims process can take time, so be patient and persistent in following up with your insurance company. Keep a record of all communications and follow up with them regularly to ensure your claim is progressing.

Negotiate Fairly

If you disagree with the insurance company’s assessment or settlement offer, don’t hesitate to negotiate. Understand your rights and be prepared to present your case with evidence. You can also seek legal advice if necessary.

Prevent Future Losses

After filing a claim, take steps to prevent similar losses from happening in the future. This may involve making changes to your property, improving security measures, or implementing risk management strategies. These measures will help protect your assets and reduce the likelihood of future claims.

Final Thoughts

Filing claims can be stressful, but understanding the process and taking the right steps can help minimize financial losses. Remember to review your coverage, document the event thoroughly, communicate with your insurance company effectively, and be persistent in pursuing your claim. By following these tips, you can navigate the claims process smoothly and safeguard your financial well-being.

Tips for Saving on Rental Insurance

Rental insurance is an important protection for your belongings, but it can be expensive. Here are a few tips to help you save on your premiums:

Choose a High Deductible: A higher deductible means you’ll pay more out of pocket in the event of a claim, but it will also lower your premium. Consider how much you can afford to pay in the event of a loss, and choose a deductible that is comfortable for you.

Bundle Your Policies: If you have other insurance policies, such as car or homeowners insurance, you may be able to get a discount by bundling your rental insurance with them. This is often a simple way to save money.

Look for Discounts: Many insurers offer discounts for things like safety features in your apartment, security systems, and being a good driver. Ask your insurance company about any available discounts.

Shop Around: Get quotes from several different insurance companies before you choose a policy. This will help you ensure you are getting the best rate possible.

Review Your Coverage Regularly: Your needs may change over time, so it’s important to review your rental insurance coverage regularly. You may be able to lower your premium by reducing your coverage if your belongings have become less valuable.

Consider a “Named Peril” Policy: A “named peril” policy only covers damage from specific events, such as fire, theft, or vandalism. It may be more affordable than a “all-risk” policy, which covers damage from any cause.

Compare Different Coverage Levels: Rental insurance policies come in various levels of coverage. Decide what level of protection you need and get quotes for different levels to find the best value.

By following these tips, you can save money on your rental insurance premiums without sacrificing the protection you need.

The Role of Insurance in Financial Planning for Renters

Renting a home can be a smart financial decision, but it’s important to remember that renters are not immune to financial risks. In fact, renters face a unique set of potential financial challenges, such as property damage, liability, and personal belongings loss. This is where insurance plays a crucial role in financial planning for renters.

Renters insurance provides financial protection against various perils that could affect a renter’s belongings, living space, or personal liability. It’s a relatively affordable way to safeguard your financial well-being and peace of mind while renting.

Key Benefits of Renters Insurance:

- Coverage for Personal Property: Renters insurance protects your personal belongings against loss or damage from covered perils such as fire, theft, vandalism, and natural disasters. This can include furniture, electronics, clothing, and other valuables.

- Liability Coverage: Renters insurance offers liability protection if someone is injured on your rented property. This coverage helps pay for medical expenses, legal fees, and other related costs.

- Additional Living Expenses: If your rental unit becomes uninhabitable due to a covered event, renters insurance can help cover additional living expenses, such as temporary housing and meals.

- Protection Against Legal Action: Renters insurance provides legal defense and financial protection if you are sued for a covered event, such as a personal injury claim.

Types of Renters Insurance:

There are several types of renters insurance available, each offering different levels of coverage and benefits. Some common types include:

- Actual Cash Value (ACV): This type of coverage pays for the replacement cost of your belongings minus depreciation. This means you will receive less than the full replacement value of your items.

- Replacement Cost Value (RCV): This coverage reimburses you for the full replacement cost of your belongings, regardless of depreciation. It provides greater financial protection, but typically comes with a higher premium.

Essential Considerations for Renters Insurance:

When choosing renters insurance, consider the following factors:

- Your budget: Determine the premium you can afford and compare different quotes to find the best value for your coverage needs.

- Your belongings: Make an inventory of your personal property and estimate its value to determine the appropriate coverage amount.

- Your liability risks: Consider your lifestyle and potential risks to determine the necessary liability coverage amount.

- Your landlord’s insurance: Understand the scope of your landlord’s insurance and how it might overlap with your renters insurance.

Conclusion:

Renters insurance is an essential part of financial planning for anyone who rents a home. It provides vital financial protection against various risks, safeguarding your belongings, liability, and peace of mind. By carefully choosing a policy that meets your needs, you can ensure you have the insurance coverage you need to navigate the potential financial challenges of renting a home.

Common Myths About Rental Insurance

Renting a property can be an exciting and liberating experience. However, it’s essential to protect yourself and your belongings from unforeseen events. Rental insurance, also known as renters insurance, provides financial protection in case of unexpected incidents. Despite its importance, many renters harbor common myths about this vital coverage. Let’s debunk some of the most prevalent misconceptions surrounding rental insurance.

Myth 1: Landlords Have You Covered

A common misconception is that your landlord’s insurance policy will cover your belongings in case of damage or theft. This is inaccurate. Landlord insurance is primarily designed to protect the property itself, not the personal possessions of tenants. It covers things like structural damage, fire, or liability claims against the landlord. If your belongings are lost or damaged, your landlord’s insurance won’t cover you.

Myth 2: Rental Insurance Is Expensive

Many believe rental insurance is an extravagant expense. In reality, it can be surprisingly affordable. Premiums vary based on factors like the value of your belongings, location, and coverage limits, but you can often secure comprehensive coverage for a monthly payment comparable to a cup of coffee. It’s a small investment for peace of mind and financial security.

Myth 3: You Only Need It If You Have Expensive Possessions

While rental insurance is essential for those with valuable belongings, it’s beneficial for all renters. Even if you don’t have luxury items, the coverage extends beyond your possessions. Rental insurance can also cover liability if you’re found responsible for causing damage to the property or injuring someone.

Myth 4: You Don’t Need It If You Live in a Safe Neighborhood

No neighborhood is immune to unforeseen events. Fires, burglaries, and natural disasters can occur anywhere. Rental insurance offers protection against these risks regardless of your location. It provides a financial safety net in case of the unexpected.

Myth 5: Your Credit Score Impacts Your Premiums

Contrary to popular belief, your credit score typically doesn’t affect your rental insurance premiums. These premiums are usually based on factors like the value of your belongings, location, and the level of coverage you choose. However, your credit score could impact your ability to secure a loan if you need to borrow money to replace lost or damaged items.

Rental insurance is an affordable and vital safeguard for renters. Don’t fall victim to common myths about its necessity or cost. Protect yourself, your belongings, and your financial well-being by investing in this valuable coverage.