Are you planning to rent a property, but unsure of your rights and responsibilities as a tenant? Look no further! This comprehensive financial savvy guide will equip you with the essential knowledge about rental policies and regulations, ensuring a smooth and stress-free renting experience. From understanding your lease agreement to navigating the complexities of security deposits and rent increases, we’ll delve into the intricacies of tenant-landlord relationships. Gain valuable insights into legal protections, tenant rights, and avoiding potential pitfalls. This guide will empower you to make informed decisions and protect your financial interests as a renter. So, let’s dive in and unravel the world of rental policies and regulations!

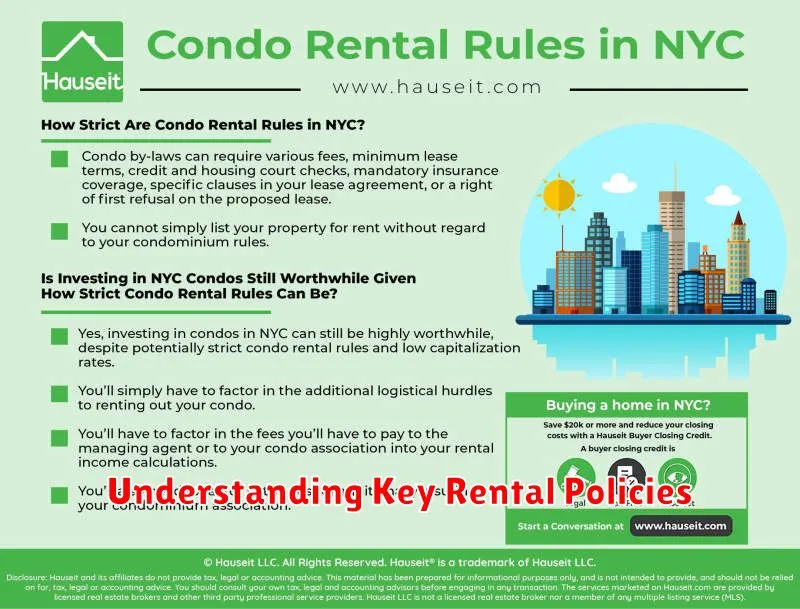

Understanding Key Rental Policies

Before you rent a property, it’s crucial to understand the rental policies set by the landlord or property management company. These policies dictate the terms of your tenancy and ensure a smooth and fair rental experience for both parties. Let’s delve into some key rental policies you should be aware of:

Lease Agreement

The lease agreement is the cornerstone of your rental relationship. It outlines the terms of your tenancy, including the rental period, rent amount, and any specific rules or restrictions. It’s vital to read the lease carefully and understand every clause before signing it. If you have any questions or concerns, don’t hesitate to ask the landlord or property manager for clarification.

Rent Payments

The lease agreement will specify the rent amount, the due date, and the accepted methods of payment. It may also include information on late fees and penalties for non-payment. Familiarize yourself with these details to ensure timely and accurate rent payments.

Security Deposit

A security deposit is usually required upon signing the lease. This deposit serves as protection for the landlord in case of damage to the property beyond normal wear and tear. The amount of the security deposit and the conditions under which it may be returned are typically outlined in the lease agreement.

Pet Policy

If you have pets, you’ll need to check the pet policy. Some properties allow pets with restrictions on breed, size, or number, while others may have a strict “no pets” policy. Make sure you understand the pet policy before bringing your furry friend to the property.

Maintenance and Repairs

The lease agreement should specify the landlord’s responsibilities for maintenance and repairs. It might also outline your responsibilities as a tenant for keeping the property clean and in good condition. If you notice any damage or need repairs, report it to the landlord promptly to avoid potential issues.

Notice to Vacate

The lease agreement will contain a notice to vacate clause, which specifies the required notice period before you can move out. It’s essential to provide the necessary notice to the landlord in writing to avoid any penalties or legal complications.

Understanding key rental policies is essential for a successful and harmonious landlord-tenant relationship. By carefully reviewing the lease agreement and familiarizing yourself with these policies, you can avoid potential issues and ensure a smooth and comfortable rental experience.

Common Apartment Rental Regulations Explained

Navigating the world of apartment rentals can be a daunting task, especially for first-time renters. From understanding lease agreements to knowing your rights as a tenant, there are numerous regulations and legalities that can seem overwhelming. This guide aims to shed light on some of the most common apartment rental regulations, empowering you to make informed decisions throughout the rental process.

Lease Agreements: The Foundation of Your Rental Relationship

The lease agreement serves as the legal contract between you and the landlord, outlining the terms of your tenancy. It’s crucial to read and understand the entirety of the lease agreement before signing. Here are some key aspects to pay close attention to:

- Rent amount and payment schedule: This section specifies the monthly rent and due date.

- Lease duration: It indicates the length of your tenancy, typically expressed in months or years.

- Security deposit: This refundable deposit protects the landlord against potential damages to the property.

- Pet policy: If you have pets, ensure the lease allows them and outlines any restrictions or fees.

- Late fees: This section defines the penalties for late rent payments.

- Termination clause: It outlines the process for ending the lease agreement, including required notice periods.

- Landlord’s right to access: The lease should specify under what circumstances the landlord can access your unit.

Tenant Rights and Responsibilities

As a tenant, you have certain rights that protect your interests and ensure a safe and habitable living environment. These rights are typically outlined in state or local laws. Here are some common tenant rights:

- Right to a safe and habitable dwelling: Your landlord is responsible for maintaining essential services, such as running water, heat, and electricity.

- Right to privacy: Your landlord cannot enter your unit without a valid reason or proper notice.

- Right to make minor repairs: You may be able to make minor repairs to the property yourself if the landlord fails to do so within a reasonable timeframe.

- Right to withhold rent: In certain circumstances, you may be able to withhold rent if your landlord fails to meet their obligations.

- Right to a peaceful and quiet enjoyment of your unit: Your landlord is responsible for controlling excessive noise or disturbances from other tenants.

However, tenants also have certain responsibilities. You are generally expected to:

- Pay rent on time: Late payments can result in penalties as outlined in your lease.

- Maintain the unit in a clean and sanitary condition: This includes keeping the unit free of excessive clutter or garbage.

- Respect the property and its surroundings: Avoid causing damage to the unit or the common areas.

- Comply with building rules: Follow any regulations set forth by the landlord or the building management.

Landlord Responsibilities

Landlords also have specific responsibilities to their tenants, ensuring a safe and comfortable living environment. These responsibilities typically include:

- Maintain essential services: Ensure the availability of running water, heat, electricity, and other essential utilities.

- Make necessary repairs: Address any issues that affect the habitability of the unit promptly.

- Provide reasonable notice: Inform tenants before entering the unit, except in emergencies.

- Respect tenant privacy: Avoid entering the unit unnecessarily or without permission.

- Protect tenant security: Take steps to prevent unauthorized access to the property or common areas.

Communication is Key

Open and respectful communication between tenants and landlords is essential for a smooth rental experience. Address any concerns or issues promptly and in writing. Document all communications and any repairs or maintenance requests. If you’re unable to resolve issues directly, you can seek assistance from your local housing authority or tenant advocacy group.

Understanding these common apartment rental regulations can equip you with the knowledge you need to navigate the rental process with confidence. By being informed about your rights and responsibilities, you can ensure a positive and harmonious tenancy.

Financial Implications of Rental Agreements

Rental agreements, also known as leases, are legally binding contracts that outline the terms and conditions under which a property is rented. These agreements encompass various financial aspects that tenants and landlords should carefully understand to ensure a smooth and mutually beneficial relationship. This article explores the crucial financial implications of rental agreements.

Rent Payment

The most fundamental financial aspect of a rental agreement is the rent payment. The agreement clearly specifies the amount of rent due, the payment frequency (e.g., monthly, weekly), and the acceptable payment methods. Timely rent payments are crucial for tenants to avoid late fees and potential eviction. Landlords rely on rent income to cover expenses related to the property.

Security Deposit

Many rental agreements require a security deposit, typically equivalent to one or two months’ rent. This deposit serves as protection for the landlord in case of damages to the property beyond normal wear and tear. Upon the tenant’s departure, the security deposit is usually refunded after deductions for any necessary repairs or cleaning.

Utilities

The responsibility for paying utilities, such as electricity, water, gas, and garbage collection, can vary depending on the agreement. It’s essential to clarify who is responsible for each utility to avoid unexpected bills and ensure the proper allocation of costs. Some leases may include utilities in the rent, while others require tenants to pay them separately.

Insurance

Rental agreements may require tenants to have renters insurance, which protects their belongings against theft, fire, or other covered perils. Landlords typically carry landlord insurance to protect their property and liability. Understanding the specific insurance requirements outlined in the agreement is crucial for both parties.

Early Termination

Early termination of a rental agreement can have financial consequences. Both tenants and landlords should be aware of the penalties associated with breaking the lease early. Tenants may be liable for unpaid rent, while landlords may have to incur costs for finding a new tenant.

Rental agreements are complex legal documents with significant financial implications. By thoroughly understanding the terms and conditions related to rent payments, security deposits, utilities, insurance, and early termination, both tenants and landlords can ensure a financially sound and harmonious rental experience. It’s always advisable to consult with a legal professional to clarify any uncertainties or seek guidance on specific financial aspects of a rental agreement.

What to Know About Security Deposits

A security deposit is a sum of money that a tenant pays to a landlord at the beginning of a lease. The deposit is intended to cover any damages to the property that may occur during the tenancy. Landlords are required to return the security deposit to the tenant within a certain timeframe after the lease ends, as long as the property is returned in good condition.

How much is a security deposit?

The amount of a security deposit varies depending on the state, city, and the type of property. In some areas, there are legal limits on the amount of security deposit that a landlord can charge. For example, in New York City, the security deposit for a one-year lease can be no more than one month’s rent. In other areas, the security deposit may be equal to two or three months’ rent.

What can a landlord use a security deposit for?

Landlords can only use a security deposit to cover damages that are not considered normal wear and tear. This includes things like:

- Holes in the walls

- Stains on the carpet

- Broken appliances

- Missing or damaged fixtures

A landlord cannot use the security deposit to cover rent that is owed or for routine maintenance such as painting or cleaning.

What if there is a dispute about the security deposit?

If a tenant and landlord disagree about whether or not the security deposit should be returned, the tenant can file a claim with the state’s small claims court. The court will then decide whether the landlord is justified in withholding the deposit.

How can tenants protect themselves?

Tenants can protect themselves by doing the following:

- Take pictures of the property before moving in to document any existing damage.

- Keep copies of all rental agreements and receipts.

- Make sure the landlord provides a written statement explaining why the security deposit is being withheld.

- File a claim in small claims court if necessary.

Security deposits are an important part of the landlord-tenant relationship. By understanding the rules and regulations surrounding security deposits, tenants can protect their rights and ensure that they receive their deposit back when they move out.

How to Avoid Costly Rental Disputes

Rental disputes can be a real headache for both landlords and tenants. They can lead to wasted time, money, and even legal action. The good news is that many rental disputes are avoidable. With a little planning and communication, you can significantly reduce your chances of ending up in a costly conflict.

Communicate Clearly and Openly

One of the most important things you can do to prevent disputes is to communicate clearly and openly. This means being upfront about your expectations and responsibilities, both as a landlord and a tenant. For example, if you have a pet, be sure to get written permission from your landlord before moving in. And if you are a landlord, clearly communicate your expectations about rent payments, maintenance requests, and guest policies.

Have a Written Lease Agreement

A written lease agreement is essential for both parties. It should outline all the terms of the tenancy, including the rent amount, the lease term, the responsibilities of each party, and any restrictions or limitations. By having a written agreement, you can avoid any ambiguity or misunderstanding about the terms of the lease.

Keep Good Records

Keeping good records is essential for both landlords and tenants. As a landlord, keep track of all rent payments, maintenance requests, and any communication with tenants. As a tenant, keep copies of all rent payments, repair requests, and communication with your landlord. This documentation can be invaluable in the event of a dispute.

Be Reasonable and Considerate

Being reasonable and considerate is key to avoiding disputes. As a landlord, be understanding if a tenant has a temporary financial hardship. And as a tenant, be respectful of your landlord’s property and try to be a good neighbor. By being reasonable and considerate, you can foster a positive and productive relationship.

Get Professional Help If Needed

If you find yourself in a dispute that you can’t resolve on your own, don’t hesitate to seek professional help. A mediator can help you and your landlord reach a mutually agreeable solution. And if mediation fails, you may need to consult with a lawyer.

By following these tips, you can significantly reduce your chances of getting caught in a costly rental dispute. Communication, documentation, and a spirit of cooperation can go a long way in ensuring a smooth and harmonious landlord-tenant relationship.

Breaking Down Car Rental Insurance Policies

Navigating car rental insurance policies can be overwhelming, but it’s crucial to understand your coverage options to avoid unexpected costs. This guide will break down the various types of insurance offered by rental companies and help you determine which ones you actually need.

What’s Included in the Base Rental Rate?

Most rental companies include liability insurance in their base rate, which protects you against financial responsibility for bodily injury or property damage to others in case of an accident. However, this coverage typically has limits, and additional insurance may be required to cover the full cost of an accident.

Optional Insurance Add-ons

Here’s a breakdown of common car rental insurance add-ons:

Collision Damage Waiver (CDW)

CDW covers the cost of repairs or replacement of the rental vehicle in case of an accident, often with a deductible. It essentially waives your financial responsibility for damage to the vehicle.

Personal Accident Insurance (PAI)

PAI covers medical expenses for you and your passengers in case of an accident, offering additional protection beyond your personal health insurance.

Loss Damage Waiver (LDW)

LDW provides coverage similar to CDW but also covers theft and vandalism of the rental vehicle. It’s often combined with CDW.

Supplemental Liability Insurance (SLI)

SLI increases the liability coverage beyond the base amount, offering additional protection against claims arising from accidents.

Deciding What You Need

Here are some factors to consider when deciding on rental insurance:

Your Existing Insurance Policies

Check if your personal auto insurance policy includes coverage for rental vehicles. Your existing policy may already offer some level of protection, potentially eliminating the need for additional rental insurance.

Your Credit Card Benefits

Many credit cards offer rental car insurance as a perk. It’s worth reviewing your credit card’s terms and conditions to see if you have this benefit and what it covers.

The Rental Company’s Policies

Be aware of the rental company’s insurance requirements and specific coverage details. Some companies may require you to purchase CDW or LDW, while others might offer waivers or discounts for certain insurance options.

Your Risk Tolerance

If you’re comfortable with the financial risk of a potential accident, you might choose to decline optional insurance add-ons. However, if you want complete peace of mind, you might opt for additional coverage.

Tips for Avoiding Insurance Scams

Beware of high-pressure sales tactics and understand that the rental company may not necessarily be offering you the best deal.

Always read the fine print carefully and clarify any unclear terms before agreeing to any insurance policy.

Don’t feel pressured to purchase unnecessary insurance. You can often decline optional add-ons and rely on your existing insurance policies or credit card benefits.

Understanding car rental insurance policies can help you save money and make informed decisions. By carefully reviewing your coverage options and considering your existing insurance and credit card benefits, you can make an informed choice that protects you financially while enjoying your rental experience.

Tenant Rights: Financial Protections for Renters

Renting can be a great way to live, but it’s important to understand your rights as a tenant. One important aspect of being a tenant is knowing about the financial protections that are in place to safeguard you. These protections can help you avoid unfair financial burdens and ensure you are treated fairly.

Security Deposits

When you sign a lease, you typically pay a security deposit, which is meant to cover any damages you might cause to the property during your tenancy. Landlords can only use your security deposit for specific reasons, and they are required to return it to you within a certain timeframe after you move out, minus any deductions for damages.

Rent Increases

In many states, there are regulations regarding how much a landlord can raise your rent. Landlords may be required to give you advance notice of a rent increase and the increase may be capped at a certain percentage. Make sure to familiarize yourself with the specific rules in your state or locality.

Late Fees

Landlords can charge late fees if you don’t pay your rent on time. However, there are often limits on how much they can charge. Be sure to understand the terms of your lease agreement regarding late fees and penalties.

Eviction Protection

Even if you fall behind on rent, you still have rights. Landlords must follow specific legal procedures before they can evict you. They need to give you proper notice, allow you a chance to catch up on your rent, and go through a court process. Knowing your rights is crucial in preventing wrongful eviction.

Lease Termination

Under certain circumstances, you may be able to break your lease without penalty. This could include situations like domestic violence, military deployment, or if the landlord fails to maintain the property.

Key Takeaways

Understanding your tenant rights is vital for protecting your finances and ensuring a fair rental experience. Familiarize yourself with the laws in your state or locality, and if you have any questions or concerns, don’t hesitate to consult with a legal professional or tenant advocacy organization. By knowing your rights, you can stand up for yourself and avoid potential financial hardship.

Evaluating Lease Terms for Long-Term Rentals

When renting a property for an extended period, carefully reviewing the lease terms is crucial. A well-drafted lease agreement protects both the landlord and the tenant, ensuring clarity and fairness throughout the rental duration. This article will delve into key aspects of lease terms to consider for long-term rentals.

Lease Duration

The lease duration specifies the length of the agreement. For long-term rentals, common durations include one year or more. Ensure that the lease term aligns with your needs and consider the implications of early termination. You can negotiate a shorter initial lease term with the option to renew.

Rent and Payment Schedule

The lease should clearly outline the monthly rent amount, due date, and accepted payment methods. Consider negotiating a rent increase schedule, especially if the lease term is longer than a year, to avoid substantial rent jumps in the future.

Security Deposit

The security deposit serves as a financial safeguard for the landlord to cover potential damages or unpaid rent. Understand the amount, purpose, and conditions for refunding the security deposit at the end of the lease. Discuss if the security deposit can be split into multiple payments.

Utilities and Responsibilities

The lease should specify which utilities are included in the rent and which are the tenant’s responsibility. It’s essential to clarify who is responsible for maintenance, repairs, and property upkeep. Determine whether there are limits on pets, smoking, or other activities.

Renewal Clause

The lease should outline the process for renewing the lease at the end of the term. Understand the terms of renewal, including any potential rent increases or changes to other lease provisions. Negotiate a renewal clause that allows for flexibility if your circumstances change.

Termination Clause

The lease should specify the conditions for early termination. Understand the notice period required and the financial penalties involved. Ensure that the termination clause provides reasonable grounds for both landlord and tenant to break the lease.

Disputes and Legal Actions

The lease should include a process for resolving disputes between the landlord and tenant. This may involve mediation, arbitration, or court proceedings. It’s crucial to understand the dispute resolution mechanism and the rights and obligations of both parties.

Other Important Considerations

Other important lease terms to consider include insurance requirements, parking privileges, access to amenities, and any specific restrictions or limitations on the use of the property. Review the lease carefully and seek legal advice if you have any questions or concerns.

Thoroughly understanding and evaluating lease terms for long-term rentals is essential. A well-drafted lease agreement safeguards both the landlord and the tenant’s interests, ensuring a smooth and equitable rental experience. By carefully reviewing and negotiating lease terms, you can protect your rights and ensure a successful long-term rental agreement.

How to Handle Lease Violations and Penalties

Lease violations can be a headache for both landlords and tenants. They can lead to fines, legal action, and even eviction. But understanding your rights and responsibilities can help you navigate this tricky situation. This article will guide you through the process of handling lease violations and penalties.

What is a Lease Violation?

A lease violation occurs when a tenant fails to comply with the terms of their lease agreement. This can include anything from failing to pay rent on time to making unauthorized modifications to the property. Common lease violations include:

- Late Rent Payment

- Unauthorized Pets

- Excessive Noise

- Illegal Activities

- Property Damage

What are the Penalties for Lease Violations?

The penalties for lease violations vary depending on the specific violation and the terms of the lease agreement. Common penalties include:

- Late Fees

- Eviction

- Termination of the Lease

- Financial Penalties

- Legal Action

How to Handle Lease Violations

If you are a tenant who has received a notice of lease violation, it’s important to take action immediately. Here are some steps you can take:

- Read the Notice Carefully: Understand the specific violation and the penalties involved.

- Contact Your Landlord: Discuss the violation and try to reach a resolution.

- Request a Written Explanation: If you disagree with the violation or penalties, ask for a written explanation from your landlord.

- Document Everything: Keep records of all communication, including dates, times, and contents of conversations.

- Seek Legal Advice: If you cannot reach a resolution with your landlord, consult with a legal professional.

How to Avoid Lease Violations

The best way to avoid lease violations is to read your lease agreement carefully and understand your responsibilities. Make sure you understand the following:

- Rent Payment Schedule

- Pet Policy

- Noise Restrictions

- Property Maintenance Requirements

By following these tips, you can avoid lease violations and maintain a good relationship with your landlord.

The Role of Financial Advisors in Rental Contracts

Financial advisors play a crucial role in guiding individuals and families through the complex world of finances, including rental agreements. While not directly involved in drafting or negotiating the contract itself, their expertise can significantly impact the financial implications of a rental decision.

Financial Planning and Budget Considerations

Before signing a lease, a financial advisor can assist in assessing the potential financial impact. They can help determine if the monthly rent aligns with the client’s budget and overall financial goals. By analyzing income, expenses, and savings, advisors can advise on the affordability of the rental property and whether it fits within the client’s financial plan.

Evaluating Rental Expenses

Financial advisors can help clients understand all the associated costs beyond the monthly rent. This includes security deposits, pet fees, utilities, and potential maintenance expenses. By analyzing these costs, advisors can provide a comprehensive picture of the total financial commitment involved in renting the property.

Negotiating Rental Terms

While financial advisors do not directly negotiate lease terms, they can provide valuable insights to clients. By understanding the client’s financial situation and goals, advisors can suggest alternative lease terms, such as shorter lease periods or options for rent increases. This can help protect the client’s financial interests and ensure a more favorable rental arrangement.

Investment Strategies and Long-Term Planning

Financial advisors can help clients consider the long-term financial implications of renting versus buying a property. They can analyze market trends, interest rates, and other relevant factors to advise on the most strategic path for achieving financial goals. For instance, if a client is considering buying a home in the future, a financial advisor can help them plan accordingly and ensure that renting does not hinder their homeownership aspirations.

While financial advisors may not be directly involved in drafting rental contracts, their expertise is invaluable in navigating the financial complexities of renting. By providing guidance on budgeting, evaluating expenses, and considering long-term financial goals, financial advisors empower clients to make informed decisions that align with their overall financial well-being.